Access to Capital Remains a Major Challenge for Growing Law Firms

How to finance your law firm growth is not always an easy problem to solve. Access to capital can be a serious barrier to long term growth of your law firm. But law firms are not alone in this struggle. Limited access to capital is a problem faced by many businesses.

In this article, we explain various sources of capital law firms should know about and take advantage of to continue growing their firm. We cover bank loans, private equity investment, mergers and acquisitions, and legal funding options like post settlement funding for law firms.

Limited access to capital is a serious barrier to growth and success. Law firms who do not figure out how to gain access to capital tend to stay small and eventually decline either from loss of market share, falling too far behind on new technologies, or not being able to access the latest trends in the legal field.

The bottom line is, if you want to grow your law firm, you are going to need capital.

Why Law Firms Struggle to Access Capital

The reasons law firms struggle to access capital are the same reasons most business struggle.

Banks and traditional lenders may be reluctant to provide loans to law firms, particularly smaller ones that lack a long track record of success. This can make it difficult for law firms to secure the capital they need to invest in growth and expansion.

Law firms may also be able to attract investors or partner with other firms to access capital, but this can be costly, high risk, and involving others may come with a loss of control over the direction of the firm.

Some law firms try to fund future growth and expansion by maximizing profits and building up cash reserves. Unfortunately, this approach is slow and not viable for most firms, nor is it desirable.

Other potential solutions include seeking out grants or low-interest loans from government or non-profit organizations or exploring the possibility of a merger or acquisition with another firm.

These are some of the challenges law firms face when trying to raise capital to grow their law firms. But these are the very things most lawyers are going to do if they want to get access to funds to keep their law firms growing.

Why Banks and Traditional Lenders Might Not Be the Easiest Solution for Law Firm Growth

Banks and traditional lenders may be reluctant to provide loans to law firms, particularly smaller ones that lack a long track record of success. This can make it difficult for law firms to secure the capital they need to invest in growth and expansion, even if the firm has a solid reputation or strong clients, their size may still affect whether they can access capital.

Also, banks usually won’t accept case inventory as collateral for loans, which is a challenge because this is typically the biggest asset lawyers have as a business. This makes it hard for law firms to take out loans because they use their caseload as collateral. This is one of the reasons the legal funding industry started – because legal funding companies saw a law firm’s case load as excellent collateral for financing law firms.

Additionally, banks may also require information such as financial statements, tax returns, cash flows projections, and more. If the law firm can’t provide these documents, banks are going to be reluctant to loan them money.

Fortunately, there are other options available from non-traditional lenders. These loan programs offer lower qualification requirements than traditional lenders but still provide access to the capital needed for growth and expansion. Unfortunately, these types of loans often have extremely high interest rates and penalties. But they are good to know about because if you need money fast to get in on a lawsuit or to fund a case, and the case has great upside potential, it might be worth it to pay higher interest rates to get the case.

Law Firms Try to Grow Using their Own Profits and Cash Reserves

Business owners who rely exclusively on their own money limit will limit their growth. Large businesses never hesitate to use funds from others to finance their future growth. They understand that it is important to leverage assets for the expansion of their companies.

Law firms should have the same mindset – if you truly want to grow, you are going to need access to liquid capital beyond what you have managed to accumulate in your savings account.

There are several reasons why companies might find it difficult to grow using their own profits and cash reserves:

Limited resources: Even profitable lawyers may not have enough excess cash on hand to fund significant growth initiatives. This is particularly true for small or mid-sized businesses, which may not have access to the same level of capital as larger corporations.

High costs of growth: Growing a law firm often requires significant investment in marketing, infrastructure, and personnel. These costs can be difficult for companies to bear, particularly if they are trying to grow quickly or in a highly competitive market.

Risk aversion: Attorneys may be hesitant to invest large sums of money in growth initiatives if they are unsure of the return on investment. This is particularly true if the company has been successful in the past by maintaining the status quo.

Short-term thinking: Law Firms may prioritize short-term profits over long-term growth initiatives. This can lead to a focus on cost-cutting or other measures to boost profitability in the short term, rather than investing in initiatives that could drive sustained growth over time.

External pressures: Companies may face pressures from partners to prioritize bonuses and salaries over growth initiatives. This can make it difficult for companies to allocate sufficient resources to strategic growth initiatives.

In general, it is difficult for law firms to grow using their own profits and cash reserves. To truly grow a firm, lawyers should expect to need access to capital. Not only that, but they will often require access to capital from every possible source if they want to truly focus on growth over the long term.

