Post Settlement Funding for Law Firms– Why Law Firms Use Post Settlement Funding

Introduction

Why Law Firms Use Post Settlement Funding – In the early days of legal funding it was thought that only smaller, less established law firms used legal financing options like post settlement funding, but this is no longer the case. Today, in 2022, law firms of all sizes make use of legal funding options to finance operations, take on bigger cases and bigger clients, to manage cash flow, and to help sustain their long term growth. Law firms use post settlement funding to get some of their contingency fees as soon as they can, instead of waiting long period of time for defendants to pay them.

Law Firms also use financial vehicles like pre-settlement funding. Pre-settlement funding helps law firms take on bigger cases they might not be able to afford to litigate; it also helps them endure the time it takes for large cases to move through the legal system. And the longer they endure the stall tactics some law firms employ, the better chance they have at winning larger settlements for their clients and earning more in contingency fees for their firm.

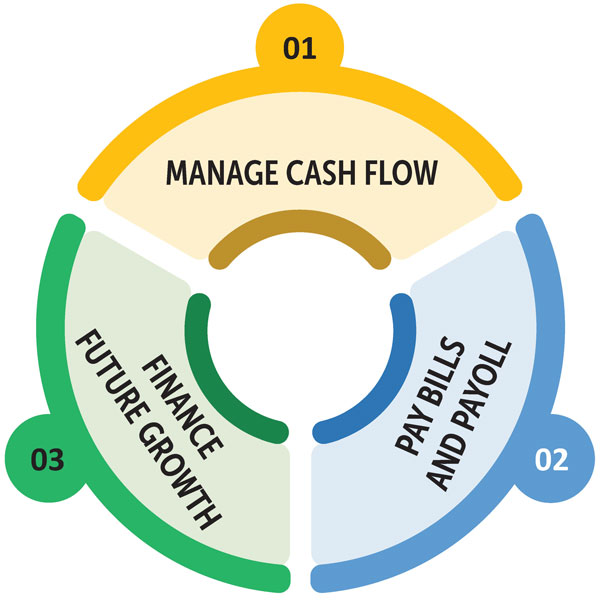

In this article we are going to focus on why law firms use post settlement funding, how they use it, what post settlement funding is, and how post settlement funding works. But to get started, it is important to know that law firms use post settlement funding for three primary reasons. Those reasons are:

- Reason #1: Law Firms use Post Settlement Funding to help manage cash flow.

- Reason #2: Law Firms use Post Settlement Funding to Pay Bills, Partners, and Employees

- Reason #3: Law Firms use Post Settlement Funding to finance future growth.

It is also important to know that post settlement funding is not a loan. We will explain this in detail later. But the important thing to know is that post settlement funding is not a loan, but rather, the law firm sells some of their pending contingency fees to a third-party legal financing company.

Another important thing to know about post settlement funding for law firms is that securing post settlement funding is fast. Law firms can have money in the bank in just a few days once a short application is complete. Opportunity waits for no one; and post settlement funding is a great way to get access to capital quickly when you need it.

There is a lot more to know about post settlement funding for law firms, but these are the basics. Continue reading to take a more in-depth look at post settlement funding, how it works, why law firms use post settlement funding, and how you can use post settlement funding to benefit your law firm.

The Main Reasons Law Firms Use Post Settlement Funding

As we mentioned before, there are three main reasons law firms use post settlement funding. They are:

Reason #1: Law Firms use Post Settlement Funding to help manage cash flow.

Reason #2: Law Firms use Post Settlement Funding to Pay Bills, Partners, and Employees

Reason #3: Law Firms use Post Settlement Funding to finance future growth.

In the early days of legal funding, it was thought that only small law firms, or law firms who weren’t “doing that well” we the primary users of legal funding vehicles like pre-settlement and post settlement funding. This way of thinking was so pervasive that law firms wanted (and still sometimes do want) their use of legal funding kept secret because they didn’t want to appear that they might be in financial trouble or were too small to be taken seriously as a law firm.

But over time, law firms began to see the benefits of using legal funding. With pre-settlement funding, they were able to take on bigger cases; they were able to wait out defendant’s stall tactics; they were able to win bigger awards for their clients, and as a result, received more money in the form of contingency fees.

Law firms also began understanding that lost time is lost money. Post settlement funding allowed them to get some of their contingency fees in the bank right away instead of waiting months (or years) for the defendant to pay them. With that money, they could pay bills, pay salaries, fund marketing campaigns, invest in new technology, and hire/recruit top talent.

