How Real Estate Commission Advances Work and Why They Are an Important Financial Vehicle for Real Estate Agents

What is a Real Estate Commission Advance?

How real estate commission advances work. A real estate commission advance is a financial service that allows real estate agents to sell a portion of their pending commission for a fee. They receive some of their money now which they can use to finance operations, conduct marketing, pay vendors, or find their next fix and flip. Waiting on money is lost time, and lost time is lost money. A real estate commission advance helps keep the cash flowing, which helps keep your business growing.

“In the real estate business, there are peaks and troughs of cash flow. If you are in a trough, you may need to realize fees in advance of the closing.”

Joseph Genovesi, CEO, Accel Real Estate Commission Advance

How Does a Real Estate Commission Advance Work

A stock or bond is considered an asset, and as an asset, you can sell it at any time at an agreed upon price. When you are owed a real estate commission (due at closing), it is also considered an asset, and you can sell that asset to a third-party buyer at an agreed upon price.

A Real Estate Commission Advance is Not an Actual Advance

How real estate commission advances work. A Real estate commission advance is not actually an “advance.” Instead, you are agreeing to sell a portion of your commission (your asset) to a third party like Accel Real Estate Commission Advance at a discounted rate. You get your money right away, and the third-party gains ownership of the asset (money in this case) which they will collect at some point in the future (at closing from the attorney or closing agent) at full price.

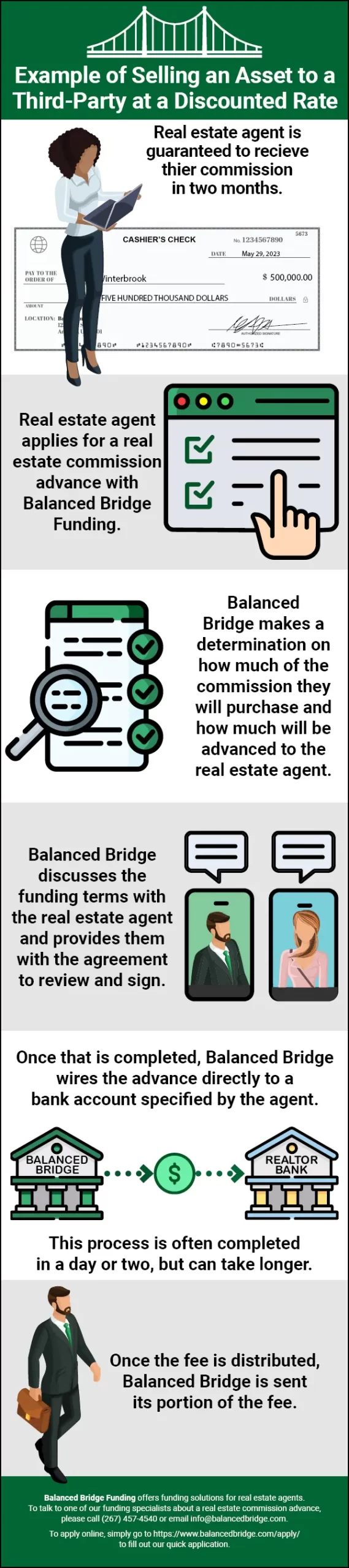

Infographic: Example of Selling an Asset to a Third Party at a Discounted Rate*

Example of Selling an Asset to a Third Party at a Discounted Rate

- A real estate agent is guaranteed to receive a commission but will experience some delay before their commission is distributed to them.

- The real estate agent applies for a real estate commission advance with Balanced Bridge Funding.

- Balanced Bridge makes a determination on how much of the commission they will purchase and how much will be advanced to the real estate agent

- Balanced Bridge discusses the funding terms with the real estate agent and provides them with the agreement to review and sign.

- Once that is completed, Balanced Bridge wires the advance directly to a bank account specified by the real estate agent

This process is often completed in a day or two but can take longer.

Once the fee is distributed, Balanced Bridge is sent its portion of the fee.

Why Realtors Use Commission Advances – Cash Flow

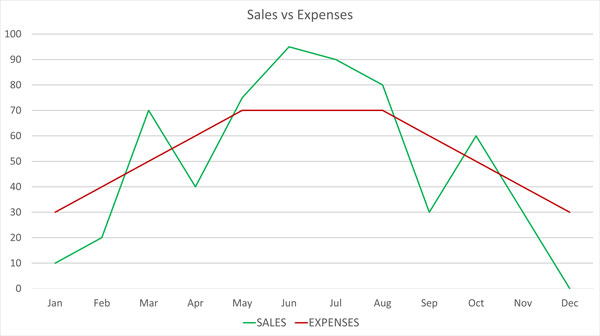

What is Cash Flow for Realtors? People in business often talk about cash flow, but few of them truly understand what it means. Cash flow is the term used to describe the “flow of cash” into your bank account versus the “flow of cash” out of your bank account.