Using Investors and Private Equity to Finance Law Firm Growth

Law firms may also be able to attract investors who are willing to inject capital in exchange for an equity stake in the firm. Investing in a law firm can be a high-risk, high-reward proposition. However, for investors who believe in the growth potential of a particular firm, private equity investment makes a lot of sense.

Why Would Investors Want to Invest in Law Firms?

Investors have learned over time that if they truly want to grow their investment portfolio, they need to be creative in finding new investment opportunities. Many of these private equity investors have discovered that law firms can be extremely lucrative business propositions if managed well and given sufficient funding.

Investors may be interested in investing in a law firm for several reasons, including:

Potential for high returns: Law firms can be very profitable, particularly if they are able to attract and retain high-value clients. This can provide investors with a good return on their investment over time.

Risk diversification: Investing in a law firm may be an attractive option for investors looking to diversify their portfolio or seeking a reliable source of long-term capital.

Access to new markets and services: Investing in a law firm may give investors access to previously untapped markets or services.

Growth potential: Investors may see potential for growth in a particular law firm, such as expansion into new geographic areas or practice areas.

Diverse revenue streams: Depending on the type of law firm, there may be multiple potential revenue streams (such as hourly billing, contingency fees, and flat-rate fees) that can make the firm attractive to investors. Having diverse revenue streams can be attractive to investors because it can help to mitigate risk and provide multiple potential sources of growth and profitability for the firm.

How diverse revenue streams can help mitigate risk for investors

Reduced reliance on a single source of revenue: If a law firm relies too heavily on a single source of revenue, such as hourly billing for one major client, it can be vulnerable if that revenue source dries up. By diversifying its revenue streams, a law firm can reduce its dependence on any single client or type of legal service.

Protection against market volatility: Certain areas of the legal industry may be more prone to market fluctuations than others. By diversifying its revenue streams across multiple practice areas, a law firm can protect itself against downturns in any one area of the market.

Increased stability: Diverse revenue streams can help provide greater financial stability for a law firm, which can be attractive to investors and clients alike. A law firm with a diverse set of revenue streams is less likely to experience significant revenue fluctuations from year to year, which can make it easier to plan for long-term growth and success.

Better able to weather unexpected events: If a crisis or unexpected event occurs, having diverse revenue streams can provide a cushion for a law firm. For example, if one practice area experiences a downturn due to a change in legislation, the firm may be able to rely on other revenue streams to offset any losses in that area.

Financing Law Firms Using Low-Interest Government Loans

Other potential solutions include seeking out grants or low-interest loans from the government or other organizations. These programs are designed to help businesses access capital when traditional sources of financing are unavailable.

Examples of government loans include the Small Business Administration’s 7(a) loan program and the Community Advantage Loan Program, which offer low-interest rates to businesses in underserved communities.

Additionally, there may be grants available from associations or other non-profit organizations that specialize in helping law firms access capital. For example, the American Bar Association offers grants to certain firms for professional development and research initiatives.

Using Mergers and Acquisitions to Grow Your Law Firm

Mergers and acquisitions can be an effective way to access capital for small and mid-size law firms, as these transactions often involve an infusion of new funds from the other party – an infusion of new funds that may not have been available through traditional financing sources. This can provide the funds needed for growth and expansion, allowing a law firm to quickly expand its operations. Mergers and acquisitions can also allow firms to gain access to resources such as additional staff or clients that could be beneficial in helping them reach their goals.

Mergers and acquisitions (M&A) can help a company grow in several ways

Increase market share: Sometimes the easiest way to grow your company is to buy another company. Purchasing another company or merging with another law firm can allow a company to expand its market share faster than it could ever “take it.”

When a law firm acquires a competitor that offers complementary products or services, it gains access to the acquired company’s customer base, distribution channels, and other assets. This can help the acquiring company expand its market share and continue its upward growth.

Access better technology: Through M&A, a law firm can gain access to the latest technology available in the industry, which can improve efficiency and productivity.

Mergers and acquisitions (M&A) can help companies access better technology in several ways. Firstly, M&A can provide companies with access to specialized technology that they may not have been able to develop on their own.

For example, if a company acquires a business that has developed proprietary technology, the acquiring company can immediately gain access to that technology. M&A can also provide access to new markets where technology is more advanced or more widely adopted. If a company acquires a business in a foreign market, it can gain access to technologies that are more advanced or more widely used in that market.

When law firms combine, or purchase another firm, it can allow law firms to combine their technology resources, subscriptions (like Lexus Nexus), IT Staff, and any proprietary technology the other firm has developed. It will also allow teams within the firm to share expertise and knowledge, which can help accelerate innovation and the development of new technologies.

By gaining access to better technology, companies can improve their competitive position in the market, which is particularly important in industries where technology is a key driver of success.

