Cash Advance on Lawsuit Settlements – What You Need to Know

Cash Advance on Lawsuit – A cash advance on lawsuit has also been referred to as settlement loans, post settlement loans, post settlement funding, pre settlement funding, legal funding, third party litigation financing, and more. But the bottom line is, a cash advance on lawsuit settlement is a great way to take out a cash advance against a pending lawsuit settlement.

People use cash advances on lawsuit settlements to pay rent, medical bills, monthly expenses, travel, and to pay for loss of work due to an injury.

If you are involved in a lawsuit and you need to borrow money against your pending settlement, taking out a cash advance on lawsuit is a great way to get some of your money right away rather than waiting.

Introduction to Cash Advance on Lawsuit Settlement

What Is a Cash Advance on Lawsuit Settlement?

A cash advance on lawsuit settlement is an advance on funds that are given to a plaintiff who is in a pending lawsuit or has a pending settlement award coming to them. The cash advance on lawsuit amount you can get is based on the expected value of the future settlement or the actual value of a settlement award (if the case has already settled).

Some people use cash advances on settlements to pay rent, medical bills, monthly expenses, or travel costs. Others may use the money to make up for lost wages due to an injury. The good news is, there are not a lot of limitations on what you can do with your cash advance on lawsuit settlement.

Why do People Take Out a Cash Advance on Lawsuit?

There are many reasons, and we will go into them in detail, but the bottom line is, it can take many years (sometimes more than ten) for a case to work its way through the court systems. During that time, while you are waiting, you may have been injured and not be able to work, you may have expenses piling up like medical bills, you might need a car, or have to relocate. A lot of things can change as a result of being injured, and most of them cost money. A cash advance on lawsuit allows you to get some of your pending settlement money right away to pay for your expenses while you wait.

In addition, and most people don’t know this, even after you win a case, there isn’t going to be someone waiting in the lobby of the courthouse with a check for you. It often takes months to get a check from a lawsuit settlement, and in some cases, it takes YEARS to get a check.

Some cases, like the BP Oil Spill settlement, dragged on for years, and it took some people over a decade to get a check. In fact, some are still waiting. That is a long time to wait for your money, and a lot can change in that time. A cash advance on lawsuit can help you get some of your money fast.

How Does a Cash Advance on Lawsuit Settlement Work?

If you’re considering taking out a cash advance on your pending lawsuit settlement, there are a few things you need to know. First, you’ll need to find a cash advance on lawsuit company that is willing to give you a loan based on the expected value of your settlement.

Once you’ve found a lawsuit settlement cash advance company to work with, you’ll need to fill out an application and provide some documentation about your pending lawsuit. The legal finance company will then review your case and make a decision about whether or not to give you a loan. If you’re approved, you will normally have the money in your hands in less than one week.

Is a Cash Advance on Lawsuit a Loan?

No, it is not a loan. In fact, some states have passed laws designed to make clear that legal funding, (also known as a cash advance on lawsuit) is not a loan and does not in any way meet the requirements of a loan.

Instead, you are actually selling your future pending legal settlement to a third party legal financing company (like Balanced Bridge Funding) at a discounted rate. In fact, these types of transactions are generally considered non-recourse transactions, meaning, if the defendant doesn’t pay, or your lawyer doesn’t win, then you don’t have to pay the money back. Not at all like a traditional loan where you must pay the lender back regardless of circumstances.

What Are the Benefits of Taking Out a Cash Advance on Lawsuit Settlement?

There are a few key benefits of taking out a cash advance on lawsuit settlement. First, it can give you much-needed financial relief while you’re waiting for your case to resolve. Second, it can help you avoid falling behind on bills or other expenses. And third, it can help you pay for necessary expenses that you may not be able to afford otherwise.

If you’re involved in a pending lawsuit and you need financial assistance, taking out a cash advance on your settlement may be a good option for you.

In this article we will answer the following questions:

- What is a cash advance on lawsuit settlement?

- How does a settlement loan work?

- How do I get money from a pending lawsuit?

- How does a cash advance on lawsuit settlement work?

- What are the benefits of taking out a cash advance on lawsuit settlement?

- Can I get a cash advance on a pending lawsuit?

- How do I borrow money from a pending settlement?

What is a Cash Advance on Lawsuit Settlement?

