Settlement Funding Versus a Line of Credit – What’s the Best Financing For Lawyers?

Settlement Funding for Attorneys or a Traditional Line of Credit for Attorneys – Which is Better? In this article we wanted to highlight these two lawyer financing options and go over some of the differences between them. We have included descriptions of what each of these financial vehicles are, how they work, and when it might be appropriate to utilize an attorney line of credit versus using settlement funding for lawyers.

Which is Better: a Traditional Line of Credit or Using Legal Financing Options Like Post Settlement Funding for Attorneys?

Both a line of credit and post settlement funding for attorneys are financial vehicles that serve an important role in helping attorneys solve cash flow problems. It isn’t that one is better than another. Each of these financial instruments can be used to help your law firm continue to grow and prosper.

What is most important is understanding how a line of credit works versus how factoring your receivables using settlement funding works. Once you understand the role each one plays and how these financial instruments operate, you can make good strategic decisions about when to use them.

What is a Line of Credit for Attorneys?

A line of credit attorneys is a revolving loan that allows an attorney access to a fixed amount of credit on an ongoing basis. Operationally, a line of credit works like a credit card; you have a credit limit, you make payments, and you pay fees and interest. But unlike a credit card, lending institutions who offer lines of credit for lawyers take many factors into consideration when they set your credit limit, versus a credit card company who might only look at your credit score and your last three tax returns to determine how much credit to extend to a particular company.

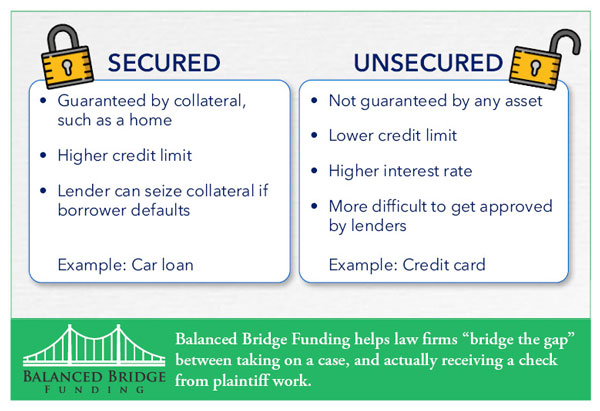

What Types of Lines of Credit are Available for Attorneys?

- Secured Line of Credit for Attorneys — A secured line of credit for attorneys is backed by some form of collateral. This might be your case load or other specific assets depending on the lender. When using a secured line of credit, if the borrower is unable to repay their line of credit according to the terms of the agreement, the lender then has the right to assume the collateral and sell it to mitigate their losses.

- Unsecured Line of Credit for Attorneys — An unsecured line of credit for attorneys is not “backed” by any collateral like a secured line of credit. However, most lenders will put a lien in place and require some sort of personal guarantee before extending an unsecured line of credit to a law firm. Also, because an unsecured line of credit for attorneys is riskier for the lending institution, fees and interest rates will generally be higher – more risk equals more reward (for the lender).

What is Settlement Funding for Attorneys?

Settlement Funding for Attorneys is a financial vehicle where a funding company purchases the future value of a specific asset, to be collected at a specified time. In the case of legal settlement funding, the funding company purchases a settlement award from the attorney NOW for a specific price, and then collects their full amount LATER when settlement checks finally go out.

Settlement Funding for Attorneys is used by contingency fee law firms who often must wait months or years to receive their contingency fees from their work, to help manage cash flow.