Access new markets: M&A can give a company access to new geographic markets or customer segments that they may not have been able to reach on their own. This can help to drive growth and increase sales.

Many law firms merge or purchase another firm specifically to gain access to practice areas they have not yet developed themselves. As an example, if a law firm does not specialize in litigating large class action lawsuits, it could take them a long time to develop that skill in-house and develop customer relationships.

But if they purchase another firm that already has this skill and has customers as well, the purchasing law firm quickly has a whole new revenue stream for their firm. One they didn’t have to develop slowly on their own.

Acquire talent and expertise: M&A can allow a company to acquire talented employees or specialized expertise that can be difficult to develop in-house. This can help the company to improve its competitive position and drive innovation.

Achieve cost savings: M&A can provide opportunities for cost savings by reducing duplication and streamlining operations. This can help the company to operate more efficiently and improve profitability.

As an example, by consolidating administrative functions between two law firms, such as finance and human resources, and reducing the number of employees required to perform these functions, law firms can achieve significant cost savings. After all, if two law firms merge, you don’t need the entire support staff of both firms – particularly if the staff of one firm or the other has been underutilized.

In addition to streamlining operations, M&A can also present opportunities to eliminate redundant costs. For example, if two law firms merge, they may be able to consolidate their facilities and reduce overhead costs. Unless they are in two different cities, they don’t need two buildings for the “new” law firm.

By achieving cost savings through M&A, companies can improve their financial performance, increase profitability, and free up resources to invest in growth initiatives.

Using Legal Funding to Finance Law Firm Growth

If you want to truly succeed and grow your law firm, you are going to have to finance your operations using sources of capital outside of your own savings account. This has traditionally meant seeking outside investment, loans, lines of credit, Etc. Today, law firms are finding more creative means of securing funding through private investors called Legal Funding Companies, or other financial institutions who engage in Legal Funding.

Legal Funding Companies Understand Law Firms

Unlike banks, which may require non-liquid assets as collateral to secure a loan or line of credit, legal funding companies accept case inventories as collateral. Legal funding firms understand the potential value of pending settlements and verdicts, so they can accept case inventories as proof that solo practitioners or larger law firms will be able to repay advances.

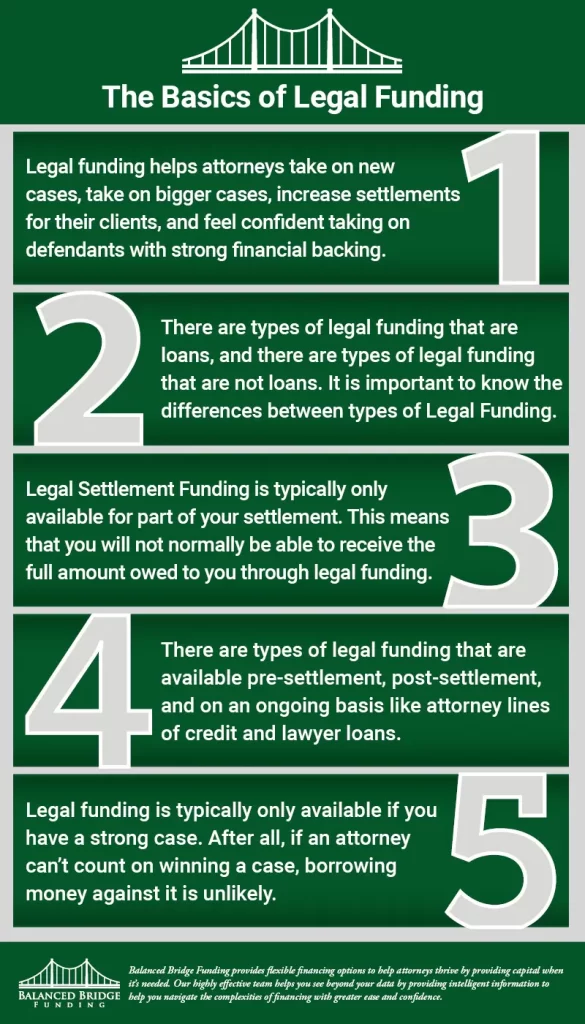

The Basics of Legal Funding

The Basics of Legal Funding Infographic

- Legal funding helps attorneys take on new cases, take on bigger cases, increase settlements for their clients, and feel confident taking on defendants with strong financial backing.

- There are types of legal funding that are loans, and there are types of legal funding that are not loans. It is important to know the differences between types of Legal Funding.

- Legal Settlement Funding is typically only available for a portion of your settlement. This means that you will not normally be able to receive the full amount owed to you through legal funding.