A cash advance on lawsuit settlement is also sometimes called pre-settlement funding, post-settlement funding, legal funding, and third-party litigation financing. But the bottom line is, you are applying to get a portion of your pending settlement money right away, rather than waiting for the case to conclude, and then for the defendant to pay, which can take years.

The cash advance on lawsuit settlement is based on the expected value of the future settlement, and it can be used for any number of expenses. Some people use cash advances on settlements to pay rent, medical bills, monthly expenses, or travel costs. Others may use the money to make up for lost wages due to an injury.

How Does a Cash Advance on Lawsuit Settlement Work?

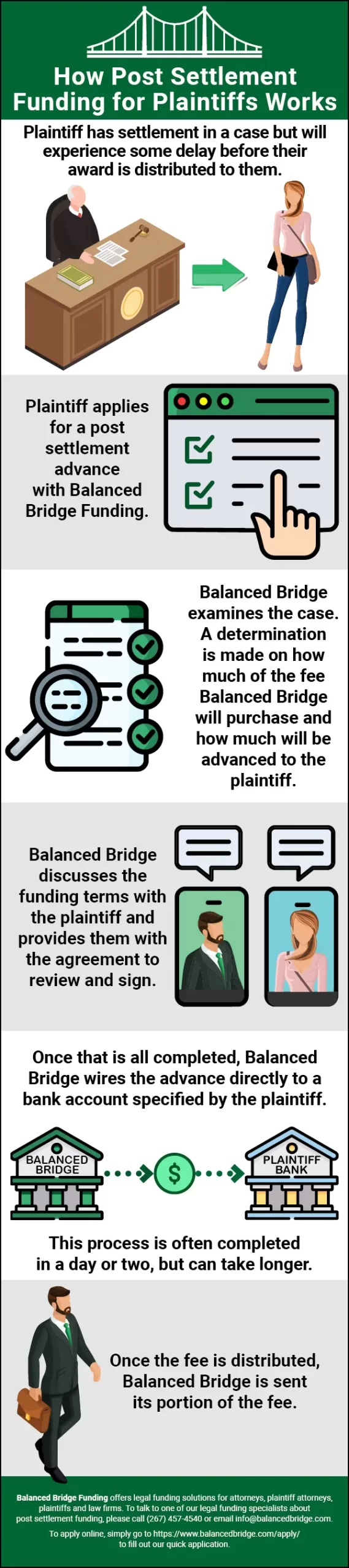

Infographic – How Settlement Funding for Plaintiffs Works

Let us explain how a cash advance on lawsuit settlement works:

- Plaintiff has settlement in a case but will experience some delay before their award is distributed to them.

- Plaintiff applies for a settlement advance with Balanced Bridge Funding.

- Balanced Bridge examines the case. A determination is made on how much of the fee Balanced Bridge will purchase and how much will be advanced to the plaintiff

- Balanced Bridge discusses the funding terms with the plaintiff and provides them with the agreement to review and sign.

- Once that is completed, Balanced Bridge wires the advance directly to a bank account specified by the plaintiff

This process is often completed in a day or two but can take longer.

Once the fee is distributed, Balanced Bridge is sent its portion of the fee.

What are the Benefits of Taking out a Cash Advance on Lawsuit Settlement?

There are a few key benefits of taking out a cash advance on lawsuit settlement. First, it can give you much-needed financial relief while you’re waiting for your case to resolve. It can take years for a case to wind its way through the legal system, and even once concluded, it can take years to get paid. A cash advance on a lawsuit helps you get some money right away to help manage your finances while you wait.

Second, it can help you avoid falling behind on bills or other expenses while you are waiting. If you’ve been injured or incapacitated in any way and are in a lawsuit to get recompense, you might end up destitute long before your lawsuit concludes.

Imagine you have a good paying job and are injured on that job and can’t continue working. How are you going to pay your bills? Workers Compensation isn’t always easy to get and often doesn’t pay enough. You may be able to file a disability claim, but these are often not approved until after all your resources run out. Taking a cash advance on a pending lawsuit is one way to get some money right away to help cover your expenses so you don’t end up broke.

Third, a lawsuit cash advance can help you pay for necessary expenses that you may not be able to afford otherwise. Medical bills, travel, relocation, and re-education may all be required while you wait on a lawsuit to conclude. All of these can be incredibly expensive, especially if you weren’t planning on any of these expenses. A cash advance on lawsuit settlement can help you cover some or all of these expenses until you get the rest of your money when your lawsuit concludes.

