Using Legal Financing to Jump Start Your Law Firm’s Success

Financing a start-up law firm can be challenging, but there are several financing options available to lawyers that are not available to other types of startup businesses. It is important you know what they are and how they work so you can drive growth without putting all your own assets at risk.

If you perform an internet search on how to finance a startup law firm, here are the typical answers you will find:

- Personal savings: One option is to use personal savings to finance the start-up law firm. This may involve investing personal funds or taking a personal loan to cover start-up costs.

- Friends and family: Another option is to seek financing from friends and family members who are willing to invest in the law firm. This can be a good option for those who have a strong personal network and are able to secure loans or investments from trusted sources.

- Loans: There are several types of loans that can be used to finance a start-up law firm, including small business loans, personal loans, and lines of credit. It’s important to research different loan options carefully and compare interest rates, terms, and fees before making a decision.

- Grants: Some organizations offer grants to start-up law firms that meet certain criteria. It’s worth researching grant opportunities in your area and applying for any that may be relevant to your business.

- Crowdfunding: Crowdfunding platforms like Kickstarter or Indiegogo can be used to raise funds for a start-up law firm. This involves creating a campaign and soliciting donations from individuals who believe in the business idea.

- Angel investors: Angel investors are individuals or groups who invest in early-stage companies in exchange for equity or ownership in the company. This can be a good option for start-up law firms that have a strong business plan and growth potential.

But the truth is – most of these options are not the best options for financing a startup law firm – and some of them, like trying to find business grants, are not always available, practical, or attainable. Lots of business owners are querying the internet trying to find these “business grants” and most of them are not finding any.

Also, a lot of the typical suggestions about how to finance a new law firm are extremely risky. As an example, let’s look at the suggestion of using your personal savings (or 401k or other investments (or taking out a second mortgage on your home). This is an extremely risky idea. Half of all businesses fail in their first year and 95% of them fail within five years according to the SBA. These are terrible odds. Why would you put your family’s money or your house at risk?

And what about the suggestion of taking on personal debt? Why would you risk personal bankruptcy and losing your property (collateral) given the extremely improbable odds of success?

These are not prudent methods for starting up and financing your law firm – nor are they the only methods available to finance your law firm.

Rather than putting your personal property at risk – consider the following types of finance options to fund your law firm:

Small business loans

Small business loans are a common option for startup law firms. These loans are typically offered by banks or other financial institutions and can be used to cover a variety of start-up expenses, such as office space, equipment, and salaries. But it is important to realize small business loans often require collateral and a strong credit score to qualify.

Lines of credit

A line of credit is a revolving loan that allows borrowers to draw on funds as needed. This can be a good option for law firms that have irregular cash flow or need access to funds on a flexible basis. They are, however, not always easy to get when you are in the startup phase of your business.

SBA loans

The Small Business Administration (SBA) offers several loan programs specifically designed for small businesses, including startup law firms. SBA loans often have more favorable terms and lower interest rates than traditional small business loans, but they also require more paperwork and documentation.

Legal Funding Companies

There are lenders who specialize in law firm financing. These lenders are typically called Legal Funding Companies or Legal Finance Companies. They understand law firm billing and operations better than many traditional lenders and tend to base their willingness to loan you money based on your caseload rather than your credit score or ability to come up with collateral.

In this article, we will discuss the various methods of financing your start up law firm and explain their individual benefits, strengths, and weaknesses to give you a better understanding of how to truly finance your law firm.

Small Business Loans

Small business loans are a type of financing that can be used to fund a variety of business expenses, including start-up costs, working capital, and equipment purchases.

Here is some additional information on how they work, who can get them, and how to apply.

How do small business loans work?

Small business loans are typically offered by banks or other financial institutions and involve borrowing a lump sum of money that is repaid over a fixed period of time, with interest. The terms and interest rates of small business loans can vary depending on the lender, the borrower’s credit score and financial history, and the nature of the business.

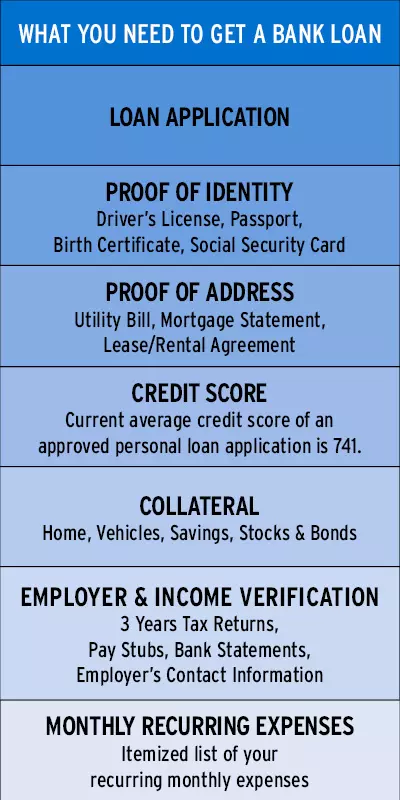

Who can get small business loans?