- There are types of legal funding that are available pre-settlement, post-settlement, and on an ongoing basis like attorney lines of credit and lawyer loans.

- Legal funding is typically only available if you have a strong case. After all, if an attorney can’t count on winning a case, borrowing money against it is unlikely.

Types of Legal Funding Available to Attorneys:

- Post Settlement Funding

- Pre-Settlement Funding

- Lawyer Loans

- Lawyer Lines of Credit

- Voucher Funding

- Factoring Accounts Receivable for Lawyers

Legal Funding – Post Settlement Funding

Once you (the law firm) have reached a settlement or received a judgment on behalf of your client, the money you are owed in contingency fees is considered an asset, just like a stock or bond. And just like a stock or bond, it is your property, and you have the right to sell it any time you want to for an agreed upon price.

Post Settlement Funding is not a loan. Instead, the Legal Funding Company purchases a portion of the contingency fees owed to the attorney (at a discount). The attorney gets some of their money right away, and then the Legal Funding Company then owns the asset (the portion they purchased from you).

Then (in most cases) once the defendant pays, the attorney pays the Legal Funding Company back. There are some scenarios where the legal funding company will notify the attorney of record of a case and collect their funds directly, but in most cases, the attorney pays the legal funding company at the agreed upon time.

Legal Funding – Pre-settlement Funding for Attorneys

Legal Funding includes pre-settlement funding for attorneys. Pre-settlement funding is perhaps one of the riskiest forms of investing under the legal funding umbrella. When a Legal Funding Company offers pre-settlement funding, they are investing money in a lawsuit that is ongoing and has not yet concluded. If the attorney should fail to win their case, or not achieve a significant settlement, the pre-settlement funding investment may lose money or be lost altogether. Attorneys and Legal Funding Companies must have a great deal of confidence in their case to take out pre-settlement funding against a pending lawsuit.

Pre-settlement funding has become a big business. Hedge funds and even traditional lending institutions are now beginning to offer pre-settlement funding for attorneys. The pre-settlement finance company gives the attorney an advance on a potential future settlement in exchange for a percentage of the settlement award once the case concludes.

Because of pre-settlement funding, attorneys can take on cases they may otherwise have to pass on due to their financial limitations. With pre-settlement funding, law firms and attorneys can focus on delivering quality legal service without worrying about running low on cash if the case drags on.

Legal Funding – Lawyer Loans

Lawyer loans are a common name given to legal funding financial vehicles an attorney line of credit or a private equity loan made to lawyers. Most of these operate like any other loan or line of credit. The main difference being it is often a private investor or group of investors loaning the money as opposed to a bank.

Legal Funding – Lawyer Line of Credit

A lawyer line of credit is an actual loan. It is an open/revolving loan attorneys can use to finance operations and help to manage cash flow. However, a line of credit is typically a secured loan, meaning the attorney will need to put up some sort of collateral. An Attorney line of credit is also fixed regarding how much money is available. Most newer attorneys will not qualify for a line of credit, but it is possible if collateral is available and/or the attorney has a significant case load to back the loan.

Legal Funding – Voucher Funding

Voucher funding is a legal financing vehicle that provides cash advances to attorneys who perform voucher work. This might include public defenders who take cases from the public defender’s office on vouchers, and it might include plaintiff work involving a municipality, city, state, or federal government.

If you win your case against a municipality, it can take a long time to get paid by a city, county, or municipality. These entities often have a great deal of say as to when/if they will pay settlements or judgments against them.

If you are an attorney who takes contract work from the public defender’s office, it might take some time to get paid for the work you are doing. You may be able to use Voucher Funding to get an advance on some of the money owed to you to help continue taking on clients and defending them without running out of money yourself.

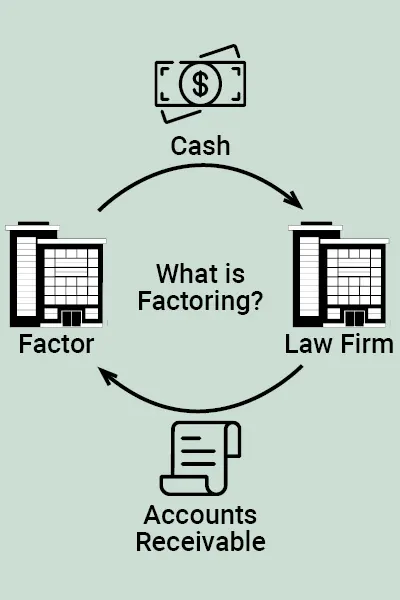

Factoring Accounts Receivables for Lawyers

There are an ever-growing number of legal practice areas and many of them do not involve plaintiff work. Lawyers who focus on billable hours rather than plaintiff work may be able to take advantage of factoring for lawyers.