Now let’s take a more in-depth look at the three primary reasons law firms use post settlement funding.

Reason #1: Using Post Settlement Funding for Managing Cash Flow

Businesspeople talk about cash flow a lot, but few of them understand what it means or how it works.

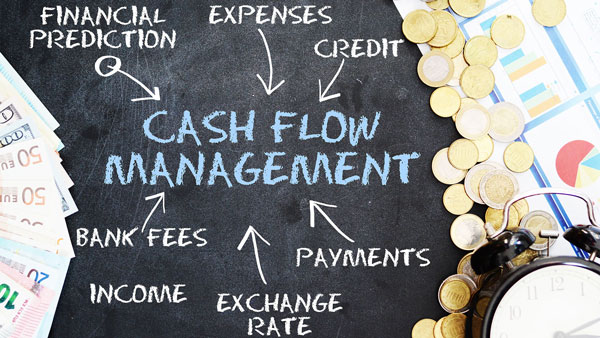

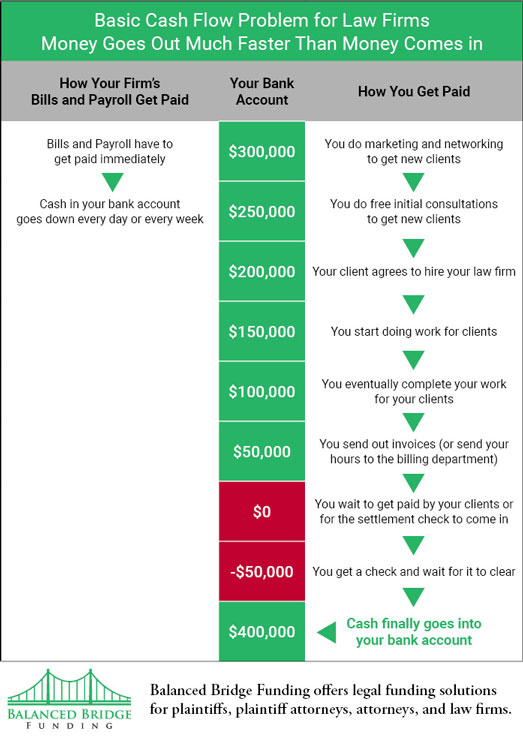

Cash flow is the term used to describe the two “flows” of cash.

The Two “flows” of Cash Are: Cash flowing IN your bank account – and – Cash flowing OUT of your bank account. That is all cash flow means. If you have sufficient cash or access to cash, to pay your bills and grow your law firm, then your cash flows are healthy. This sounds simple but managing cash flow is a challenge for almost every type of business, but it is especially hard for plaintiff law firms.

When you are thinking about “cash” it is important to not conflate “sales” or “profit” with cash flow. In fact, an increase in closed sales (getting a new client) often results in cash rapidly flowing OUT of your bank account rather than into it. It is also important to not fixate on sales or profit as being the primary means by which cash “flows into” your bank account. Why? Because cash could come from a loan, a line of credit, private equity, selling stock, issuing bonds, etc. When you are talking about cash flow for law firms (or any business), it doesn’t matter “where” the cash comes from. Cash in the bank account is cash in the bank account – it doesn’t matter where it came from, it is still cash “flowing into” your business.

If fact, it is cash flowing in that tends to confuse people – everyone seems to be clear about how and why cash “flows out” of your bank account: paying bills, paying people, marketing, advertising, paying partners, paying employees, paying rent, etc.

What is Cash Flow Management?

Cash flow management is any activity used to regulate these two flows of cash (cash flowing – cash flowing out).

The goal of cash flow management is to keep the money flowing into the account and make sure it doesn’t flow out faster than it comes in. Why? Because when your bank account is empty, you can’t pay bills or payroll, and when that happens, your business closes. It doesn’t matter if you have millions of dollars in contingency fees that are owed to you – if you can’t write a check for the rent, you get evicted from your office space.

This is why keeping your finger on the pulse of these two flows of cash is important. It is also why financing activities like using legal funding is important for law firms – it doesn’t matter where the money comes from, as long as it comes.

What are Cash Flow Problems?

Cash flow problems is the phrase used to describe a situation where your business is having trouble keeping enough cash in the bank to pay bills, pay employees, pay vendors, or pay for growth activities like marketing, or acquisitions.

What Causes Cash Flow Problems for Law Firms?

