Everything You Ever Wanted to Know About Real Estate Commission Advances and Real Estate Commission Advance Companies

What is a Real Estate Commission Advance?

When a real estate agent secures a commission advance from a lender, it is essentially a loan real estate agents use to get some of their commission right away. The advance is typically due upon closing of the property transaction, and the interest rate is usually lower than what the agent could get on a personal loan.

If you’re a real estate agent who is looking for some extra funds to help with your finances, you may be interested in a commission advance. Commission advances are loans that are secured by the commissions owed to the agent. This means that there is little risk involved for the lender, and the interest rate is usually lower than what the agent might get on an unsecured personal loan.

The commission advance can be a huge help to agents who are waiting for their commissions to come through. It allows them to continue marketing their properties and keep up with their other business expenses. And since the advance is secured by the commissions owed to the agent, there’s little risk to the lender.

If you’re a real estate agent, then you know that one of the biggest challenges is getting paid. It can often take weeks or even months to receive your commission from a successful sale. This can put a lot of strain on your finances, especially if you have a family to support. A real estate commission advance can help to ease this financial burden by giving you access to the money you’ve earned right away.

This type of advance is provided by a third-party lender, and it’s typically repaid out of the proceeds from your sale. This means that you don’t have to worry about making payments until the deal is closed. And because the repayment amount is based on a percentage of the sale price, you’ll only need to repay the advance if the sale is successful. This type of financing can be a real lifesaver for real estate agents who are struggling to make ends meet.

How Does a Real Estate Commission Advance Work

A stock or bond is categorized as an asset because you can sell it whenever you want at a specified price. The same goes for real estate commissions that are pending – they too are seen as assets that could be sold to another person for a set price. When you take a real estate commission advance, you sell your pending commission to a real estate commission advance company like Accel Advance at a discount. Then at closing, you receive whatever commission you have left, and the real estate commission advance company receives the amount they are owed.

A Real Estate Commission Advance is Not an Actual Advance

When you get a real estate commission advance, you are not receiving actually getting your commission upfront, even though everyone refers to this type of transaction as a real estate commission advance. Instead, you are selling a portion of your commission (your asset) to a third-party company like Accel Real Estate Commission Advance at a reduced rate. This allows you to get some of your money immediately. The third-party finance company then collects what is owed to them at some point later on (like during closing from the attorney or closing agent) for its full (mature) value.

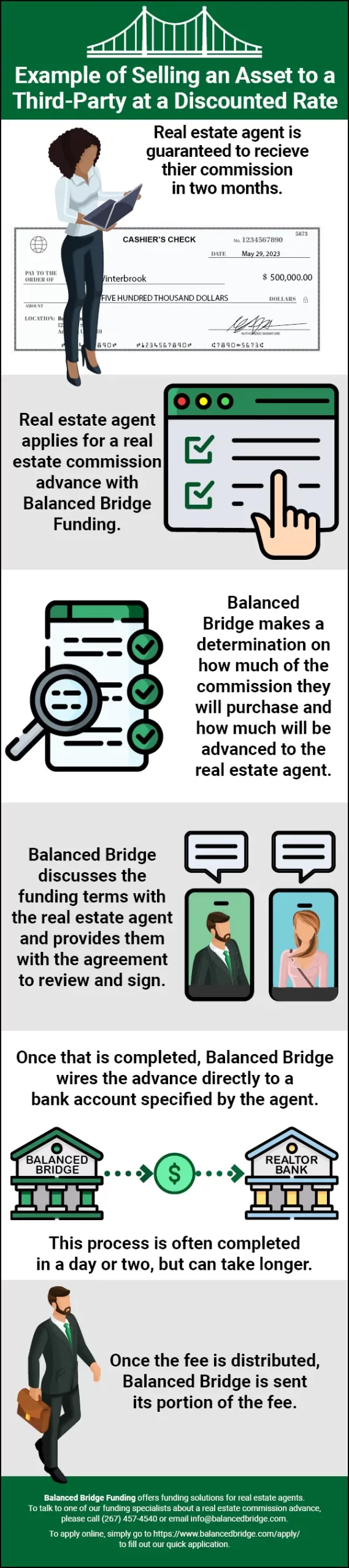

Infographic: Example of Selling an Asset to a Third Party at a Discounted Rate*

Example of Selling an Asset to a Third Party at a Discounted Rate*

- A real estate agent is guaranteed to receive a commission but will experience some delay before their commission is distributed to them.