Often billable clients are given thirty days to pay their bill, but in some cases, they might not pay their bill for sixty or even ninety days. During that time, the law firm has more cash going out than they have coming in because they still must pay bills and make payroll while they are waiting on their clients to pay them.

For larger law firms, they may have millions of dollars in outstanding accounts receivable they are waiting to collect. Law firms can take advantage of factoring their accounts receivable to get some of their money right away.

Factoring for lawyers works a lot like post-settlement funding for lawyers. The attorney or law firm is owed money for work they have completed for a client (accounts receivable). Once the law firm has invoiced the client, they can sell that invoice to a Law firm Factoring Company at a discounted rate and get some of their money right away.

The factoring company then collects the invoice directly from the client – or – from the law firm once the client pays, depending on the agreement the law firm has with the law firm factoring company as far as how they will be paid.

Many businesses factor their accounts receivable because they have already completed their work, waited until the end of the month to send out invoices, and then must wait thirty, sixty, or ninety days for the client to pay. This waiting period is precisely what creates cash flow problems for all businesses – law firms included.

Factoring for lawyers is one way law firms can get cash back in their hands to pay bills, make payroll, and fund future growth.

Using Legal Funding for Growth

Business owners who rely exclusively on their own money limit will limit their growth. Large businesses never hesitate to use funds from others to finance their future growth. They understand that it is important to leverage assets for the expansion of their companies.

Law firms should have the same mindset – if you truly want to grow, you are going to need access to liquid capital beyond what you have managed to accumulate in your savings account.

Legal funding used to be something that only smaller law firms considered, but that is no longer the case. At Balanced Bridge Funding we frequently talk to larger law firms who have done the math and realized that legal funding is a great way to fuel their growth. It is also an inexpensive way to finance ongoing operations.

Larger law firms are fully aware that every day they spend waiting for their cash from a settlement is time wasted that they can never recover. They want to have that money in their account as soon as possible so they can use it on hiring top talent, adding new law practice areas, buying up other law firms, marketing, finding expert witnesses, and staying current on technology.

The longer they wait for their funds, the more opportunities pass them by or are snatched up by quicker thinking competition.

Real growth never comes from waiting on your money. You need to reinvest it as soon you get it so you can keep growing.

Summary

Faced with limited access to capital, small and mid-size law firms should consider both traditional banking services and alternative financing options to adequately fund their growth and expansion. Additionally, they may also explore the possibility of grants or low-interest loans from government or non-profit organizations, seeking out investors, partnering with other firms, considering a merger or acquisition, or learning about legal funding.

Many traditional methods of securing capital have become more challenging for law firms (and all types of businesses). But, because private equity investors are looking for better investments than they can find in traditional markets (like the stock market), there are new opportunities (like legal funding sources) for securing capital for law firms.

Legal funding companies understand law firms and tend to make their lending/capital investment decisions based on the law firm case load rather than their credit score. This makes legal funding for law firms an excellent source for accessing capital for attorneys.

Taking a comprehensive approach to accessing capital is essential for law firms looking to stay competitive and continue growing. With the right combination of banking services, SBA backed loans and legal funding, law firms can secure the capital they need to invest in growth and expansion opportunities and keep themselves on track for long term success.

About Legal Funding with Balanced Bridge Funding

Does Balanced Bridge Funding Offer Pre-Settlement Lawsuit Funding?

Balanced Bridge Funding does not offer pre-settlement funding at this time. We do offer post-settlement funding options for attorneys as well as plaintiffs whose potential settlements qualify (which many do).

A Post Settlement Advance is a Non-Recourse Transaction: We Accept All the Risk

Post Settlement funding is a non-recourse transaction. This means you don’t need to worry about what might happen if the defendant suddenly can’t pay your settlement award — we accept all risk of non-payment, meaning that you will still get to keep the money from your settlement advance if the defendant goes bankrupt or is unable to pay for whatever reason.

Fast, Hassle-Free Application

In most cases, we can get your money in your hands in one week or less. Our application is simple, straightforward, and easy to complete. Remember, this isn’t a loan, so there isn’t as much paperwork to go through. In most cases, we can approve your application and have your money deposited into your checking account in a matter of days.

About The Authors

Balanced Bridge Funding offers legal funding solutions for plaintiffs, plaintiff attorneys, attorneys, and law firms. To talk to one of our legal funding specialists about getting help managing your law firm cash flow, please call (267) 457-4540 or email: info@balancedbridge.com or, to apply online, simply CLICK HERE and fill out our short, quick application.