Cash flow problems for Law Firms are caused by the same things that cause cash flow problems for any type of businesses:

#1: Spending cash on operations and lawsuits right now but not getting paid until later. Sometimes MUCH later.

Lots of businesses have this type of situation happening. They go out and get work, but to perform that work creates costs. This could be for parts, materials, labor, Etc. If the company sales team does their job and deals get closed – then, someone has to perform that work, and in many types of business (like Plaintiff Attorneys), you have to perform the work before you get paid for it. This “time gap” between the time you have to shell out cash to perform your work and get it done, and the time you have to wait to get paid for it, creates cash flow problems.

This scenario perfectly describes Plaintiff work. You have to spend a lot of money to win the case, but it can take years for a case to settle or conclude, and then you still have to wait months, or sometimes years, before you get paid your contingency fees. And while you are waiting to get paid, money keeps going out to keep the lawsuit going, to pay your bills, and to pay employees. Plus, if you want to grow your law firm, you need to keep marketing and taking on even more cases, which creates an even larger cash flow challenge to solve.

The worst part is, you can’t solve this type of cash flow problem by getting more clients. In fact, more sales would exacerbate this type of cash flow problem, not solve it. And in many cases, this is the precise reason a lot of small businesses stay small and fluctuate wildly between having lots of cash, and being on the edge of disaster, because it is hard for any business to self-finance their growth when “winning” work ultimately means taking on major expenses and waiting a long time to get paid.

Why Cash Flow for Law Firms Matters

Businesses fail when they run out of cash, and for no other reason. When you are out of money to pay bills and employees, you are out of the game. Businesses do not close because of lack of profit, or even lack of sales (although this contributes to the problem). Businesses close when they run out of cash. If you have cash available to pay bills, employees, and vendors, you are still in the game.

Companies like Amazon and Uber never make a profit. But they have massive amounts of cash coming directly into their bank account every minute of every day from around the world. A company like that will never go out of business because they will ALWAYS have cash coming in every single day they an use to pay employees, bills, and vendors. They might overextend themselves and need to lay people off, or make some other cuts, but they will never be short of cash, so they will never close.

Contrast this with being a law firm who specializes in plaintiff work – you may only get paid a few times per year from your work. And you can never be truly certain when you will get a check. This “gap” between doing work and getting paid must be navigated carefully or you may end up closing your law firm even though on paper, you are worth millions. It doesn’t matter if a lawsuit you won six months ago is going to pay you millions of dollars “soon” – when you can’t pay the rent or make payroll, your law firm will close its doors. This is why cash flow matters.

How Law Firms Can Resolve Their Cash Flow Problems

Remember the basic law firm cash flow problem? Money goes out fast and comes in slow. The solution to cash flow problems is regular cash infusions into your law firm and to have access to sufficient capital whenever you need it.

We mentioned this in the introduction, but it is worth repeating – it doesn’t matter “where” the money comes from. If you have money to pay bills, expert witnesses, marketing, salaries, and other expenses, you get to keep going.

The reason we bring this up is because most people tend to think if “cash in the bank” coming from sales, but that is just one way to get cash to pay for things. Companies sell stock to raise cash, they issue bonds to raise cash, they solicit private equity investors, the take out loans, get attorney lines of credit, use business credit cards, use pre-settlement funding to get cases, and post settlement funding to get some of their contingency fees right away rather than waiting to get paid from the defendant.

And lots of law firms are catching on to these various financial vehicles. They are learning what big businesses have known for hundreds of years, that financing operations with “other people’s money” is the best way to finance your growth. Trying to finance operations and manage cash flow with your own resources rarely works, and often just serves to prolong the growth and success of your law firm. Big businesses never hesitate to finance their success with other people’s money – why should law firms be any different?

Not only are law firms getting used to legal financing alternatives, but traditional finance companies like banks, and even hedge funds, have discovered that funding plaintiff attorneys on big cases can be very lucrative investments. Plus – new data shows that with large financial backing, law firms are able to withstand the never-ending stall tactics defendants often employ. Because plaintiff lawyers don’t have to “take any deal” on the table, and can afford to wait, not only are they winning more cases, they are also winning much large settlements for their clients and in so doing, taking home bigger checks for their contingency fees.

Using Post Settlement Funding to Help Law Firms Manage Cash Flow

We have talked a little about pre-settlement funding, but this article is about why law firms use post settlement funding. When you win a case, or have billed a client, and are waiting to be paid from either the lawsuit or the client, you can “sell” all or a portion of the money that is owed to you to a legal funding company like Balanced Bridge Funding for a fee.