Can I Get a Cash Advance on a Pending Lawsuit?

Yes, you can get a cash advance on a pending lawsuit. This type of arrangement is often referred to as legal funding, lawsuit funding, third party litigation financing, lawsuit loans, and of course, cash advance on pending lawsuits. To receive a cash advance on a pending lawsuit, you need to contact a cash advance on lawsuit company like Balanced Bridge Funding. You will need to provide the information about your lawsuit, complete an application, and then if you qualify, you can receive your funds in just a few days.

How Do I Borrow Money from a Pending Lawsuit Settlement?

If you’re involved in a pending lawsuit and need financial assistance, taking out a cash advance on your settlement may be a good option for you. A cash advance on the settlement can be used for any number of expenses, including rent, medical bills, monthly expenses, or travel costs.

To get a cash advance on your pending lawsuit settlement, you’ll need to fill out an application and provide some documentation about your pending lawsuit. The lender will then review your case and decide whether they can provide you with a cash advance on your lawsuit settlement.

One thing that is important to know is that when you “borrow money from a pending lawsuit” you actually don’t take out a loan. Instead, the legal financing company purchases a portion of your legal settlement award from you for a fee. So instead of paying the legal funding company back like a traditional loan, they collect their money directly from the attorney of record who handles the distribution of the funds once the case concludes, and the defendant pays.

What are the Terms of a Cash Advance on Lawsuit Settlement?

The terms of a cash advance on lawsuit settlement will vary depending on the amount of advance, and the timeline of the legal funding company getting paid. Your agreement will spell out for you the precise fees involved, how much you are to receive, and how the cash advance on lawsuit company will be paid.

The “terms” may look foreign to you at first, as most types of funding agreements are not set up like loans. But when it comes to cash advances on lawsuits, you aren’t receiving a loan. Instead, the legal funding company is purchasing a portion of your future settlement from you at a discounted rate. Then, when the case concludes, they will receive what is owed to them directly from the attorney of record. So, the terms of the agreement are mostly explaining to you how much money you are getting, and that you are selling that portion of your pending settlement to the cash advance on lawsuit company.

Why do People Take Out a Cash Advance on Lawsuit?

Case #1: Injured on the Job

If you’ve never been injured at work, you are probably unaware of what happens afterward.

If you are injured at work, you might think that your expenses will be automatically covered by workers compensation insurance. But this is not always the case. Workers comp will normally cover your medical expenses. But won’t normally pay you 100% of your normal wages. Usually, they will only pay you a percentage of your weekly paycheck. But a lot of people need their entire paycheck to afford their bills, not a percentage of it.

This can leave you in a situation where you can’t work because of your injury, and you also can’t afford to pay your bills based only on what you are getting from workers compensation. If that happens, your creditors don’t make exceptions for you because you’ve been injured. They still want their money, and they will still send you to collections if you don’t pay them which can ruin your credit for seven years and make it difficult to get loans in the future.

And that is just part of it – if you decide to file a lawsuit against the company where you were injured (or their insurance), it can take years for a case to wind its way through the court, and after that, it can several more years before a defendant pays you. While you are waiting, you could lose everything and be forced to declare bankruptcy while you wait.

These are some of the reasons people take out a cash advance on their pending lawsuits. Taking out a cash advance on your pending lawsuit you can pay for the things you need and offset the reduction in your income while you are waiting for your lawsuit to conclude.

Case #2: Injured by Negligence

Getting injured at work is difficult. Navigating workers compensation insurance can be frustrating. But at least if you are injured at work, you can get your medical bills and a percentage of your pay covered by workers compensation insurance. It may not be enough to cover everything, but at least it is something.

But what happens if you are injured outside of work, as the result of someone else’s negligence? You aren’t going to get workers compensation insurance to help you cover your medical bills or regular living expenses. You might get compensated at some point, but it isn’t going to happen quickly.

As an example, if you are injured in a car accident because of someone else’s error, you may have expensive medical bills from your injury. You might not be able to work for a period of time or you might not be able to ever do your job again. And unlike workers compensation, if you are injured off of the job, you aren’t going to get your medical expenses automatically covered by workers comp insurance. You also aren’t going to get a portion of your salary paid to you.

Instead, you will be forced to hire a lawyer and wait while your lawyer talks to the insurance company of the person who injured you and tries to get you some money. This process, depending on the insurance company and their lawyers, can take years to settle a case and give you money.