- The real estate agent applies for a real estate commission advance with Balanced Bridge Funding.

- Balanced Bridge makes a determination on how much of the commission they will purchase and how much will be advanced to the real estate agent

- Balanced Bridge discusses the funding terms with the real estate agent and provides them with the agreement to review and sign.

- Once that is completed, Balanced Bridge wires the advance directly to a bank account specified by the real estate agent

This process is often completed in a day or two but can take longer.

Once the fee is distributed, Balanced Bridge is sent its portion of the fee.

Why Realtors Use Commission Advances – The First Sale is Always the Hardest

It doesn’t matter what industry you are in, when you are in sales, the first sale is always the most difficult to get done. It is also the sale that takes the most time. If you are a new realtor, and you have finally got your first home under contract, chances are you’ve already incurred significant expenses between business cards, signs, office space, getting your real estate license, open houses, staging the house, Etc.

So you’ve probably been putting money out there for quite a while, and would probably like to pay off some credit cards or replenish your savings account. You might also be close to being tapped out until you get paid. You wouldn’t be the first sales rep to be right on the edge of being broke, sitting at home hoping a check comes through today.

It can take thirty days to six months for a closing to go through. That is a long time to wait if you are running out of money. By taking out a real estate commission advance, new real estate agents can get a quick cash infusion to help them keep going, get on to that next deal, and keep their business going.

Often times in a new solo enterprise, like being a real estate agent, the difference between making it, and having to quit and go get a job that pays a regular paycheck, is simply being able to survive in between closing deals. A Real estate commission advance is one way junior realtors can get some of their real estate commission right away to help keep them going and get through the lean times.

Cash Flow for Realtors

What is Cash Flow for Realtors?

Cash flow is the term used to describe the “flow of cash” into your bank account versus the “flow of cash” out of your bank account. So, when people talk about cash flow, all they are talking about is “money flowing in and money flowing out.”

If you end up in a situation where your income is consistently outpaced by your expenses, this cash flow issue will persist until you have no more money left to pay bills. It doesn’t matter if a large amount of money is coming in at some point down the road; when you don’t have any liquid funds readily available, creditors aren’t interested – they want their payments now. Consequently, running out of cash can force people out of the game entirely.

You must have cash flowing in faster than it flows out – or, you must figure out a way to borrow money to finance the gaps between running out of money and more money coming in. This is essentially cash flow for real estate agents.

When it comes to cash flow management, most people try to think of ways to reduce spending and keep costs low. But the reality is, successful businesses don’t always focus on cost cutting. Instead, they typically direct their attention to bringing in money as often as possible and receiving payment quickly. They may do this by taking out loans, selling bonds or stock (equity), factoring payments they’re owed (selling the debt at a discount), and working hard to generate revenue through sales activity. It doesn’t matter if it is your money or someone else’s – as long as you can pay your bills, you stay in business.

What is Cash Flow management?

The purpose of cash flow management is to ensure that money comes in faster than it goes out. This can be done through a variety of activities designed to regulate the two flows of cash (cash in and cash out).

But however you do it, the goal of cash flow management is to take action to make sure you don’t run out of cash to pay bills, fund operations, and keep your real estate business growing. Very few people are going to “cut” their way to success. You need money coming in frequently, whether that is from sales, or from taking out loans. Either way, you must have enough cash available to you to pay people, or you are out of business.

What Are Cash Flow Problems?

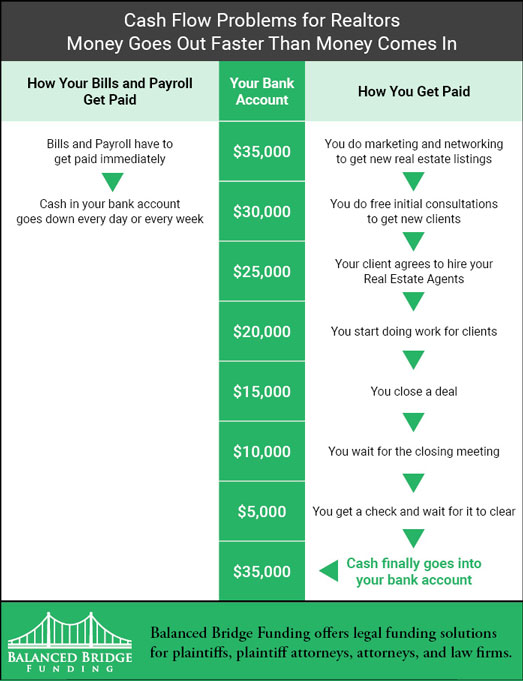

Cash flow problems are what people think of when they hear the term “cash flow.” Realtors must worry about cash flow because often times they have more money going OUT of their bank account than coming IN. This can happen when you’re waiting for closing; you still have bills to pay and your creditors do not care that you are going to get money soon from a closing. They want their money now.

