Class Action Settlement Funding for Plaintiff Attorneys – Post Settlement Funding for Plaintiff Attorneys

Class Action Settlement Funding for Plaintiff Attorneys – Settlement funding for plaintiff attorneys exists to help plaintiff lawyers manage cash flow. Lawsuits, especially class action lawsuits, by their nature create an environment where managing cash flow is going to be a struggle.

It takes a long time to have a judge to certify a group of people as a class, work your way through discovery, and navigate the back-and-forth negotiations to reach a settlement. And then, once the case settles or a judgment is rendered, you still must wait to receive your fees. During that time, you still have to pay bills, pay expert witnesses, pay your staff, and pay yourself.

One way to help reduce this cash flow burden is to take out a settlement advance.

Settlement advances (also called settlement loans) give you the opportunity to get some of your money right away, so you can pay yourself, pay bills, take on new cases, hire new people, or finance future growth or simply reward yourself and your family for years of hard work.

If you are a smaller firm, or a solo attorney, chances are you’ve had some struggles while you’ve waited for your class action lawsuit to conclude. Why wouldn’t you want to get some of your cash right away?

Some people might say, “well, you’ve waited this long, what is a little longer?” Those people are obviously not used to waiting through long dry spells before they receive their legal fees.

Why Plaintiff Attorneys Who Specialize in Class Action Lawsuits Use Settlement Funding

Plaintiff Attorneys who specialize in class action lawsuits have a unique cash flow management challenge. Most businesses don’t have to wait years to get paid for their work. But for plaintiff attorneys who specialize in class action litigation, waiting on your money is part of the business. Waiting on your money creates cash flow problems for plaintiff attorneys. Settlement Funding for Plaintiff Attorneys is a financial vehicle plaintiff attorneys can use to get at least some of their money in the bank right away.

What is Cash Flow for Plaintiff Attorneys?

People throw the words “cash flow” around a lot, but very few people truly understand its implications.

Cash flow is the flowing of cash INTO your bank and cash flowing OUT of your bank account. That is what cash flow is. Money going into your bank and money flowing out.

What is Cash Flow Management?

Cash flow management is the act of regulating the flow of cash coming into your bank and the flow of cash leaving it. The goal of cash flow management efforts is to keep the money flowing into the account faster than it leaves.

What are Cash Flow Problems?

When you’ve got money flowing OUT of your bank account faster than money flow IN to your bank account, you have cash flow problems. And when you have cash flow problems, you will struggle to pay your bills, your employees, and yourself. There will come a day where there simply isn’t enough cash in the bank account to pay everyone.

What Causes Cash Flow Problems?

Cash Flow problems for businesses are (mostly) caused by one of two problems:

Problem #1: The company has taken on expenses because they are experiencing growth – or – because they are anticipating growth, but either sales slowdown or they never materialize the way the company anticipated. When this happens, the company has all of the extra expenses to pay, but does not have the sales coming in to pay the bill. This causes cash to leave the account faster than it comes in and creates a cash flow problem.

Problem #2: The Plaintiff Attorney Cash Flow Problem – The second type of cash flow problem is caused by the “timing” of cash coming into the bank account versus the timing of the money flowing out.

If the money flows in slowly and at irregular intervals (timing), and the money leaves the bank account quickly and at regular intervals (like payroll), then you have a cash flow problem.

And this perfectly describes Plaintiff work. You get paid at highly irregular intervals, so cash only comes into the bank every now and then, and there is no way to predict when it will arrive or how often. But – your rent, payroll, personal salary, expert witnesses, travel, and more all must be paid immediately, and these expenses happen at regular intervals.

The net effect is that you have money constantly leaving the cash account at regular intervals, but money might only enter the cash account a few times per year (or less). Money is continuously being drained every day, but only getting replenished every now and then.

Businesses Fail Because They Run Out of Cash and For No Other Reason

It is important to understand why businesses close. Businesses do not close because of lack of profit, or even lack of sales (although this contributes to the problem). Businesses go out of business when they run out of cash and for no other reason. As long as you have cash in the bank to pay bills, employees, and vendors, you are still in the game.

Companies like Amazon and Uber never make a profit. But they have massive amounts of cash coming directly into their cash account every minute of every day. A company like that will never go out of business because they will ALWAYS have cash to pay employees, bills, and vendors. They might overextend themselves and have to lay off people or make some other cuts, but they will be in business as long as they have money coming in.