The contingency fees you are owed are considered an asset, and just like any asset, you can sell it to a third party at an agreed upon price whenever you want to do so.

The benefit to the law firm is they get some of their money right away, and when the bill is paid by the client or lawsuit. The benefit to the legal funding company is they get paid a fee for “waiting to get paid.”

It is as simple as that. You get your money now, and the legal funding company gets paid to do the waiting for you.

This type of transaction historically was known as factoring. Most industries take advantage of factoring to help solve their cash flow challenges.

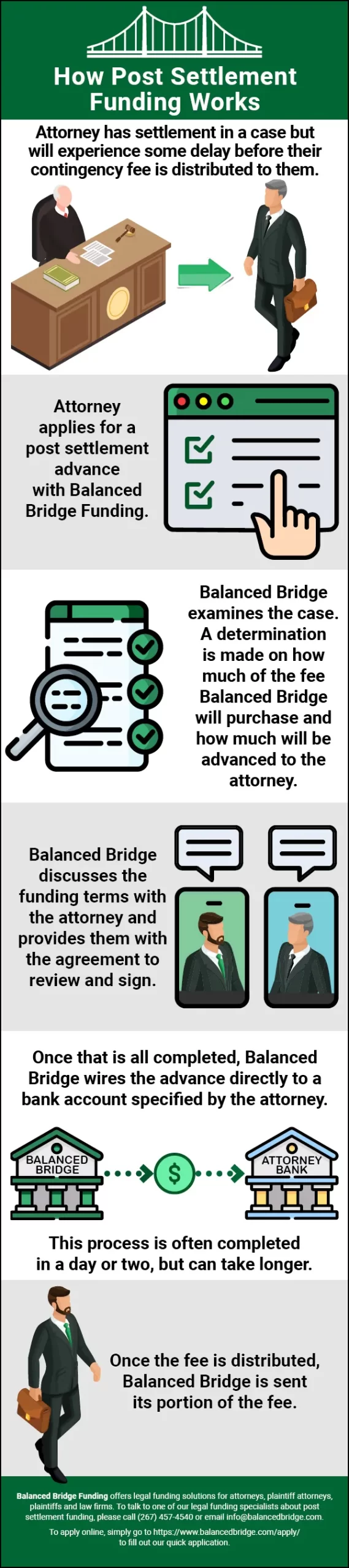

Infographic – How Post Settlement Funding for Law Firms Works

Let us explain how Post Settlement Funding for Law Firms Works:

• Attorney has settlement in a case but will experience some delay before their contingency fee is distributed to them

• Attorney applies for a post-settlement advance with Balanced Bridge Funding.

• Balanced Bridge examines the case. A determination is made on how much of the fee Balanced Bridge will purchase and how much will be advanced to the attorney

• Balanced Bridge discusses the funding terms with the attorney and provides them with the agreement to review and sign.

• Once that is all completed, Balanced Bridge wires the advance directly to a bank account specified by the attorney.

This process is often completed in a day or two but can take longer.

Once the fee is distributed, Balanced Bridge is sent its portion of the fee.

Is Post Settlement Funding for Law Firms a Loan?

A post settlement advance for Law Firms is not a loan. When you receive a settlement advance, the legal funding company does not loan you money. The fees you are owed from a lawsuit are considered an asset (like a stock or bond). And just like any other asset you own (like a stock, bond, or your car or house); you can sell it to someone else for an agreed price.

Using the example from the infographic above, this person agreed to sell $50,000 of their fees for the price of $45,000. The settlement advance company now OWNS the right to $50,000 of the lawsuit settlement and will receive their $50,000 directly from the case attorney of record. They bought the asset from you for $45,000 and will receive $50,000 from the attorney of record when the settlement award is paid, earning the legal funding company $5,000.

Who Pays the Legal Funding Company Back?

Remember, this isn’t a loan. As a post settlement advance company, we purchase the asset from you, and then we own it. You do not have to pay us back; instead, we notify the attorney of record of our ownership of a portion of your settlement award, and when the defendant pays, the attorney of record will pay us directly. There is nothing for you to do.

Reason #2: Law Firms Use Post Settlement Funding to Pay Themselves, Employees, and Bills

Law firms use post settlement funding and other legal funding options is to pay bills, pay employees, and pay themselves. If you are doing plaintiff work, by the time you get paid, you will have waited a long time to wade through the process of settling or winning a case. Why shouldn’t you want to get access to some of the money you are owed right away? You’ve waited a long time already, why keep waiting?