What Causes Cash Flow Problems for Realtors?

Timing is what creates most cash flow problems for realtors. The “timing” of when they get paid (money flowing into their bank account) versus the timing of when that money gets spent (money flowing out of the bank account) are greatly misaligned.

How does that work?

It works like this: You spend a lot of money up front to secure listings, host open houses, and get the deal closed. But during that time, you are not getting paid, so your savings is going down steadily (or your credit card balance is going up). And when you finally do get paid at closing, often you are already behind because you had so much cash flowing out on the front end, and you get paid until much later.

This is what causes cash flow problems for realtors. And you aren’t alone. Most businesses struggle with cash flow unless they get paid up front for their services and don’t have to pay for costs prior to delivering those services. That’s just how business is.

The Solution to Cash Flow Problems For Realtors

The solution to cash flow problems for realtors (and any other business for that matter) is to find ways to “finance the gap” between spending your money and getting some of your money back. One way to get money into your bank account quickly is by taking out a real estate commission advance. This way, you don’t have to wait for the closing to get some money.

Financing Options for Real Estate Agents – Financing Options for Real Estate Brokers

Using Business Lines of Credit and Business Loans for Cash Flow Management

Most people think of bank loans and business lines of credit when it comes to financing options, but for realtors, it may not be easy to get either one.

Banks usually request that applicants offer non-liquid assets, for example, bonds, stocks, and property, as collateral in case the loan isn’t able to be paid back. They do this to make sure the bank has something of worth to collect if you’re unable to make payments.

This can create a long term issue because once assets are being used as leverage for a loan or line of credit, you can’t use them again for collateral against another loan (normally). This limits your ability to grow your company – if you run out of collateral, the banks simply stop lending you money.

A quick Google search for “business line of credit for realtors” will reveal that not a single bank appears on the first page of search results. In fact, most of what you’ll see are articles discussing how difficult it is to obtain a business line of credit, with private equity firms occasionally offering loans as an alternative. From this, we can infer that banking institutions likely don’t view lines of credit for real estate agents as being integral to their success. Otherwise, they would be advertising for it.

While it may not be easy to obtain a line of credit from a bank or other lending institution when your business is first starting out, this does not mean that it is impossible. As your business grows and establishes itself, you will find it easier to get financing. But until then, you may have to explore alternative options for funding.

SBA loans Can Help Finance Real Estate Agents

You can get SBA loans for certain real estate transactions. According to the SBA website, a SBA 7 (a) loan can be used for:

- Long- and short-term working capital

- Revolving funds based on the value of existing inventory and receivables

- The purchase of equipment, machinery, furniture, fixtures, supplies, or materials

- The purchase of real estate, including land and buildings

- The construction of a new building or renovation of an existing building

- Establishing a new business or assisting in the acquisition, operation, or expansion of an existing business

- Refinancing existing business debt, under certain conditions

Source: SBA Website: Link https://www.sba.gov/funding-programs/loans/7a-loans#section-header-2

According to the SBA website, the SBA 7(a) loan may be the best type of SBA financing for independent real estate agents and small to mid-size brokerages.

However, there are some drawbacks to SBA loans. First – you still need to have good credit, and significant business history to be accepted for an SBA Loan. Second and probably more important, the paperwork required for obtaining any type of SBA loan is notoriously daunting. Just filling out the paperwork to apply for an SBA loan is sufficient to keep many small business owners from attempting it.

Source: https://www.sba.gov/funding-programs/loans/7a-loans#section-header-2

Also, when you are considering an SBA loan, you also must consider “speed.” If you are needing a cash injection in your business, or you have a great real estate investment opportunity in front of you, an SBA loan is probably going to be too “slow” for you. Just the reporting requirement would take most people a long time to get together.

What Is the Difference Between a Realtor Commission Advance and a Bank Loan?

