With All Appeals Exhausted – The Interchange Fee Lawsuit Which Began in 2005 Will Finally Settle

March 26, 2024 – Visa announced on Business Wire they are settling with business owners over the amount they have been charging in credit card processing fees. According to the article, over 90% of plaintiffs were small businesses.

The final settlement includes over $30 Billion in settlement awards, plus guarantees in the future to help those who have been harmed.

Additionally, the article claims that the settlement will also give merchants more choice in how they accept payments.

The settlement agreement also includes provisions to help businesses that include:

- Lower interchange rates and keeping them capped for five years (until 2030)

There are, of course, critics of the settlement who feel the damages are not enough, and the future protections agreed upon do not go far enough to protect business owners in the future. But few massive lawsuits escape criticism. It is to be expected.

If the court approves the settlement, this will be the end to a class action lawsuit that began in 2005 and has stretched on for nearly two decades.

The credit card interchange fee lawsuits are headed to the settlement administration process, which means that everyone involved is looking forward to being paid after being involved in this case for 18 years (since 2005).

The current settlement is $5.5 billion – claimants have until May 31st of 2024 to submit their claims.

If If your business accepted Visa and/or Mastercard between 2004 – 2019, you are eligible to claim your share of a $5.5 billion Settlement.

The interchange fee lawsuits are also known as the “swipe fee” lawsuits, the payment card interchange fee lawsuits, and/or the merchant discount antitrust litigation. It is hard to believe, but the initial litigation started in 2005 and it is unlikely the lawyers who brought these lawsuits or their clients will see any money until after 2024, or maybe even longer.

This all began when merchants and trade organizations filed a class-action lawsuit against Visa and MasterCard, alleging that these companies adopted and enforced rules and practices that resulted in excessive fees for accepting their cards.

The lawsuits claimed that Visa and MasterCard’s rules and practices limited competition and charged merchants higher fees. They claim that these fees are fixed at an artificially high rate, violating antitrust laws, and causing them to pay more than necessary for card processing services. The plaintiffs argued that these actions violated antitrust laws and harmed merchants.

What is amazing is just how long this lawsuit has dragged on. The case was originally filed against Visa and Mastercard in 2005. Here we are, almost TWENTY YEARS later, and it appears as though final appeals have finally been exhausted and settlements should be happening soon.

A significant milestone was reached on March 15, 2023, when a settlement of $5.6 billion was approved. This settlement is the largest ever in a private antitrust action in the 130-year history of the Sherman Act.

These lawsuits aim to hold credit card companies accountable and potentially result in lower fees for merchants and consumers. So, the outcome of these lawsuits could have a significant impact on the fees we pay when using our credit cards.

Is it Too Late to Submit a Claim for the Interchange Fee Lawsuit?

The claims period ends May 31st 2024 – If you think you are part of the interchange fee lawsuit group, you have until May 31st of 2024 to file a claim under the proposed settlement.

Am I Eligible For Part of the Interchange Fee Settlement?

If your business accepted Visa and/or Mastercard between 2004 – 2019, you’re now eligible to claim your share of a $5.5 billion Settlement.

What Are Interchange Fees?

Before diving into the details of the lawsuits, let’s first understand what interchange fees are.

The short explanation is this: Whenever you swipe your credit or debit card, the merchant you are buying from is charged a fee. Fees are often as high as 4% per transaction. This might not seem like a lot, but for merchants who are processing hundreds of thousands, or even hundreds of millions of credit card transactions every year, it adds up.

Imagine you are an auto shop, and you charge a customer’s credit card for a $5,000 repair. Right off the top, the credit card processor takes $175 of your profit before you even receive your funds just for allowing you to “take” credit cards.

What are merchants doing to offset these additional costs? They are passing them on to the consumer in the form of higher prices and/or upcharging the consumer for the fees as a separate charge. The truth is, most consumers didn’t know about credit card processing fees until merchants started passing those charges on to consumers directly.