How Settlement Funding for Attorneys Works

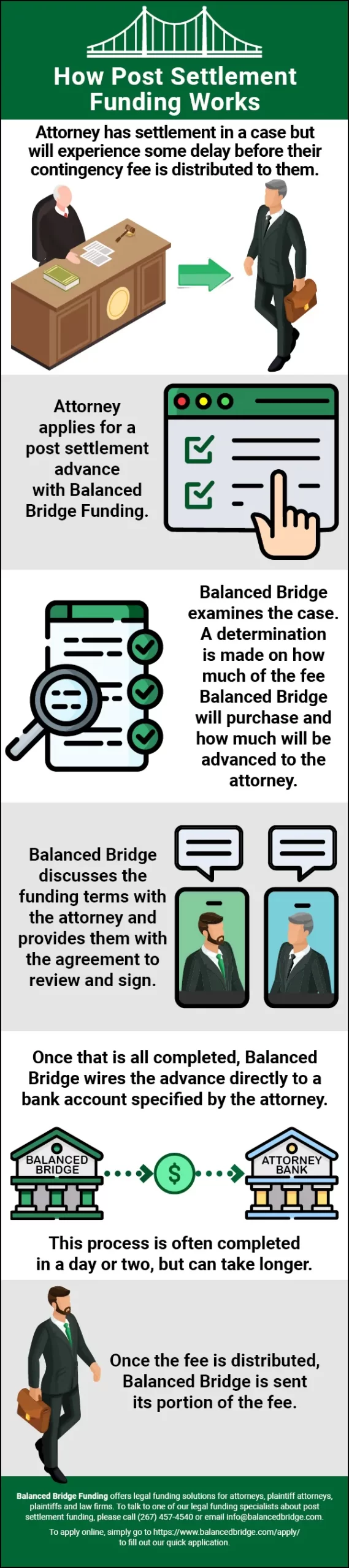

When a lawyer wins a case (or settles a case) and a settlement award is ordered, the fees they are owed to the law firm are considered an asset, just like a stock or bond is considered an asset. And just like a stock or bond, the money an attorney is owed post settlement can be sold or traded at an agreed upon price. Please see the infographic below for an example of how this works:

How Settlement Funding for Attorneys Works

Let us explain how legal funding works:

• Attorney has settlement in a case but will experience some delay before their contingency fee is distributed to them

• Attorney applies for a post-settlement advance with Balanced Bridge Funding.

• Balanced Bridge examines the case. A determination is made on how much of the fee Balanced Bridge will purchase and how much will be advanced to the attorney

• Balanced Bridge discusses the funding terms with the attorney and provides them with the agreement to review and sign.

• Once that is all completed, Balanced Bridge wires the advance directly to a bank account specified by the attorney.

This process is often completed in a day or two but can take longer.

Once the fee is distributed, Balanced Bridge is sent its portion of the fee.

Settlement Funding for Attorneys is Not a Loan

It is important to know that settlement funding for attorneys is not a loan. Some states (like Utah) have passed legislation specifically to delineate the differences between attorney funding and loans. Their law states that Legal Funding Financial Vehicles do not in any way meet the requirements of a loan and therefore cannot be considered a loan.

Settlement Funding for Attorneys is a financial instrument where one party purchases the future value of a specific asset (at a specified time) from another party. In this way, settlement funding is more akin to futures trading on a commodity exchange than it is a traditional line of credit, which is a loan.

Why Do Law Firms Use a Line of Credit?

Law firms use a line of credit to help finance the gap between taking on cases and getting paid from the settlement award. They also use a line of credit to finance operations, conduct marketing, take on new clients, make payroll, pay rent, buy new technology, hire expert witnesses, and build rock solid cases.

In plaintiff work there is always going to be a significant gap in time between taking on a case and actually getting the money in your bank account. During that time, you have bills that must be paid on a regular and predictable schedule, but your money comes in at irregular intervals. This is what creates cash flow problems for law firms. A line of credit is one financial vehicle lawyers can use to help keep their day-to-day operations going while they wait to get paid from the cases they win for their clients.

Why Do Law Firms use Settlement Funding for Attorneys?

Law firms use settlement funding for attorneys for the same reasons they use a line of credit – to help solve cash flow problems.