A real estate commission advance does not in any way resemble a bank loan. A real estate commission advance does not require excellent credit and can be received without having to repay the amount in installments. Furthermore, the fee structure is much different than that of a typical bank loan. Not to mention, a real estate commission advance doesn’t rack up daily, monthly, or yearly interest like other loans do.

In fact, a real estate commission advance is more like selling futures (puts and calls) than it is a loan. You are selling an asset to a third party today for a discounted rate, and the third party gets paid an agreed upon amount of money for the asset at some designated date in the future. This does not in any way line up with how a bank loan works.

This distinction might seem like semantics, but the difference between a loan and an advance on real estate commission is such that some states have written laws to specifically declare that these types of transactions in no way meet the threshold to be considered a loan.

Credit Checks Are Not Necessary for Commission Advances

Credit checks can make it tough for real estate agents to get approved for a bank loan or line of credit. If an agent is new to the industry, recently declared bankruptcy, or has a high credit utilization ratio, they might not meet the requirements set by banks to secure a loan or line of credit.

In the underwriting process for real estate commission advance companies, a credit score is not a major determining factor. Real Estate Commission Advance companies do check for liens and judgments against the realtor before they enter into an agreement with them. They do this to make sure they can collect their money at closing and there are no other lien holders who have a priority claim against the commissions they intend to collect at closing; however, your credit score will not stand in the way of you getting approved.

Having Options is Important for Business Finance

Financial vehicles like loans, lines of credit, and bonds are often used to finance growth or day-to-day operations. This is because relying on one source of financing (like a line of credit) is not ideal for cash flow management. In fact, large businesses tend to use multiple sources of financing including private equity, futures trading, and factoring in addition to lines of credit. You have probably heard the saying, “don’t put all of your eggs in one basket.” This is true for financing your business operations. Having one method of financing your cash flow could cause your business to fail if that financing option is shut down on you for some reason. Having multiple options is always best when it comes to business finance.

Agility and Flexibility in Finance

Another important factor to think about when you are choosing your business finance options is speed, agility, and flexibility. If you needed to secure a large amount of cash by tomorrow afternoon to take advantage of a real estate deal, in most cases it will be nearly impossible to secure a loan or line of credit in time.

Banks are some of the most powerful financial institutions in the world, but they are not known for being fast or agile. They are careful. They have lending standards that are precise and specific. Their processes help ensure that they don’t make “bad loans.” All of their checking and double checking in their underwriting process takes time. Unfortunately, opportunity waits on nobody (as the saying goes). If a deal is good enough, someone is going to come in with a check and close the deal while you are waiting for someone else to loan you money.

Real estate commission advance companies often have different lending standards than banks, making the industry much more flexible. This in turn allows for next-day capital secured by a real estate commission advance.

Plus, using a real estate commission advance is very flexible. You can take out a real estate commission advance when you need it and use other financing vehicles when you don’t.

Real Estate Commission Advances Do Not Require Additional Collateral

A real estate commission advance is ideal because you don’t need to use any of your other assets as collateral – only the future commissions from the transaction. This frees up your other assets to be used for different purposes.

It isn’t easy to always have collateral on hand when you need it. When you use an asset as collateral for a loan, a Lien is filed against it- meaning that if you default on the loan, someone else has the first claim to the asset. Because of this, you often can’t use one piece of collateral for two different loans. This means that in order to keep taking out loans that require collateral, you must continuously come up with new assets to pledge. However, with a real estate commission advance, the commission owed to you becomes the collateral (in most cases), so no additional belongings are needed.

Getting Used to Real Estate Commission Advances

Realtors could start taking advantage of advances on their future commissions right away to finance expansion, hire new personnel, increase their marketing budget, and more. If large businesses never think twice about financing their growth by using third-party finance companies, why should small businesses be any different? Get used to the idea of financing your operations and growth with other people’s money. Get comfortable with it, because if you want to grow and be successful, you are most likely going to need financing from third parties.

Self-Financing Your Real Estate Business

If you perform an internet search on Google for “how to finance your real estate business” – most of the articles focus on using your personal savings, and credit cards, taking out a second mortgage, borrowing from friends or family, and selling off valuable items. These methods are unfortunately very commonplace suggestions in the world of real estate financing.

Rather than depleting your rainy-day fund or selling off valuables, start using commission advances for realtors to even out your cash flow. Getting started now will help you get into the habit of financing operations with third party funding companies instead of relying on personal funds or borrowing money from your family members and putting their financial future at risk. Large businesses do not use the money in their savings account to finance their success, and neither should you.