Small business loans are available to a wide range of businesses, including start-ups, sole proprietorships, and established companies. However, to qualify for a loan, the borrower must typically have a business plan, a good credit score, and collateral to secure the loan.

How to apply for small business loans

The application process for small business loans typically involves several steps. First, complete an application, which may require detailed financial information about the business, including its revenue, expenses, and projections for future growth. The lender will then review the application and decide whether to approve or deny the loan.

Some tips for applying for small business loans include:

- Start early and do your research to find the best loan options for your business

- Have a solid business plan that explains how your business is going to succeed

- Be prepared to provide collateral if required

- Make sure your credit score is as high as it can be before applying

- Be patient and persistent throughout the application process

There are many different types of small business loans available. It is extremely important you read all the details associated with such loans. Remember, the easier a small business loan is to get, the higher the interest rates are going to be. Business lines of credit that are easy to get, or do not require a high credit score, may have interest rates as high as 25-50%.

Here are seven small business loans that are “easy” to get, but you will notice right away how high their interest rate charges are: https://www.nerdwallet.com/best/small-business/easy-business-loans

Can’t I get a Small Business Loan from my Bank?

This is the truth – banks are not risk takers. Can you get a small business loan from your bank? Perhaps. Are they going to make you put up your house as collateral? Probably.

Small businesses fail, and they often fail suddenly and catastrophically. Banks know this and are not in the habit of loaning money to small businesses because of it. This is especially true of startup companies, companies in their first ten years of business, and companies with sales that do not reach tens of millions of dollars annually.

It isn’t that banks are not good for lending money, startup businesses are high risk and banks are often risk averse in their loan portfolios. Private investors, however, are often more willing to take on short term risks if they believe in the potential of your business and the long-term growth potential if they invest to get you through the startup phase.

SBA Loans for Start Up Law Firms

The Small Business Administration (SBA) is an independent agency of the U.S. federal government that helps provide financial assistance, resources, and support to small businesses. Their mission is to aid, counsel, assist, and protect the interests of small business concerns and ensure that these entrepreneurs have access to capital and a fair chance at success.

The SBA helps small businesses by providing access to capital, counseling services, and various forms of assistance.

They help entrepreneurs get startup funding through loans made by commercial lenders with a government guarantee, as well as provide grants and access to venture capital funds. The SBA also offers advice on a variety of topics such as business management and operations, legal advice, taxes and accounting, human resources, marketing strategies, procurement procedures, and more.

So, you should definitely get acquainted with your local SBA office because they provide a lot of resources for startup businesses.

However, it is also important to know that the SBA is not generally considered an “easy” source of financing. You should expect a lengthy and detailed process to secure a loan from the SBA. We say this, just so you are prepared for the process, which most people will tell you they find daunting. That doesn’t mean that you shouldn’t try. SBA loans are often low interest with favorable terms, making them a great source of capital if you can get them.

Plus, you shouldn’t expect any part of your business startup to be easy, especially financing. The SBA can be a pain to deal with, but your long-term odds of succeeding in securing capital from the SBA is much higher than many other forms of financing.

When considering SBA loans for start-up law firms, there are a few important things to keep in mind.

- It is typically considered difficult for start-up firms to qualify for an SBA loan, due to the loan requirements and lengthy application process.

- If a firm does qualify for an SBA loan, the firm will likely need to provide extra paperwork such as business plans, tax returns, financial documents, and more.

- While the process can be difficult, it can also be beneficial if a firm is able to secure an SBA loan as they often come with lower interest rates than other forms of financing.

Contact the SBA

To learn more about the SBA, you should visit their website: https://www.sba.gov

To find an SBA office in your area, you should visit the SBA website here: https://www.sba.gov/about-sba/sba-locations/sba-district-offices

Business Credit Cards

Pros of starting a law firm with credit cards

There are several advantages to starting your law firm with credit cards. As mentioned above, starting a business on credit cards is relatively easy and offers flexibility in terms of repayment plans. In addition, the convenience of having all your expenses in one account makes it easier to track spending and budget for future expenses.