And what happens to you while all of that is going on? You can be put into collections by the hospital (which is becoming more common). If you miss work, and can’t pay your bills, you could get evicted. Your credit can be ruined. Even if you were to get millions from a lawsuit settlement in the future, while you are waiting, it is entirely possible to go broke and endure a long hardship while your case winds its way through the courtroom.

What if you are injured so badly that you can no longer perform the work you were trained to do? You may need a completely new education, which can also take years. You might need long lasting physical rehabilitation to function again – who is going to pay for that? The insurance company might, and then again, they might not. Or they might fight paying you for years, and eventually pay you, but at that point, you’ve lost a lot of time trying to move forward in your life.

These types of cases are often lengthy and frustrating. But at least if you take a cash advance on lawsuit settlement, you can get some money right away to help you endure the financial difficulty until the case concludes.

Case #3: Emotional Trauma or Loss

There are many types of injuries that do not leave visible scars. These might include sexual abuse, wrongful death of a loved one, discrimination, and more. But just because you can’t see the marks these events leave; doesn’t mean they aren’t just as harmful (if not more) as being physically injured.

Persons can be impacted for years or even decades by trauma or a loss caused by someone else. It can impact their ability to work, and life as much, or more than a physical injury does. You may need counseling or therapy. You might feel compelled to relocate. You may want to seek out a new career or occupation for any number of reasons.

As a result of your injury, you may decide to file a lawsuit against the people, places, or institutions that injured you (or failed to protect you). These types of cases rarely qualify people to receive financial compensation upfront from insurance companies. They just aren’t that type of case.

And while your lawsuit is working its way through the court, until your case settles, or damages are awarded when the case concludes, you will most likely have to navigate living your life, adjusting as necessary, taking retraining, counseling, or therapy expenses, and pay for all these things yourself (if you can afford them).

And if your life is impacted in such a way that you cannot work, your creditors are still going to want their money. Your landlord will still expect their rent check. Your credit can be ruined. Your life can be ruined. And even if you are awarded a great deal of money in a settlement or award from the court, it can take years once a case concludes to get paid.

This is one of the reasons people take out an advance on a pending settlement, to get some of their money right away to help them live their life, pay their bills, and get the help they need.

Getting Money from Lawsuits is Usually Slow – See Cases Above

What all three cases we mentioned above have in common is that someone has been impacted in a way that makes it difficult or impossible to cover their expenses because of someone else’s actions (or lack of action).

Lawsuits progress slowly – this is another truth. It can take years for your case to wind its way through the courts. And even once the case settles or concludes, it can take years to get your money, and in some cases, people never get their money.

And while all of that is going on – creditors still want their money, regardless of your ability to continue paying them. If you can’t pay your creditors, they turn you over to collections, your credit score is often ruined, and sometimes you may be forced to declare bankruptcy. It happens every day across the country.

That is why people take out Cash Advances on Lawsuits – because they need money to cover their living expenses while they are waiting to receive just compensation through the court. Even if you were going to receive tens of millions of dollars from a lawsuit settlement “someday” – you will suffer every day until you do if you can’t pay your rent, car payment, and medical bills. You can’t spend money you are going to get “someday.” Most people who are seriously injured, whether physically or emotionally, are going to need financial aid to get through the time it takes to get their settlement award money.

Is a Cash Advance on Lawsuit Settlement a Loan?

A cash advance on Lawsuit Settlement is not a loan. When you receive a cash advance on your pending lawsuit settlement, the legal funding company does not loan you money. The money you are owed from a lawsuit is considered an asset (like a stock or bond). And just like any other asset you own (like a stock, bond, or your car or house); you can sell it to someone else for an agreed price.

Using the example from the infographic above, this person agreed to sell $50,000 of their class action lawsuit settlement for the price of $45,000. The settlement advance company now OWNS the right to $50,000 of the lawsuit settlement and will receive their money directly from the settlement. They bought the asset from you for $45,000 and will receive $50,000 from the settlement attorney of record when the settlement is paid, earning the legal funding company $5,000.

Who Pays the Cash Advance for Lawsuit Company Back?

Remember, this isn’t a loan. As a lawsuit cash advance company, we purchase the asset from you, and then we own it. You do not have to pay us back; instead, we notify the attorney of record of our ownership of a portion of your settlement award, and when the lawsuit settlement pays out, the attorney of record will pay us directly. There is nothing for you to do.