How Much Should Real Estate Agents Spend on Marketing?

How much should realtors spend on marketing? If you search the internet for “how much should realtors spend on Marketing,” a common number thrown out is 8% to 10% of total sales.

But this doesn’t make much sense. Some real estate companies out there spend over $200,000 (PER MONTH) on pay-per-click ads alone. You shouldn’t be limiting your marketing expenditures based on a percentage of sales. How much you spend on marketing as a realtor shouldn’t be determined by a percentage of any number. You need to spend as much money on marketing as you possibly can until you reach your growth goals.

This is one of the reasons big businesses secure financings either by selling stocks and bonds, securing private equity backers, or taking on debt. They would never limit their marketing budget to a small percentage of sales. They are constantly raising capital to finance their sales and marketing campaigns so they can meet their goals. They don’t “wait until they have the money,” to grow. They get money from other people and get moving. You should do the same.

How much should realtors spend on marketing then? You should spend as much as it takes to reach your long term financial goals as quickly as you can. If you are going to limit your marketing budget to an arbitrary number, you will forever limit your growth potential – or – increase the time it takes you to become successful.

Real Estate Agents Need to Keep Their Money Moving

To be successful, it is important to keep your money “flipping.” You should avoid sitting around waiting for your money. That is lost time you can’t get back. And where does that lost time show up? It gets “added” to the time it takes you to become successful. Basically, it gets “added on to the end” of your career. Get your money as quickly as you can, and get it back in the game working for you.

In an interview about spending money for your future success, Gary Vee (Vaynerchuk) said something like this: “Every month I saw the bill come in from Google and it was like, eighty thousand dollars per month. And I thought to myself I should try to keep that expense down. I was wrong. So wrong. I should have been figuring out how to spend three million dollars per month. And If I had done that, my company could have been where it is now, three years ago. But I only looked at the expense, not the goal of my marketing.”

If your marketing works, you shouldn’t be trying to reduce marketing costs, you should be figuring out how you can borrow as much money as you can to do more marketing.

Myths About Using Real Estate Commission Advances

The assumption that only realtors who don’t manage their money well would get a real estate commission advance is FALSE. People believe this because they think, “if you’re doing well, you should be able to finance your own growth.” However, no successful realtors do this.

Big businesses never hesitate to use “other people’s money” to finance their growth while keeping their own money in their checking accounts. Why should you be any different?

Contrary to popular belief, business owners should not aspire to be debt-free or finance their company’s growth with cash reserves. As a matter of fact, if you come across a business that has no debt and only utilizes cash for financing growth and operations, then this particular organization is missing out on many opportunities because they are “asleep at the wheel.”

If a business is hiring excellent employees, utilizing the best technology, marketing its products aggressively, and constantly seeking new deals to pursue, it wouldn’t be able to afford all of it through its own cash flow. Thus, if you come across a debt-free company, you can be confident that they are losing ground to some other organization that is financing its development with borrowed money.

If you finance your growth all on your own, you’re intentionally slowing it down and putting a cap on how far you can go. Not to mention, other real estate agents who seek out funding sources will quickly snatch up market share while you miss out on opportunities because of financial limitations. They secure loans, find private investors, and factor their commissions to get ahead–and if they do that successfully, you’ll be left behind trying unsuccessfully to finance your growth by yourself.

Business owners who think small tend to stay small. If staying small is your goal, then this article probably isn’t for you. But if you’re determined to achieve greater success, secure more market share, and achieve significant career goals, then relying on your own limited cash reserves to finance the growth of your business isn’t the best idea – big businesses would never do this.

Always be wary of taking advice from those you deem experts in your field. Just because they dress and speak the part, does not mean they really know what they are talking about. In fact, some of their untested thinking might hold you back professionally. Do not feel ashamed to take out loans or use others’ money to finance your growth–that is what almost all big businesses do. If they did not, they would quickly get left behind by rival companies.

Summary

Real Estate Commission Advances play an important financial role for Realtors. It can take a long time to get paid once a listing is under contract. But as a realtor, you might have waited a long time already trying to get the deal closed. You may have had to spend a lot of money to get your listing sold. It can be hard to wait another thirty to ninety days to get some of that money back into your bank account. A real estate commission advance is one way to get some of your money now, and then collect the rest at closing.

A real estate commission advance is not a loan. Instead, the real estate commission advance company is purchasing a portion of your future real estate commission for a fee. The real estate commission advance company then collects its money at closing.