Interchange fees, also known as swipe fees, are fees charged by payment card networks, such as Visa and MasterCard, to merchants for accepting their cards as a form of payment. These fees are typically a percentage of the transaction value or a fixed amount per transaction.

Credit card processing companies say that Interchange fees fund the infrastructure and services provided by card networks, including processing transactions, fraud prevention, and customer support. These fees are shared between the issuing bank (the bank that issued the payment card to the customer) and the card network.

The specific interchange fee for a transaction depends on various factors, including the type of card (debit, credit, rewards, etc.), the merchant’s industry, transaction volume, and specific card program rules.

While interchange fees are an essential source of revenue for payment card networks and issuing banks, they have been a subject of debate and legal challenges. Critics argue that interchange fees are often excessive, leading to higher costs for merchants and potentially passed on to consumers in the form of higher prices. This has prompted regulatory scrutiny and legal actions seeking to address interchange fee practices and promote transparency and fairness in the payment card industry.

The Lawsuits

The interchange fee lawsuits were initiated in 2005 when several merchants sued major credit card companies, including Visa and Mastercard, for allegedly fixing these fees at an artificially high rate. The merchants claimed that this was a violation of antitrust laws and resulted in them paying more than necessary for card processing services.

Plus, the laws in 2005 did not allow merchants to legally pass on credit card processing fees to consumers. The laws changed in 2013 allowing merchants to place the burden of credit card processing fees on their customers. Once merchants began doing so, consumers became aware of how much credit card companies were charging merchants – because the merchants started charging them!

Who Is Impacted?

The impact of these lawsuits is far-reaching – the credit card companies, merchants, and consumers will all be impacted as a result of this litigation. It is estimated that interchange fees cost U.S. merchants over $80 billion annually, which ultimately leads to higher prices for consumers.

Current Status of the Interchange Fee Lawsuits Updated March 1st 2024

The deadline for submitting appeals has passed, meaning no more appeals can be filed. Now the administration of the claims process should begin, which will determine the structure of the payments the defendants must make and the timeline they have to make those payments.

What this means is, everyone who has been involved, from lawyers to plaintiffs, may be on the verge of collecting their portion of the $5.5 Billion settlement.

But something most people do not understand is that settlement does not equal payment. Once a case settles, there isn’t a person waiting in the lobby of the courthouse to cut a check.

Even though this case has dragged on for eighteen years, it could still take a decade before attorneys who have been working on this case receive their final payments. It just depends on how the administration of the claims is structured.

You would think with two companies the size of Visa and Mastercard, they would just wire the money immediately, but this is rarely the case. Based on other massive settlements, you can expect the terms of the settlement payment to extend out up to ten years.

Post Settlement Funding for Attorneys Involved in the Interchange Fee Lawsuit

Remember, the interchange fee lawsuit has been going on since 2005. For 18 years lawyers have been involved in this case without receiving any funds for doing so.

Now that the interchange fee lawsuit settlement is approved, lawyers will begin making claims to recoup their attorney’s fees out of the $5.6 Billion settlement.

Attorneys who would like to get some of those fees more quickly may consider taking out a post settlement funding advance for attorneys against their pending interchange fee lawsuit settlement claim for attorney’s fees.

How Long Does It Take for Lawyers to Receive Their Fees Once a Case Settles?

Something most people don’t understand is that when a case settles or concludes, there isn’t someone outside the courtroom waiting to pay the plaintiff’s attorney. It can take months, years, or sometimes a decade or more for lawyers to receive their contingency fees from a defendant.

Factors that determine the length of time it takes for a plaintiff attorney to get paid include:

- Size of the settlement

- The number of plaintiffs and defendants involved

- How well the defendant negotiates the terms of the settlement payment

- The defendant’s perceived ability to pay

- And more

As an example, in the massive USC sexual assault lawsuit, the defendant (USC in this case) was given eighteen months to pay even though they had more than sufficient cash available to pay the settlement the day the case was settled.