Contrast this with being a class action plaintiff attorney who has to go long periods of time without receiving any cash at all from their work. A serious cash flow struggle is nearly guaranteed.

Financing the Cash Flow Gap for Plaintiff Attorneys

When you don’t get paid quickly, and at regular intervals from case work, you are probably going to have to finance “the gap” using “other people’s money” until you reach a place where you can “self-finance” the gap.

What is “The Gap?”

The gap we are talking about is the time gap between taking on new cases and getting paid for them. You will have to finance this “gap” if you are going to stay in business as a plaintiff lawyer.

Factor Your Receivables

Today, even large law firms are taking advantage of law firm financing vehicles like factoring. When you sell all or a portion of the money owed to you from a client at a discounted rate, this is known as factoring. Most industries take advantage of these financial vehicles because they often allow their customers to pay their bills thirty (or more) days after their work is completed (or products received).

But allowing their customers to wait thirty days to pay, creates a cash flow problem. The company has laid out payroll, and cost of goods to produce the product, and delivered it to the customer, but the customer doesn’t pay for a month. Companies in this cash flow problem use factoring to get all or some of their money back right away to continue financing operations.

Companies that provide factoring for law firms are variously known as legal funding companies, lawsuit funding companies, settlement advance companies, law firm factoring companies, law firm finance companies, etc.

How Legal Funding Companies Work

Remember the basic law firm cash flow problem? Money goes out fast and comes in slow.

One of the ways law firms can help “bridge the cash flow gap” is by using legal funding companies to factor their receivables or settlements.

Here is how it works:

When you win a case, or have billed a client, and are waiting to be paid from either the lawsuit or the client, you can “sell” all or a portion of the money that is owed to you to a legal funding company like Balanced Bridge Funding for a fee.

You get some of your money right away, and when the bill is paid by the client or lawsuit, we get paid directly from the client or the attorney of record in the case of a lawsuit settlement.

It is as simple as that. You get your money now, and we get paid to do the waiting for you.

This type of transaction historically was known as factoring. And most industries take advantage of using factoring companies to help solve their cash flow challenges. Even large law firms use legal funding companies to factor their receivables and keep cash in the cash account to finance long term growth of their business.

Why Legal Funding Instead of a Traditional Line of Credit?

We get this question a lot, and there are lots of good reasons to use law firm funding instead of a traditional line of credit.

First, using a line of credit assumes you are able to secure a line of credit. Banks rarely offer good lines of credit to new companies or small companies.

Second, a line of credit is fixed, meaning if you have a huge case come in, you cannot easily just bump up your line of credit to accommodate new caseloads. It is fixed.

Third, legal funding is not a loan, so it is not based on your credit, nor does it impact your credit score because you are not applying for or taking out a loan.

Fourth, the more you borrow, the less you are allowed to borrow. This is called your debt-to-equity ratio. The more you have already borrowed, the less banks will loan you in the future, which can be very restrictive when you are trying to grow. But with legal settlement funding, there is ultimate flexibility. You can factor only what you need.

Fifth, variable cost – unlike a loan that must be paid back every month (which reduces cash in the bank), you don’t pay us back for legal settlement funding. The attorney of record or the client pays us. And legal settlement funding is truly variable cost because you are only using legal funding when you have a case. If things slow down, you factor less, and there is less expense.

How Legal Funding for Plaintiff Attorneys Works

- Attorney has settlement in a case but will experience some delay before their contingency fee is distributed to them.

- Attorney applies for a post-settlement advance with Balanced Bridge Funding.

- Balanced Bridge examines the case. A determination is made on how much of the fee Balanced Bridge will purchase and how much will be advanced to the attorney.

- Balanced Bridge discusses the funding terms with the attorney and provides them with the agreement to review and sign.

- Once that is all completed, Balanced Bridge wires the advance directly to a bank account specified by the attorney.

This process is often completed in a day or two but can take longer.

Once the fee is distributed, Balanced Bridge is sent its portion of the fee.

Is Post Settlement Funding for Plaintiff Attorneys A Loan?

A settlement advance for class action lawsuits is not a loan. When you receive a settlement advance, the legal funding company does not loan you money. The money you are owed from a class action lawsuit is considered an asset (like a stock or bond). And just like any other asset you own (like a stock, bond, or your car or house); you can sell it to someone else for an agreed price.

