Waiting for your settlement payout?

Once a case settles and a judgment award is forthcoming, some of the contingency fees that attorneys are owed can be sold to Balanced Bridge Funding. This allows the attorney or law firm access to their funds right away to pay bills, take on new clients, or expand into new law firm practice areas. Whatever the funds are used for, using attorney post settlement funding allows fast and easy access to money you are owed rather than waiting months or even years for the defendant to pay.

What is Post Settlement Funding for Attorneys?

Post settlement funding for attorneys is a financial vehicle that allows a lawyer to get some of the contingency fees they are owed right away by selling a portion of what they are owed to Balanced Bridge Funding. This allows attorneys quicker access to funds instead of waiting for defendants to pay which can often take months or even years in some cases.

How does Attorney Post Settlement Funding Work?

Balanced Bridge’s Fast and Easy Attorney Post Settlement Funding Process

The attorney has settlement in a case but will experience some delay before their contingency fee is distributed.

1. Apply

Attorney applies for a post settlement advance with Balanced Bridge Funding. Apply here.

2. Determination

Balanced Bridge examines the case and determines how much of the contingency fee they will purchase, and how much capital will be advanced to the attorney.

3. Review & Sign

Balanced Bridge discusses the funding terms with the attorney and provides them with an agreement to review and sign.

4. Wire the Advance

Balanced Bridge wires the advance directly to a bank account specified by the attorney within days after their agreement has been approved.

Balanced Bridge Funding is the industry leader in post settlement funding for attorneys and law firms.

If you are an attorney that has settlement in a case, but you are experiencing delays in contingency fee distribution, Balanced Bridge Funding provides flexible financing options to help attorneys and law firms thrive by providing the money you need when it’s needed. We’ve helped attorneys and law firms nationwide get faster access to funds, instead of waiting for defendants to pay.

Post Settlement Funding for Attorneys and Law Firms

Customized to Fit Your Specific Needs

Attorneys and law firms can take advantage of Balanced Bridge Funding’s personalized financing solutions for faster access to funds based on collectible fees on settled litigation cases.

fast, Hassle free

financing

Access fast non-recourse financing with a hassle free process designed for attorneys. Once the fee is distributed, Balanced Bridge is sent its portion of the fee.

Convert future fees into immediate capital

Contingency fees are considered an asset and like any asset, it can be sold. We deliver greater liquidity and faster access to your contingency fees than any other funder.

No credit check, no monthly payment, no hidden fees

Unlike a loan, attorney post settlement funding does not require a credit check. There are no monthly or interim payments to a lender, and there are no hidden fees.

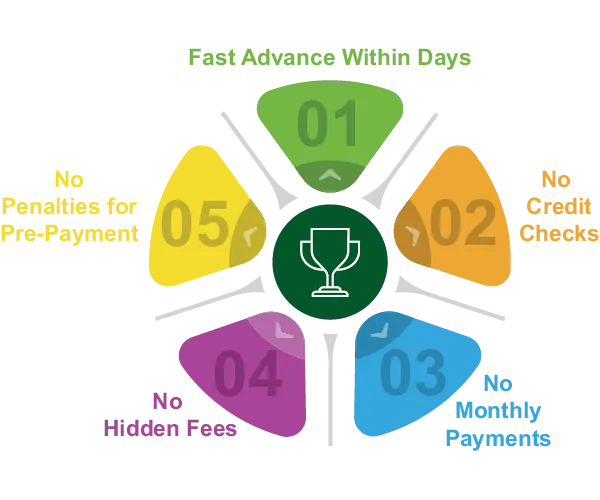

Post settlement funding is fast access to money you’re owed

There are five distinct advantages of post settlement funding with Balanced Bridge Funding.

Balanced Bridge wires the money directly to the bank account you specify within days after the agreement has been approved. There are no credit checks before funding approval. Your case is your collateral. There are no monthly or interim payments to a lender. There are no hidden fees. There are no penalties for pre-payment.

apply now

Apply today for a rapid advance on your settled cases.

There is no mountain of paperwork to weed through. The form to get the process started takes less than 2 minutes. It’s simple, straightforward, and fast.

APPLY NOWWe offer advances on a wide range of cases.

We fund all types of settlements where there is a delay between time of settlement and actual payment. Below are just a few (not all) of our recent case types that qualified for settlement advances:

Class Actions

Personal Injury

Employment Discrimination

Infant Injuries

Product Liability

Truck Accidents

SSDI

Mass Torts

Multi-District Litigation

Medical Malpractice

Slip & Fall

Wrongful Death

Veterans Disability Claims

Sexual Assault

Chances are, if you are going to receive a settlement, you can receive funding from Balanced Bridge Funding.

Why do lawyers use post settlement funding?