Opportunities are a strange phenomenon; they seem to favor the prepared and the able. A lot of law firm owners use post settlement funding advances because a personal opportunity has come up. Sometimes a house comes up on the market they have had their eye on for a long time, or a house isn’t even on the market yet, but it is about to list and it is in a neighborhood they have always wanted to live in, and now they have a chance. The only problem is, if you’ve got a lot of your money and credit tied up in a big case that has concluded, but the defendant hasn’t paid you yet, and might not for a few months, you are going to miss that opportunity.

But you don’t have to miss these opportunities because you lack cash at the moment. You can sell a portion of your pending contingency fees to a third party litigation finance company like Balanced Bridge Funding, and use that money to buy that house right now. Unlike traditional loans, there aren’t any limitations on what you can use your post settlement funding advance to finance. If you want to buy a second home, a car, a yacht, take a vacation, or pay cash for one of you kid’s college tuition, you can do it with your money from a post settlement advance.

Plus, approval for post settlement funding is fast. You can complete you application and have your money in just a few days. You’ve probably heard the saying “opportunity waits for no one,” and it is true. Opportunities seem to pop up suddenly and disappear just as quickly. Speed matters when it comes to taking advantage of rising opportunities, and you can get a check from post settlement funding fast.

Also, when it comes to qualifying for post settlement funding, your credit and debt to equity ratio aren’t major factors the underwriters consider when making a post settlement advance. They know they are going to get paid directly from the attorney of record from the lawsuit, so your personal credit isn’t a major deciding factor (like a loan).

Sometimes law firms want a post settlement advance for paying bills, paying bonuses, or paying partners. If you’ve been financing operations for a long time while you have been working on a major case, it might be nice to pay down some of the debt you’ve built up, pay out bonuses, or look at an office space upgrade. Very few businesses have to wait as long as plaintiff attorneys to get paid for the work they do. It makes sense that after the wait you would want access to some of your contingency fees right away. Post settlement funding is a great way to do it.

Reason #3: Law Firms Use Post Settlement Funding To Fund Future Growth

Law firms use post settlement funding and other legal funding options is to finance their future growth. Big businesses never hesitate to use “other people’s money” to finance their growth. In fact, they count on it. They raise private equity, sell bonds, sell equity, and take on debt to finance their future growth. This is commonly referred to as “leveraging.”

When you think of “leverage” what do you think of? You probably imagine “prying” something or “moving” something with a large lever. This is exactly what leverage is – using a large object like a lever to compound the force you have available to accomplish a task. And if you remember a bit from basic mechanical theory, the bigger the lever the easier things are to move. That is what using other people’s money is – it is a lever you use to move your law firm forward.

Archimedes said, “Give me a place to stand and a lever long enough, and I will move the world.”

Think about it like this – if you want to move something on your own, without a lever, you have only as much power and strength as you have in your arms, legs and back muscles. Even if you are the strongest person in the world, you will be severely limited in how much you can move. But if you have a lever, you can move nearly anything if the lever is long enough. The “leverage” provides a multiplying effect to the individual’s power and ability to accomplish a task.

This is the effect using other people’s capital has on trying to “move” your business forward. You can only go so far using your own financial power to move ahead. But if you “leverage” other people’s money you can grow much more rapidly.

Plus, if you decide to rely solely on your own financial strength, and one of your competitors goes out and uses leverage, they are going to leave you behind. They will continue growing, taking market share, expanding into new markets, hiring better talent, taking on the best clients and the best cases, while you fall further and further behind. So instead of thinking negatively about leverage, be grateful you understand it. Now you can get started using it to grow and you can be the one leaving your competitors behind who try to grow based entirely on their own financial strength.

Don’t be Debt Averse – did you know that being debt free as a business is not good? Being debt free might be desirable on a personal level, but as a business, you should never find yourself debt free.

Why shouldn’t your business be debt free? Because if a company is debt free they can’t be:

- Updating their technology

- Hiring the best people they can

- Taking Risks

- Growing Market Share

- Entering New Markets

- Opening New Branches

- Hiring More Specialist to Grow Practice Areas

Why is being debt free not good for your business? Because if you were updating technology, expanding into new markets, hiring the best and brightest new lawyers, and entering new practice areas, you wouldn’t be debt free. When finance experts see a company that is debt free, they see a company whose leadership is asleep at the wheel, coasting on their past successes, or is out of touch with the rest of the industry and falling behind. Finance experts are always on the lookout for debt free companies because they know if they take over such a company and then start using leverage to grow, that there is a lot of room for growth and expansion, which makes their holdings more valuable.