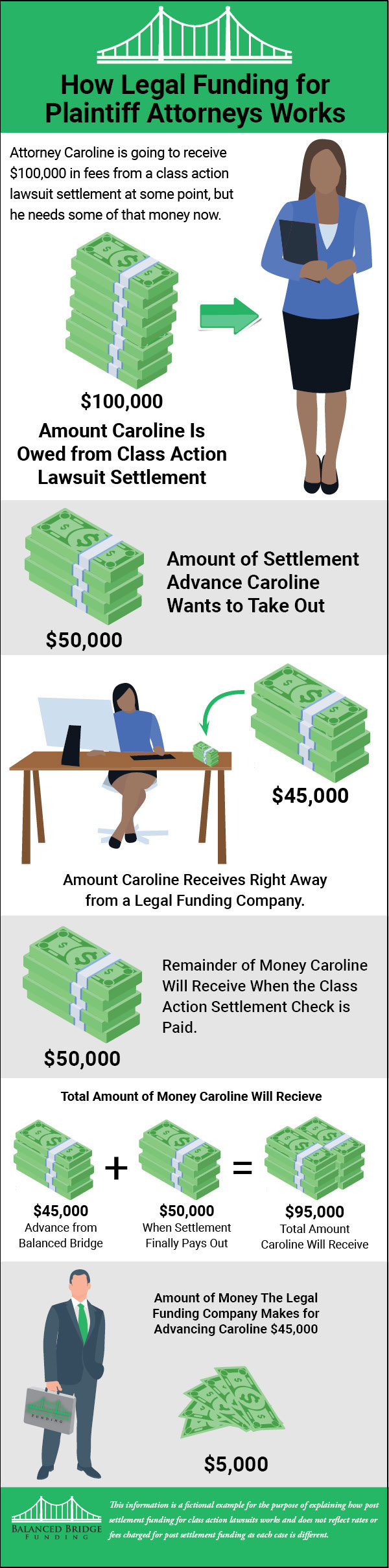

Using the example from the infographic above, this person agreed to sell $50,000 of their class action lawsuit settlement fees for the price of $45,000. The settlement advance company now OWNS the right to $50,000 of the class action lawsuit settlement and will receive their $50,000 directly from the settlement attorney of record. They bought the asset from you for $45,000 and will receive $50,000 from the settlement attorney of record when the settlement is paid, earning the legal settlement funding company $5,000.

Who Pays the Legal Funding Company Back?

Remember, this isn’t a loan. As a settlement advance company, we purchase the asset from you, and then we own it. You do not have to pay us back; instead, we notify the attorney of record of our ownership of a portion of your settlement award, and when the class action lawsuit settlement pays out, the attorney of record will pay us directly. There is nothing for you to do.

Summary

Plaintiff work creates an environment where cash is flowing out of your bank account constantly, but cash only flow into your bank account occasionally and at irregular and unpredictable intervals. This imbalance between cash flowing out of your account quickly and flowing into your account slowly creates a cash flow problem that must be managed properly to be successful as a plaintiff attorney.

Companies do not close because of profit, or lack of it. They close when they are out of cash, and for no other reason.

One financial vehicle plaintiff attorneys can use to help solve this cash flow problem is to factor their post settlement awards to a legal settlement funding company like Balanced Bridge Funding.

Legal Settlement Funding for Plaintiff Attorneys is not a loan. Any settlement that is owed to you is an asset, just like a stock or bond, and can be sold at an agreed upon price just like a stock or bond.

Legal Financing like a settlement advance is flexible, unlike a line of credit. You an factor as much of your settlement as you need to or as little.

About a Post Settlement Funding for Class Action Lawsuit Plaintiff Attorneys with Balanced Bridge Funding

A Class Action Settlement Advance is a Non-Recourse Transaction: We Accept All the Risk.

Class Action Lawsuit funding is a non-recourse transaction. This means you don’t need to worry about what might happen if the defendant suddenly can’t pay your settlement award — we accept all risk of non-payment, meaning that you will still get to keep the money from your settlement advance if the defendant goes bankrupt or is unable to pay for whatever reason.

Fast, Hassle Free Application

In most cases we can get your money in your hands in one week or less. Our application is simple, straightforward, and easy to complete. Remember, this isn’t a loan, so there isn’t as much paperwork to go through. In most cases, we can approve your application and have your money deposited into your checking account in a matter of days.

Class Action Lawsuit Funding for Plaintiff Attorneys: If you think our post settlement funding solution could be the right fit for you, please call one of our legal funding specialists at 267-457-4540.

Or to apply online, simply CLICK HERE and fill out our quick application.