Reason #1: Take On New Clients

Attorneys use post settlement funding to take on new clients. Lawyers often struggle with taking on new clients and cases because it is expensive, time-consuming work that could result in the firm struggling financially. Every new client a law firm takes on creates more work, which often means more expenses. If you are already short on cash to pay bills, it makes it harder to imagine taking on new clients, even if the payout could be huge later on. By taking out a attorney post settlement funding advance, attorneys can keep cash in the bank, which they can then use to take on larger clientele or more projects than they would otherwise.

Reason #2: Manage Cash Flow

Lawyers use post settlement funding to help manage cash flow. It can take a long time to go through the legal process and often, attorneys must wait for defendants to pay their contingency fees. Using post settlement funding helps attorneys get access to the funds they are owed which helps reduce cash flow struggles.

Reason #3: Fund Growth

Lawyers use post settlement funding to fund growth. Law firms are no different than any other business in that they need to grow and expand. Time spent waiting on money is lost time and may mean missed opportunities or taking longer to get to your goals. By using post settlement funding, attorneys gain access to their contingency fees faster, enabling them to continue growing their law practice.

Is post settlement funding a loan?

Post settlement funding is NOT a loan. Although post settlement funding is often referred to as a loan for lawyers or settlement advances for lawyers, it is NOT a loan. Unlike a loan, attorney post settlement funding does not have monthly or interim payments to a lender.

Instead, Balanced Bridge Funding is purchasing your pending attorney fees. When your case finally pays out, we will send you the current pay-off amount, and you will send us the payment directly.

Timing

Payments

penalties

credit score

post settlement funding

fast advance in days

no monthly payments

no pre-payment penalties

no credit check

traditional loan

Lots of time and Paperwork

Regular Monthly payments

penalties for pre-payment

credit score is a factor

Frequently Asked Questions about Post Settlement Funding for Lawyers

Any lawyer who is working on a contingency fee basis and has a pending settlement can benefit from post settlement funding. This can include class action/MDL, personal injury, medical malpractice, product liability, and other types of cases. Law firms of all sizes now use post settlement funding to continue growing their law practices.

A post settlement advance for attorneys is not a loan. When you receive a settlement advance, Balanced Bridge is not loaning you money. The fees you are owed from a lawsuit are considered an asset (like a stock or your house). And just like any other assets you own, you can sell it to someone for an agreed upon price.

Taking out a post settlement advance is easy. It is not dependent on your credit score. This is one of the benefits of working with Balanced Bridge Funding – we do most of the work for you. You fill out the application and we do the rest. Getting a settlement advance might be one of the easiest things you do while dealing with a class action lawsuit.

Balanced Bridge funds all types of settlements where there is a delay between the time of settlement and actual payment. Here are just a few (not all) types of settlements we fund:

- Class Actions

- SSDI

- Veterans Disability Claims

- Sexual Assault

- Infant Injuries

- Product Liability

- Personal Injury

- Truck Accidents

- Mass Torts

- Multi-District Litigation

- Employment Discrimination

- Wrongful Death

- Slip & Fall

- Medical Malpractice

- And More!

Chances are, if you are going to receive a settlement, you can receive funding from Balanced Bridge Funding.

Our post settlement funding application is fast and hassle free. The form to get started takes 2 minutes or less. Input your name, firm name, phone, email, and amount you are requesting — and that’s it.

Our application is simple, straightforward, and easy to complete. This is not a loan, so there is no mountain of paperwork to weed through. In most cases, we can get funding approval in a matter of days and have your money deposited into your checking account a few days after that.

Once the defendants have paid the settlement amount and distributed your fee, we will send you the current pay-off amount, and you will send us the payment directly.

Yes, there are no restrictions on how you use our advances. It doesn’t necessarily have to be for expenses related to a specific case. It can be for any expenses you have for your business, or you can use it for personal reasons. This allows lawyers to have the financial stability they need to fully focus on continuing to take on new clients and better cases.

Unlike a traditional loan or line of credit, post settlement funding does not require any credit checks. The funding is based solely on the case you are applying for and the expected settlement amount. Additionally, there are no monthly payments with our post-settlement advances. We collect what we’re owed to satisfy the advance at the end when the case you applied with finally distributes.

We focus on you.

At Balanced Bridge, we excel at what is most important – our client’s satisfaction, the desire for progress, and rapid response. We choose to practice our values rather than just profess them. Demanding of ourselves and others the highest ethical standards. We recognize that the quality of our performance directly impacts our clients. Therefore, we deliver on our commitments. Period. That is the Balanced Bridge Funding difference.

LEARN MOREApply in 2 minutes or less.

Your time is valuable which is why our 5 question application to get the process started can be completed in a matter of minutes. Input your name, firm name, phone, email, and the amount you are requesting — and that’s it! We contact you pronto!

APPLY NOWin legal funds.

of accepted cases get funded.

clients have funded with us.