Real estate agents struggle with cash flow for the same reasons other businesses do – they have to pay out a lot of money to get a sale completed, and then they have to wait to get paid. This gap between putting out money and getting paid for your services is always going to create a cash flow issue.

You can help finance cash flow by taking advantage of business lines of credit, bank loans, SBA backed bank loans, and credit cards, and using real estate commission advances. But of these options, a real estate commission advance is the easiest to qualify for, does not require good credit, does not impact your credit rating, and allows you to get cash in your bank account quickly.

Being debt free should not be a goal for your business if you want it to grow. Businesses that are debt free are “asleep at the wheel.” If they were hiring new talent, investing in the latest technology, marketing heavily, and constantly finding new deals to close, they wouldn’t be debt free. Big businesses ALWAYS finance operations with “other people’s money.” Why should small businesses operate differently?

Real Estate Commission Advances are fast, flexible, easy to get, and can help you solve your cash flow struggles and help keep you “in the game.”

What does a Real Estate Commission Advance Application look like?

The application takes about 10 minutes to complete and can be filled out online. It asks for the amount of advance you are looking for, information related to the property on which you are requesting an advance, and the approximate closing date. Information related to the lender and lending officer is also usually requested.

In the application, you will be asked to provide:

- Proper identification, such as your driver’s license

- MLS listing of the property showing the status as “under contract”, “pending”, or “sold”

- Wire instructions (where to send your advance)

- Closing date

- Whether you are representing the buyer or seller.

- Evidence that contingencies have been satisfied.

- Commission sharing agreement or documentation showing net fees owed to you.

Applying with Accel Commission Advance

Once Accel receives your application, their proprietary cloud-based processing system allows them to advance your commission quickly and efficiently, in as little as 24 hours.

What do the Underwriters Look for on an Application?

To confirm that the agent or broker requesting the advance is actively representing buyers or sellers in real estate transactions, underwriters look at data related to the number of transactions that the agent or broker has completed in the last six months and how many active and pending listings they currently have.

Accel Commission Advance requires that an agent or broker has at least one other listing or active deal in the process of closing. The deal must also be scheduled to will close within 45 days. A credit score is not considered in their underwriting process.

How are the Fees Determined?

Fees are set based on numerous factors, and each case is assessed individually. Accel offers reduced fees as an agent or broker completes more advances with them and establishes a consistent track record. Accel offers competitive fees as low as 8 percent.

How Do I Get My Money from a Real Estate Commission Advance?

Advances will be delivered to your bank account via a wire transfer. Accel gets you paid fast. Overnight funding for Realtors is possible, especially for agents and brokers that have already done business with Accel.

How Do I Pay Back a Real Estate Commission Advance?

Repayment of the advance happens automatically when your sale closes. The settlement company will receive a commission disbursement authorization signed by your broker instructing them to send a portion of your commission directly to Accel on your closing date. So there is nothing for you to do. We collect our money directly at closing.

About Accel Real Estate Commission Advance

We are a direct funder, not a broker like most real estate commission advance companies. Because there’s no middleman involved, our fees are among the lowest in the industry, as we pass our savings on to you.

We factor numerous asset classes, helping attorneys, professional athletes, business owners, and of course real estate agents and brokers. Let Accel finance your next Real Estate Commission Advance.

Frequently Asked Questions about Real Estate Commission Advance

Question: Is there a minimum size commission that you advance Real Estate Agents?

Answer: There is no minimum size commission, but the minimum fee is $250.

Question: Is there a maximum size commission that you advance?

Answer: Yes. The maximum amount is $30,000.

Question: Are there any reserve holdbacks?

Answer: Yes, there is a 10% reserve holdback on every advance.

Question: Are there any administration fees?

Answer: There is a $30 wire fee for any outgoing wires. Agents can opt to receive funds via eCheck for no charge.

Question: Are there any application fees?

Answer: No

Question: Do you advance brokers of record?

Answer: Yes, on a case-by-case basis.

Question: Can I advance more than one deal at a time?

Answer: Yes

Question: How much of my Commission can I Advance?

Answer: Up to 80% of net commission due to the agent.

Question: How quickly can I get my advance processed?

Answer: Advances are processed in 48 hours or less – majority of advances fund same day.

Question: Are your advances restricted to a closing within 90 days?

Answer: Within 120 days.

Question: Do you require a minimum size deposit?

Answer: No