How Much of My Lawsuit Settlement Can I Get a Cash Advance on?

The answer is – it depends. In most cases, you will be able to sell about 50% of your lawsuit settlement for cash advance. But you will not normally be able to sell 100% of it.

Is There a Minimum Amount of Cash Advance on Lawsuit I Must Take Out?

At Balanced Bridge Funding the minimum we are generally willing to advance someone is $10,000. And because we can only advance 50% of the total amount owed to you, you must have at least $20,000 (total) coming to you from your lawsuit to qualify for a lawsuit settlement cash advance.

Do I Have to Pay Taxes on My Lawsuit Cash Advance?

We cannot answer this question for you as an individual, but many types of settlements you receive are considered income by the IRS and are 100% taxable. This is not always the case, however. There are types of settlements that could be exempt from taxation. You should consult with your attorney and CPA to make sure you pay your taxes properly on any settlement money you receive.

Can’t I Just Get a Lawsuit Cash Advance From My Lawyer?

You can’t take out a cash advance or loan from your lawyer. Lawyers are not allowed to loan money to their clients. This is an ethical violation on their part. Judges in cases are on the lookout for this sort of arrangement to make sure it does not happen. If your lawyer has a vested financial stake in getting repaid, the way they present and handle the case for their clients could be influenced; judges watch for this sort of thing carefully. This is one of the reasons third party legal finance companies exist because your lawyer is not allowed to give you a cash advance on a pending lawsuit or purchase part of your settlement, even if it would help you out a great deal.

Don’t Create Unnecessary Delays Receiving Your Settlement Award

We included the following information to help make sure that you as a plaintiff do not accidentally delay receiving the remainder of your funds. Even if you sell a significant amount of your pending settlement award to take out a cash advance on lawsuit, you will still have some money coming to you when the defendant pays. Don’t make the mistakes listed below, or you will delay your settlement check.

- Update Your Contact Information – If you move, change phones, or change email, make sure you update your contact information with your own attorney and the attorney of record. If the attorney of record must find you, contact you, and verify that it is you, all of this takes time and causes delays.

- Updated Bank Account Information – Some lawsuits distribute funds by depositing the funds directly into your bank account. If you change bank accounts, which people do all the time, make sure you update the attorney of record, or it might take them a long time to locate you and for you to receive your money.

- Release Forms – Not signing your release form is another way your funds might be delayed. Until you sign your release form, you will not get your money. Simple as that. So make sure you have it signed.

The bottom line is – don’t make it hard for the attorney of record to find you. As of March 2021, $700 million dollars of funds were turned over to the treasurer of the State of Louisiana from the BP Oil Spill Lawsuit – this is money that people are owed, who probably didn’t update their contact information and couldn’t be found by the attorney of record in the case and the money is just sitting there waiting to be claimed. One person is owed $68,000 in that case, but they don’t know how to contact them, so the money is just sitting in the state treasury waiting to be claimed.

About a Lawsuit Settlement Cash Advance From Balanced Bridge Funding

Does Balanced Bridge Funding offer Pre-Settlement Funding as well as Post Settlement Funding?

Balanced Bridge does not offer pre-settlement funding solutions for plaintiffs currently. We do offer post settlement funding; meaning, once your lawsuit has settled or concluded, and you are owed a settlement, we can offer you a cash advance on your lawsuit settlement (if you qualify). But no, we do not offer pre-settlement funding options currently.

A Cash Advance on Lawsuit Settlement is a Non-Recourse Transaction: We Accept All the Risk

Lawsuit funding is a non-recourse transaction. This means you don’t need to worry about what might happen if the defendant suddenly can’t pay your settlement award — we accept all risk of non-payment, meaning that you will still get to keep the money from your settlement advance if the defendant goes bankrupt or is unable to pay for whatever reason.

Fast, Hassle Free Application

In most cases we can get your money in your hands in one week or less. Our application is simple, straightforward, and easy to complete. Remember, this isn’t a loan, so there isn’t as much paperwork to go through. In most cases, we can approve your application and have your money deposited into your checking account in a matter of days.

Cash Advance on Lawsuit Settlement: If you think our settlement funding solution could be the right fit for you, please call one of our legal funding specialists at 267-457-4540.

Or to apply online, simply CLICK HERE and fill out our quick application.