Another benefit of starting a law firm on credit cards is the potential for rewards and cash back. Many credit card providers offer reward points that can be used toward travel, merchandise, or cash back, so starting your business on this route can give you access to these perks as well.

The truth is, many entrepreneurs are using credit cards to finance their operations, pay bills, and sometimes to make payroll (not ideal). And first and foremost, a law firm is a business.

According to the 2019 Intuit survey, “60% of entrepreneurs use business credit cards for their businesses”.

Cons of starting a law firm with credit cards (high-interest rates, lack of protection, etc.)

While starting your law firm with credit cards has its benefits, there are some drawbacks to consider as well. The most important one is the potential for debt. If you are not careful with your spending and fail to make payments on time, starting a business on credit cards can cause you to rack up debt in a hurry.

This can become a real problem because credit cards charge high interest rates. The average interest rate for business credit cards is above 20%. If you cannot pay off the balance in full each month, you can find yourself in a situation where even if you are paying much more than your minimum payments each month, you can still be accruing hundreds of dollars per month in interest charges, making it hard to get your principal balance paid down.

And if you are only making your minimum credit card payments, it can take years (or decades) to pay off your balance. According to the Consumer Federation of America, it would take more than 10 years to pay off an average credit card with minimum payments if you owe just $5000 in principal.

Source: https://consumerfed.org/wp-content/uploads/2018/04/Debt-Payoff-Calculator.pdf

If you are going to use credit cards to finance your business, you need to pay attention to your balance and keep it low – and if it does start to creep up, you should start paying it down aggressively rather than making only your minimum monthly payments, which might not be easy when you aren’t making a lot of money yet off of your new law firm.

Finally, starting a business on credit cards can negatively affect your credit score if not managed carefully because of the potential for high balances, increasing debit and/or utilizing more than 30% of available credit. A high balance and increased debit can result in a lower credit utilization ratio, which is one of the factors used to calculate a credit score. Additionally, using more than 30% of available credit will also impact your score.

Source: https://www.huffpost.com/entry/how-starting-a-business_b_5311902

Credit card debt is often seen as a bad or “questionable debt” when it comes to businesses. Generally speaking, credit card debt is seen as high risk because interest rates tend to be very high and when used for business, the stakes are even higher. Businesses can quickly find themselves in a precarious financial situation if they are not careful about how much they use and how quickly they pay off their credit cards. However, there may be certain situations when taking on credit card debt makes sense for a business – especially if it is done in the context of an overall strategy that includes other financing methods.

There is also the risk of identity theft and fraud when using credit cards, so it is important to keep track of your account activity and only use trusted sources for online purchases. Identity theft and fraud are serious issues when it comes to using credit cards for business purposes. To minimize the risk of identity theft and fraud, businesses should take the following steps:

- Ensure the safety of their customer’s personal information by only using secure payment methods that protect their data.

- Monitor transactions regularly to detect any fraudulent activity in a timely manner.

- Implement strong security protocols that include two-factor authentication whenever possible.

- Regularly update software, and use firewalls and other technologies to keep up with emerging cybersecurity threats.

Strategies for starting a law firm with credit cards (setting limits, budgeting effectively, etc.)

When it comes to starting a law firm with credit cards, there are certain strategies that can help to make the process easier and reduce the risk.

These strategies include:

Setting limits – This means setting an upper limit on how much credit card debt you are willing to take on and making sure you always stay within those limits.

Budgeting effectively – Creating a budget that takes into account your current financial situation as well as expected future expenses will help you better manage your credit card debt.

Paying off balances in full – If possible, make sure to pay off your balance in full each month so as not to accumulate interest payments.

Utilizing automatic payments – Setting up automatic payments will help ensure that monthly payments are made on time and reduce the risk of bad credit due to missed or late payments.

Which Business Credit Cards Might Be Good for a Startup Law Firm?

Many companies are currently offering excellent rewards programs for business credit cards. Some of the best ones include:

- Chase – Offers several cash back reward options and a wide range of benefits for business owners.

- American Express – Provides generous cash back rewards with its various business cards, in addition to exclusive perks such as access to airport lounges and free auto rental insurance. Plus, their rewards credit card is outstanding. Many businesses pay all of their expense on their American Express Rewards card just to build up points for travel. Their booking engine operates exactly like the Expedia.com website – except you don’t have to pay to travel (except with points)

- Citi – Gives customers a range of reward points and automatic bonuses when they use their business card.