So unless you own a “lifestyle” law firm, that only exists to pay for your lifestyle, you should embrace the idea of using leverage to grow.

Using Post Settlement Funding to Fund Your Law Firm Growth

It is common to hear people say, “time is money.” But what does that really mean? Maybe they should say “lost time equals lost money you can never get back.” Because this is what “time is money” really means; it means every moment you spend waiting to get paid, you are not marketing, recruiting, investing in technology, etc., and you can never get that time back. It is lost.

At a minimum, your future success will be delayed. But if you are low on cash because you are waiting to get paid, you might miss some huge opportunities as they come along because you are not in position to capitalize on them.

Once a case concludes, and a judgment is ordered, you should be taking out a post settlement advance right away to get that money into your cash account so you can execute your future growth initiatives.

Wrong Thinking About Leverage Delays Growth

Gary Vaynerchuk (Gary Vee) was talking in a video clip about financing mistakes he had made.

He said something like this: “Every month I saw that Google Ads bill come in for sixty, seventy, eighty thousand dollars, and it freaked me out. I just kept seeing all that money leaving. So, I decided to try and cut it down as much as possible. And you know what, I was so wrong. So wrong. I was totally thinking about it the wrong way. Instead of trying to reduce my ad spend, I should have been figuring out how to spend two million or three million on Google Ads every month. And if I had, my business could have been where it is now three years ago.”

This is what we are talking about when we suggest using debt and financing to fund your future growth instead of sitting around waiting to get paid from lawsuits you’ve already won. Every moment you spend waiting, just prolongs your wait “down the road.” So instead of selling the law firm three years from now, maybe you’ll be selling it six years from now instead. Instead of being the number one law firm in your city, maybe you’ll be number six forever.

Without financing your future growth, it is likely your law firm will simply muddle along, having a few big victories here and there which are punctuated by anxiety ridden days in the future as you watch your cash account go down, down, down; hoping and waiting for another case to come in and be concluded, and then the whole cycle will start over again.

Summary

Law Firms use Post Settlement funding primarily to solve cash flow problems, pay bills, employees or themselves, and to fund their future growth.

Cash Flow Problems – are caused by having regular expenses (like rent and payroll) and irregular income (like waiting on a case to settle and then for the defendant to pay).

Paying Bills or Yourself – Opportunities tend to pop up suddenly and disappear quickly. Having quick and easy access to capital is important to capitalize on opportunities as they arise. This might be for a new home, college tuition, a car, or a trip. A post settlement advance is a great way to get your hands on money quickly.

Or, if you’ve been working on a case for years, using post settlement funding to pay down debt, bonus employees, or pay partners makes sense. Very few businesses have to wait as long as plaintiff attorneys to get paid for work they’ve already done.

Funding Future Growth – Large businesses never hesitate to use “other people’s money” to finance their future growth and if you want to growth your law firm, neither should you. Trying to fund future growth using only your own money is going to delay your future success and may prevent it entirely as other competitors use debt and private equity to raise capital and take market share from you.

Lost Time = Lost Money – Time spent “waiting” on money can never be recovered. It is lost forever. This is what is meant by time is money – any time spent waiting on money is lost and will inevitably prolong the time it takes your law firm to become successful. You need to be marketing now, adding the best and brightest talent now, entering new markets now, adding branches and divisions now; you can’t do that while you sit back and wait to get paid.

About Post Settlement Funding for Law Firms with Balanced Bridge Funding

A Post Settlement Advance is a Non-Recourse Transaction: We Accept All the Risk

Post Settlement funding is a non-recourse transaction. This means you don’t need to worry about what might happen if the defendant suddenly can’t pay your settlement award — we accept all risk of non-payment, meaning that you will still get to keep the money from your settlement advance if the defendant goes bankrupt or is unable to pay for whatever reason.

Fast, Hassle Free Application

In most cases we can get your money in your hands in one week or less. Our application is simple, straightforward, and easy to complete. Remember, this isn’t a loan, so there isn’t as much paperwork to go through. In most cases, we can approve your application and have your money deposited into your checking account in a matter of days.

Post Settlement Funding for Plaintiff Attorneys: If you think our post settlement funding solution could be the right fit for you, please call one of our legal funding specialists at 267-457-4540.

Or to apply online, simply CLICK HERE and fill out our quick form application.