In the case of the BP Oil Spill case, some plaintiff attorneys waited over a decade to receive their funds.

In the recent class action lawsuit settlement against E-Cigarette maker JUUL the judge allowed JUUL to pay over the course of ten years.

Just because a law firm has won a lawsuit or reached a settlement, doesn’t mean they are going to be cashing checks any time soon.

This can place a heavy financial burden on the law firm. Plaintiff lawyers incur significant expenses throughout a lawsuit. Lawyers don’t get reimbursed for those expenses until the defendant pays what they owe.

Imagine having to work for 18 years to win a case and then also having to wait even longer to get paid – because that is exactly what plaintiff attorneys do.

Because law firms wait so long to recoup their fees and have so many costs associated with bringing cases to trial or settlement, many plaintiff attorneys use post settlement funding to get an advance on the contingency fees they are owed. Post settlement advances provide law firms with the ability to get some of that money back in the bank and put it back to work for them.

A post settlement advance allows attorneys to receive some of the contingency fees they are owed, in advance.

Post settlement funding is a financial vehicle that allows plaintiff attorneys to sell some of their settlement to a finance company that specializes in post settlement funding (like Balanced Bridge Funding). Then with the proceeds of that sale, they can pay down debt, market their firm, pay bonuses, or just enjoy some of their hard earned money.

Summary – Interchange Fee Lawsuit Update March 2024

The Payment Card Interchange Fee and Merchant Discount Antitrust Litigation, commonly referred to as the interchange fee lawsuit settlement, has been a significant legal case involving major credit card companies. The lawsuit centers around claims that merchants were charged excessive fees to accept Visa and Mastercard cards due to alleged anticompetitive practices by Visa and Mastercard.

As of February 2024, the lawsuit has resulted in a substantial $5.5 billion settlement, marking a significant victory for the plaintiffs. Robins Kaplan attorneys played a pivotal role in achieving this extraordinary settlement, which is one of the largest ever in the realm of interchange fee litigation. The approved settlement amount signifies a major win for the affected merchants and signifies a substantial effort to address the alleged antitrust violations by Visa and Mastercard.

Millions of business owners across the United States are eligible to claim a portion of the $5.5 billion settlement, making this a crucial development for the business community. The settlement aims to provide restitution to the affected businesses that incurred excessive interchange fees for accepting Visa and Mastercard payments. This marks a pivotal moment for the merchants who have long sought redress for what they deemed as unfairly charged fees.

Notably, the Court of Appeals for the Second Circuit upheld the district court’s order giving final approval to the $5.54 billion settlement. This judicial affirmation further solidifies the legitimacy and significance of the settlement, providing assurance to the affected businesses that the legal process has reached a conclusive stage.

The size and scope of this settlement underscore its impact on the payment card industry and its implications for the future practices of major credit card companies. Furthermore, the settlement serves as a notable example of how antitrust litigation can lead to substantial financial repercussions for large corporations found to have engaged in anticompetitive behavior.

Remember, If your business accepted Visa and/or Mastercard between 2004 – 2019, you are eligible to claim part of a $5.5 billion Settlement.

Post Settlement Funding for Attorneys

Attorneys use post settlement funding to take an advance on the contingency fees they are owed from cases they’ve won. Take the interchange fee lawsuits as an example – once this case goes into the administrative claims process and the law firms have filed their claims, they can take out a legal funding advance on what they are owed.

Get Some of Your Fees Fast

If you are an attorney involved in these interchange fee lawsuits, and you are just waiting to receive your funds, you can work with a company like Balanced Bridge Funding and get some of your money right away (for a fee). In the industry, this is known as a “settlement advance.”