- Bank of America – Offers flexible reward points, no annual fees, and other incentives.

Which Business Credit Cards Are Easiest to Get as a New Law Firm

Capital One Spark Cash for Business – This card offers easy approval and features a generous cash back rewards program. This has been the first business credit card for a lot of small businesses. It is easy to apply for, and (as of 2023), they approve a lot of their applications.

Bank of America Business Advantage Cash Rewards Mastercard – This card is a great option for businesses that want to earn cash back with no annual fee and an introductory APR offer.

Wells Fargo Business Secured Credit Card – This card requires a security deposit but provides access to features such as purchase protection, extended warranties, and travel benefits.

Here are some tips to help you stay out of financial trouble while using credit cards:

- Pay your balance in full each month. This will help you avoid interest charges and can help you manage your credit utilization ratio.

- Track your spending and make sure it falls within your budget.

- Avoid unnecessary purchases and consider using cash or other payment options for items that are outside of your budget.

- Monitor due dates for payments and set up reminders if needed to ensure that all payments are made on time. Late payments can negatively impact your credit score.

- Try to pay more than the minimum amount due each month. Doing so will reduce your overall balance and save you money on interest payments.

- Compare different credit cards to find one with a lower interest rate or a better rewards program.

- Contact your credit card issuer if you’re having difficulty making payments in order to discuss potential solutions.

- Transfer your balance to credit cards with lower monthly interest rates to help get your principal balance paid down as quickly as you can.

Legal Funding for Start Up Law Firms

Law firms are now discovering what other types of businesses have known for years – financing your future success with your own money is extremely limiting. If you want to truly succeed and grow your law firm, you are going to have to finance your operations using sources of capital outside of your own savings account. This has traditionally meant seeking outside investment, loans, lines of credit, Etc.

Today, law firms are finding more creative means of securing funding through private investors called Legal Funding Companies, or other financial institutions who engage in Legal Funding.

Law firms are not alone in their desire to find more creative means of funding their businesses. According to a recent Wall Street Journal Article, 2022 was one of the worst years on record for Initial Public Offerings – many businesses are seeking out new forms of private equity investment to finance their ongoing growth.

Additionally, lots of investment groups and cash rich entities are interested in investing their money. Having become wary of the stock market’s volatility, many private equity investors are looking for other opportunities to invest their money, like financing lawsuits, factoring legal receivables, and offering private equity investment to attorneys and law firms.

Legal Funding is Favorable to Lawyers

Unlike banks, which may require non-liquid assets as collateral to secure a loan or line of credit, legal funding companies accept case inventories as collateral. Legal funding firms understand the potential value of pending settlements and verdicts, so they can accept case inventories as proof that solo practitioners or larger law firms will be able to repay advances.

Legal Funding Companies do not perform personal credit checks as part of an application. Funding advances are business expenses, not personal expenses, making personal credit checks unnecessary. Moreover, in most legal funding arrangements, attorneys are not directly responsible for repayments; rather, payments are directly taken from attorney escrow accounts, administrative accounts, or obligor accounts.

The Basics of Legal Funding

- Legal funding helps attorneys take on new cases, take on bigger cases, increase settlements for their clients, and feel confident taking on defendants with strong financial backing.

- There are types of legal funding that are loans, and there are types of legal funding that are not loans. It is important to know the differences between types of Legal Funding.

- Legal Settlement Funding is typically only available for a portion of your settlement. This means that you will not normally be able to receive the full amount owed to you through legal funding.

- There are types of legal funding that are available pre-settlement, post-settlement, and on an ongoing basis like attorney lines of credit and lawyer loans.

- Legal funding is typically only available if you have a strong case. After all, if an attorney can’t count on winning a case, borrowing money against it is unlikely.

Types of Legal Funding Available to Attorneys

- Post Settlement Funding

- Pre-Settlement Funding

- Lawyer Loans

- Lawyer Lines of Credit

- Voucher Funding

- Factoring Accounts Receivable for Lawyers

Legal Funding – Post Settlement Funding

Once you (the law firm) have reached a settlement or received a judgment on behalf of your client, the money you are owed in contingency fees is considered an asset, just like a stock or bond. And just like a stock or bond, it is your property, and you have the right to sell it any time you want to for an agreed upon price.

Post Settlement Funding is not a loan. Instead, the Legal Funding Company purchases a portion of the contingency fees owed to the attorney (at a discount). The attorney gets some of their money right away, and then the Legal Funding Company then owns the asset (the portion they purchased from you).