Extend Your Credit Line

It is also helpful to use settlement funding to help ensure you don’t exhaust your available credit on your credit line. Rather than using up your attorney line of credit to finance operations while you wait for your check from a lawsuit, you can use post settlement funding solutions to get some of your money right away instead of burning up your entire line of credit.

Easier to Get Than Credit

Law firms also like to use settlement funding for attorneys because the credit requirements are usually much “lighter” than applying for additional credit from a lending institution. Settlement funding companies who offer settlement funding for attorneys aren’t worried as much about your credit or financial position because they get paid directly by the attorney of record for the case, not the law firm itself. It is a low-risk proposition for the Legal Funding Company.

They know they will be paid directly from the settlement attorney of record, so your credit isn’t a significant factor in determining whether a Legal Funding Company will finance your law firm or not. This makes settlement funding “easier to get” than a line of credit. And, because the risk is much lower, the fees associated with settlement funding for attorneys are often significantly lower than a line of credit. Lower risk means lower fees.

When Does it Make Sense to Use A Line of Credit for Attorneys?

If you are a law firm that regularly takes cases on a contingency basis, it would make sense to secure a line of credit for attorneys as soon as you possibly can. Being a contingency fee lawyer is always going to create cash flow management struggles because you have money flowing out of your bank account on a regular (and continuous) basis, but money flows in at irregular times and in unpredictable amounts; this is always going to create cash flow problems.

Because of this, as soon as you can get approved for an attorney line of credit, you should. The challenge is going to be unless you have excellent personal credit, lending institutions are often reluctant to extend a line of credit to a newly established business or to a business owner who doesn’t have impeccable credit who can personally guarantee the line of credit.

But you should consider securing a line of credit for your law firm as soon as you possibly can. You are going to need it, so you might as well have it.

When Does it Make Sense to Use Settlement Funding for Attorneys?

Just like a line of credit, you should begin taking advantage of settlement funding for attorneys right away. Large corporations (and large law firms) never hesitate to finance their growth and operations with “other people’s money” and neither should you. The longer you think small, the longer you will stay small, and if you want to grow, sooner or later you will need financial instruments to make it possible, so you might as well “get on with it” and learn how these financial vehicles work and start taking advantage of them straight away.

Large firms are taking advantage of settlement funding vehicles to continue their expansion, take on new cases, hire better expert witnesses, and win big for their clients. And if the big firms are doing it, why wouldn’t you?

How Does a Line of Credit Help Solve Cash Flow Problems for Law Firms?

Regardless of the type of business you are in, any time you are in a business that gets paid AFTER they provide their service or deliver a product, you are going to have cash flow issues.

Why? Because to provide the service or manufacture the product, you must already be in business, which means you already have expenses to pay. If you do the work now, and get paid sometime later, you have had money going out now to pay bills, but no money coming in until later.

This is especially true for law firms who operate on a contingency fee basis because in addition to their operating expenses and overhead, they also have to lay out cash to pay for expert witnesses, e-discovery experts, courtroom videographers, demonstratives, travel, and more. Then they have to wait for the case to conclude, and then they have to wait even longer to receive a check. This is what creates cash flow problems – waiting for your money while you continue to pay expenses to operate.

This is where a line of credit for lawyers comes in. A line of credit can help you keep operations going while you wait to get paid. It helps “bridge the gap” so to speak. So, while you are working on a case or waiting to get paid from a settlement award, you can use an attorney line of credit to keep your law firm going (and growing) until you actually get paid.

How Does Settlement Funding for Attorneys Help to Manage Cash Flow?

Settlement funding for attorneys helps law firms manage cash flow in a similar manner as a line of credit – by getting cash into your bank account now, to help survive the time you spend waiting to get paid for services you’ve already provided.

It can take months or even years to receive your contingency fees from a lawsuit. That is a long time to keep paying rent, employees, marketing, expert witnesses, videographers, E-discovery specialists, etc while you wait to get a check from a lawsuit you finished months or years ago.