How Post Settlement Funding for Attorneys Works

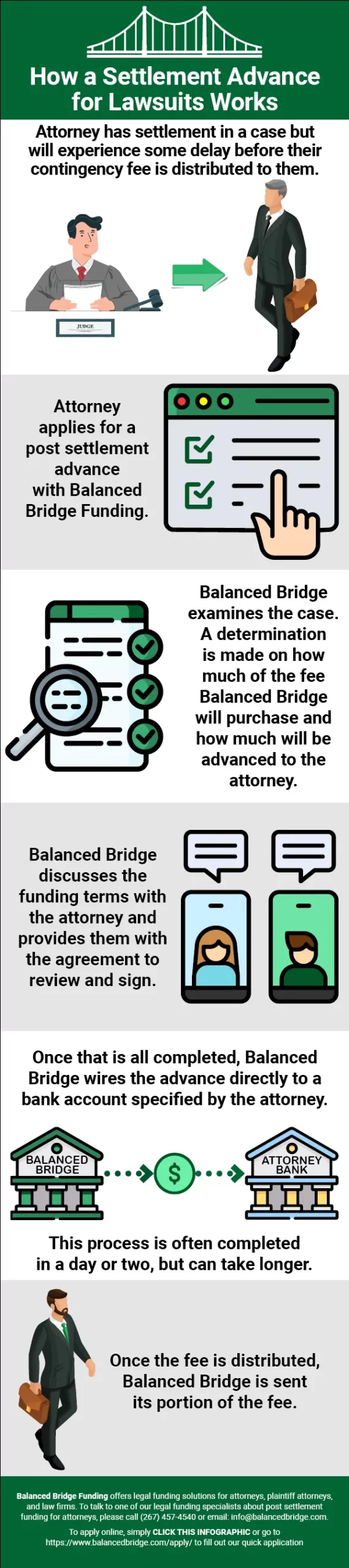

- Attorney has settlement in a case but will experience some delay before their contingency fee is distributed to them.

- Attorney applies for a post-settlement advance with Balanced Bridge Funding.

- Balanced Bridge examines the case. A determination is made on how much of the fee Balanced Bridge will purchase and how much will be advanced to the attorney.

- Balanced Bridge discusses the funding terms with the attorney and provides them with the agreement to review and sign.

- Once that is all completed, Balanced Bridge wires the advance directly to a bank account specified by the attorney.

This process is often completed in a day or two but can take longer.

Once the fee is distributed, Balanced Bridge is sent its portion of the fee.

Is Post Settlement Funding a Loan?

A settlement advance is not a loan. When you receive a post settlement advance, the legal funding company does not loan you money. The money you are owed from a settlement is considered an asset (like a stock or bond). And just like any other asset you own (like a stock, bond, or your car or house); you can sell it to someone else for an agreed price.

Post Settlement Funding is a Non-Recourse Transaction: We Accept All the Risk

Post settlement funding is a non-recourse transaction. This means you don’t need to worry about what might happen if the defendant suddenly can’t pay — we accept all risk of non-payment, meaning that you will still get to keep the money from your settlement advance if the defendant goes bankrupt or is unable to pay for whatever reason.

Fast, Hassle Free Application

In most cases, we can get your money in your hands in one week or less.

Our application is simple, straightforward, and easy to complete. Remember, this isn’t a loan, so there isn’t as much paperwork to go through. In most cases, we can approve your application and have your money deposited into your checking account in a matter of days.

If you are a lawyer involved in the interchange fee lawsuits and would like to take out an advance on the contingency fees you are owed, Post Settlement Funding for Attorneys could be the right fit for you, please call one of our Post Settlement Funding specialists at 267-457-4540.

To apply online, simply CLICK HERE and fill out our quick form application.

About The Authors

Balanced Bridge Funding offers legal funding solutions for plaintiff attorneys, attorneys, and law firms. To talk to one of our legal funding specialists about post settlement funding for attorneys, please call (267) 457-4540 or email info@balancedbridge.com.