The Attorney then pays the legal funding company back according to the terms of the Post Settlement Agreement.*

*This is not true however of plaintiff post settlement funding. For post settlement funding made with plaintiffs, the attorney of record is notified and pays the legal funding company when the defendant pays what they owe and then the attorney of record pays everyone with a claim, including the legal funding company.

Legal Funding – Pre-Settlement Funding for Attorneys

Legal Funding includes pre-settlement funding for attorneys. Pre-settlement funding is perhaps one of the riskiest forms of investing under the legal funding umbrella. When a Legal Funding Company offers pre-settlement funding, they are investing money in a lawsuit that is ongoing and has not yet concluded. If the attorney should fail to win their case, or not achieve a significant settlement, the pre-settlement funding investment may lose money or be lost altogether. Attorneys and Legal Funding Companies must have a great deal of confidence in their case to take out pre-settlement funding against a pending lawsuit.

Attorneys use pre-settlement funding because it can help offset costs associated with litigation or court proceedings and help them “wait out” the stall tactics defendants sometimes use to try and force a favorable settlement. Pre-settlement funding enables law firms to take on more clients and more cases.

Pre-settlement funding has become a big business. Hedge funds and even traditional lending institutions are now beginning to offer pre-settlement funding for attorneys. The pre-settlement finance company gives the attorney an advance on a potential future settlement in exchange for a percentage of the settlement award once the case concludes.

Because of pre-settlement funding, attorneys can take on cases they may otherwise have to pass on due to their financial limitations. With pre-settlement funding, law firms and attorneys can focus on delivering quality legal service without worrying about running low on cash if the case drags on. This form of financing helps preserve access to justice for more individuals and businesses because their attorneys are no longer as willing to take a settlement simply because a case is dragging on. They have the cash to “stay in the fight” as it were.

As a result of the availability of pre-settlement funding, attorneys are winning bigger awards for their clients, garnering larger settlements for their clients, and in so doing, receiving much bigger paydays in the form of contingency fees for themselves.

Ultimately, pre-settlement funding helps law firms meet the growing demand for legal services and ensures that individuals have access to justice when they need it most. Through Legal Funding, attorneys can secure the capital they need to make a positive impact in the courtroom and beyond.

Legal Funding – Lawyer Loans

Lawyer loans are a common name given to legal funding financial vehicles an attorney line of credit or a private equity loan made to lawyers. Most of these operate like any other loan or line of credit. The difference is, it is often a private investor or group of investors loaning the money as opposed to a bank.

Legal Funding – Lawyer Line of Credit

A lawyer line of credit is an actual loan. It is an open/revolving loan attorneys can use to finance operations and help to manage cash flow. However, a line of credit is typically a secured loan, meaning the attorney will need to put up some sort of collateral. An Attorney line of credit is also fixed regarding how much money is available. Most newer attorneys will not qualify for a line of credit, but it is possible if collateral is available and/or the attorney has a significant caseload and can prove the history of their clients (as is often the case if an attorney leaves a firm and brings their clientele with them).

Legal Funding – Voucher Funding

Voucher funding is a legal financing vehicle that provides cash advances to attorneys who perform voucher work. This might include public defenders who take cases from the public defender’s office on vouchers, and it might include work plaintiff work involving a municipality, city, state, or federal government.

If you win your case against a municipality, it can take a long time to get paid by a city, county, or municipality. These entities often have a great deal of say as to when/if they will pay settlements or judgments against them.

Cities and governments must continue operating to serve the people they are responsible to – they can’t do this if they are bankrupted by a lawsuit. Because of this, they are often allowed to decide for themselves when/if they have enough cash on hand to start paying settlements or judgments rendered against them.

If you are a law firm that has extended considerable cash and time to win such a lawsuit, voucher funding may be a way to get some of your money right away.

If you are an attorney who takes contract work from the public defender’s office, it might take some time to get paid for the work you are doing. You may be able to use Voucher Funding to get an advance on some of the money owed to you to help continue taking on clients and defending them without running out of money yourself.

Factoring Accounts Receivable for Lawyers

There are an ever-growing number of legal practice areas and many of them do not involve plaintiff work. Lawyers who focus on billable hours rather than plaintiff work may be able to take advantage of factoring for lawyers.

Often billable clients are given thirty days to pay their bills, but in some cases, they might not pay their bills for sixty or even ninety days. During that time, the law firm has more cash going out than they have coming in because they still have to pay bills and make payroll while they are waiting on their clients to pay them.