Who offers Settlement Funding for Attorneys?

Legal Funding Companies like Balanced Bridge Funding offer settlement funding for attorneys (as well as plaintiffs).

Brokers Versus Direct Lenders

It is important to know when you are considering Legal Funding Companies that some companies are brokers, meaning they are a sort of “middle man” for financial institutions who specialize in these types of financial vehicles. Other companies, like Balanced Bridge Funding are direct funders, meaning, you are talking directly to the people who are financing the transaction, and not to a middle man. One thing you can know is that the more “middle men” there are, the more fees get tacked on to pay each additional party who is involved in the transaction. Plus, if there is a problem or question with your transaction, when you are dealing with a direct funder you are talking to the people who make the decisions about your settlement funding.

Who Offers Lines of Credit for Attorneys?

Most major banks and credit unions offer some sort of line of credit for businesses. However, many of these traditional institutions will only consider more established businesses with a positive credit history for a line of credit.

For less established businesses, some lenders may offer a line of credit if it is backed by the SBA (Small Business Administration), but SBA loans can be complicated and require a lot of documentation up front before a business is approved.

Then there are some lesser-known providers of lines of credit for attorneys. As an example, Balanced Bridge Funding offers an attorney line of credit option. Even larger financial institutions like hedge funds have started offering lines of credit for larger law firms.

To learn more about an attorney line of credit from Balanced Bridge Funding, visit our web page on Attorney Line of Credit.

If you’d like to apply for our Attorney Line of Credit, please CLICK HERE.

Understanding Line of Credit Fees

Before opening a line of credit, it is important you are clear on all the fees. There may be fees for account set-up, fees per transaction on your line of credit, and annual fees. Also, your line of credit may have a variable interest rate, especially for an unsecured line of credit. This can be important in 2022 as the Federal Reserve has been continuously raising interest rates to contain inflation.

Some lenders may require the business to pay down their line of credit balance to zero dollars at intervals during the year or even every thirty days.

So before you sign up for a line of credit, make sure you are aware of all of the fees and agreements associated with the line of credit.

Summary

An attorney line of credit and settlement funding for attorneys are both financial vehicles law firms can use to help minimize the outsized impact contingency fee work has on cash flow.

Cash flow problems, regardless of the industry you are in, are created when there is a gap between the time a service or product is provided (or delivered), and the time the provider receives payment for services rendered. While you are waiting, you still have to pay rent, payroll, marketing, notes payable, etc. This means you always have cash flowing out of your bank account faster and more regularly than it comes in. This is what creates cash flow problems.

A line of credit is a traditional loan offered by banks, credit unions, commercial banks, and other financial institutions and operates a lot like a credit card. You have a credit limit, make payments, and pay interest and fees.

Settlement Funding for Attorneys is Not a Loan

It is an agreement between a law firm and a Legal Funding Company like Balanced Bridge Funding to sell an award settlement at a discounted rate that will be collected by the Legal Funding Company directly from the Attorney of Record for the settlement.

Both attorney lines of credit and settlement funding for attorneys offers the same benefit – helping law firms “bridge the gap” between taking on a case, and actually receiving a check from plaintiff work.

Fast, Hassle Free Application

If you are interested in applying for settlement funding for lawyers please contact one of our consultants. In the case of settlement funding, in most cases, we can get your money in your hands in one week or less. Our application is simple, straightforward, and easy to complete. Remember, this isn’t a loan, so there isn’t as much paperwork to go through. In most cases, we can approve your application and have your money deposited into your checking account in a matter of days.

Settlement Funding for Attorneys

If you think our settlement funding solution could be the right fit for you, please call one of our legal funding specialists at 267-457-4540. Or to apply online, simply CLICK HERE and fill out our quick form application.

A line of credit for attorneys is a little lengthier process and requires additional documentation. Please contact us to begin the process of applying for your line of credit for attorneys by calling : 267-457-4540.