For larger law firms, they may have millions of dollars in outstanding accounts receivable they are waiting to collect. Law firms can take advantage of factoring their accounts receivable to get some of their money right away.

Factoring for Lawyers works a lot like post-settlement funding for lawyers. The attorney or law firm is owed money for work they have completed for a client (accounts receivable). Once the law firm has invoiced the client, they can sell that invoice to a Law firm Factoring Company at a discounted rate and get some of their money right away.

The factoring company then collects the invoice directly from the client – or – from the law firm once they client pays, depending on the agreement the law firm has with the law firm factoring company as far as how they will be paid.

Many businesses factor their accounts receivable because they have already completed their work, waited until the end of the month to send out invoices, and then must wait thirty, sixty, or ninety days for the client to pay. This waiting period is precisely what creates cash flow problems for all businesses – law firms included.

Factoring for lawyers is one way law firms can get cash back in their hands to pay bills, make payroll, and fund future growth.

Using Legal Funding for Growth

Business owners who rely exclusively on their own money limit will limit their growth. Large businesses never hesitate to use funds from others to finance their future growth. They understand that it is important to leverage assets for the expansion of their companies.

Law firms should have the same mindset – if you truly want to grow, you are going to need access to liquid capital beyond what you have managed to accumulate in your savings account.

Legal funding used to be something that only smaller law firms considered, but that is no longer the case. At Balanced Bridge Funding we frequently talk to larger law firms who have done the math and realized that legal funding is a great way to fuel their growth. It is also an inexpensive way to finance ongoing operations.

Larger law firms are fully aware that every day they spend waiting for their cash from a settlement is time wasted that they can never recover. They want to have that money in their account as soon as possible so they can use it on hiring top talent, adding new law practice areas, buying up other law firms, marketing, finding expert witnesses, and staying current on technology.

The longer they wait for their funds, the more opportunities pass them by or are snatched up by quicker thinking competition.

Real growth never comes from waiting on your money. You need to reinvest it as soon you get it so you can keep growing.

Summary – Financing a New Law Firm

When you are considering the options for starting a law firm, it is important to realize that most small businesses fail. Half of them fail in their first year. Of the half that doesn’t fail in the first year, 95% of them fail in the next four and half years. And of those who won’t fail outright, many of them muddle along for years and never make any significant amount of money.

Because of these “long odds,” it isn’t a great idea to put your own personal property at risk as there is a high probability of losing it all.

Historically, it might have made sense to use your own money and assets to start up your law firm. Banks were often the only source of funding, and they were often unwilling to loan a new business money.

But those times are in the past. Today, startup companies have many options for financing. Individual as well as institutional investors have started looking for better investment options than the typical financial markets (like stocks and bonds). One of the areas they have discovered great potential in is investing in law firms and individual lawsuits.

Because of this, startup law firms have many great financial vehicles available to them from Legal Funding Companies. These include pre-settlement funding, post-settlement funding, lawyer loans, lawyer lines of credit, factoring accounts receivable, and more.

You don’t need to use your own savings or take out a second mortgage to finance your law firm. Contact a legal funding company to begin learning about how legal finance works, what is available to you, and how to get started building the long term success of your law firm today.

About Legal Funding with Balanced Bridge Funding

Does Balanced Bridge Funding Offer Pre-Settlement Lawsuit Funding?

Balanced Bridge Funding does not offer pre-settlement funding at this time. We do offer post-settlement funding options for attorneys as well as plaintiffs whose potential settlements qualify (which many do).

A Post Settlement Advance is a Non-Recourse Transaction: We Accept All the Risk

Post Settlement funding is a non-recourse transaction. This means you don’t need to worry about what might happen if the defendant suddenly can’t pay your settlement award — we accept all risk of non-payment, meaning that you will still get to keep the money from your settlement advance if the defendant goes bankrupt or is unable to pay for whatever reason.

Fast, Hassle-Free Application

In most cases, we can get your money in your hands in one week or less. Our application is simple, straightforward, and easy to complete. Remember, this isn’t a loan, so there isn’t as much paperwork to go through. In most cases, we can approve your application and have your money deposited into your checking account in a matter of days.

About The Authors

Balanced Bridge Funding offers legal funding solutions for plaintiffs, plaintiff attorneys, attorneys, and law firms. To talk to one of our legal funding specialists about getting help managing your law firm cash flow, please call (267) 457-4540 or email: info@balancedbridge.com. Or to apply online, simply click the button below and fill out our quick and easy application.