So, when people talk about cash flow, all they are talking about is “money flowing in and money flowing out.”

How real estate commission advances work. When your money is flowing out quickly and flowing in slowly, you tend to have “cash flow problems.” Why? Because the money is “flowing out” faster than it is “flowing in” and if this continues to happen long enough you will run out of cash to pay your bills. And when you can’t pay your bills, you are out of the game. It doesn’t matter if you have a large sum of money guaranteed to you sometime in the future; when you don’t have any of it in the bank, your creditors don’t care – they want their money now and you can’t pay them.

What is Cash Flow management? Cash flow management is any activity used to regulate these two flows of cash (cash flowing versus cash flowing out). The goal of cash flow management activities is to keep the money flowing into the account faster than it leaves.

When most people think about cash flow management, they tend to envision activities that reduce spending and keep costs down. But the truth is, most serious businesses do not over-focus on cost cutting. Instead, they tend to focus on keeping cash coming in as frequently as they can and as quickly as they can get it. They may do this by borrowing money, selling bonds, selling stock (equity), factoring the money they are owed (selling it early as a discount), and trying to drive up revenues through sales activity. How real estate commission advances work.

Very few people are going to “reduce” their way to success. You need cash coming in frequently, whether that is from sales, or from taking out loans. Either way, you must have enough cash available to you to pay people, or you are out of business.

What Are Cash Flow Problems? Cash flow problems are the only reason people care about cash flow at all. Realtors have “cash flow problems” because they have money flowing OUT of their bank account faster than money flows IN to their bank account (like while you are waiting months for closing to get paid).

What Causes Cash Flow Problems for Realtors? Cash flow problems for realtors are caused by the “timing” of when they get paid (money flowing into their bank account) versus the timing of when that money gets spent (money flowing out of the bank account). How real estate commission advances work.

Understanding the Timing Problem. When you close a deal on a house, you must wait to be paid at closing. This is the cause of the “timing problem.” It doesn’t matter that you have money coming in “soon,” you still have to pay bills, make payroll, pay for marketing, etc. So, you have money going out constantly, but you only have money coming in “occasionally.”

How real estate commission advances work. Because you get paid at irregular intervals as a realtor, but you spend your money at regular intervals on bills and living expenses, you have a situation where the “timing” of money coming do not match the “timing” of money going out, which creates cash flow problems.

This isn’t a problem that is unique to the real estate industry; most businesses have this kind of cash flow challenge. Hospitals must perform expensive operations, pay rent, and pay huge salaries; but they don’t get paid immediately upon rendering services. Instead, they do their work, and then they “do their billing” and then they WAIT for their money. Lawyers who work on a contingency fee basis may work for years on a case, incurring massive expenses along the way, conclude the case, and then still have to wait years before they are finally paid. Just about every type of business has cash flow struggles created by money going out constantly, and money coming in occasionally.

How real estate commission advances work. The solution to this cash flow problem is to find ways to “finance the gap” between reaching an agreement and actual closing.

One way to get money into your cash account as quickly as possible is to take out a real estate commission advance instead of waiting for closing to receive your funds at some point in the future. You can’t do anything with “money you are owed.” You have to get the money into your bank account to make it work for you. A real estate commission advance is one way to do it.

Financing “The Gap” to Solve the Cash Flow Problem for Realtors

Using Business Lines of Credit and Business Loans for Cash Flow Management

When it comes to financing options most people think of bank loans and business lines of credit. And although bank loans and lines of credit are helpful for realtors, you may find that trying to secure a business loan or a line of credit is not the easiest or most practical solution.

How real estate commission advances work. Banks often require applicants to present non-liquid assets, such as bonds, stocks, and real estate. These assets, used as collateral, guarantee that the applicant will have something of significant value with which to pay back the loan. Plus, once you have those assets “tied up” backing a loan or line of credit, you can’t use them in the future as collateral for new loans.

If you perform a search on the internet for “business line of credit for realtors” you might notice that banks do not show up on the first page of Google. No financial institution shows up at all on the first page of search results. Most of what you see are articles about how hard it is to get a business line of credit or private equity firms offering capital loans. This tells us that banking institutions may not be that interested in marketing a business line of credit to real estate agents as an important part of their business strategy.

How real estate commission advances work. Does this mean you cannot receive a line of credit from a traditional lending institution? Not at all. Over time as your business grows, establishes a history of revenues, develops a strong balance sheet, and has assets to use for collateral, you will find it easier to obtain financing (including a business line of credit) from banks and other lending institutions. But until then, it is not going to be easy to get a line of credit.

SBA loans for Real Estate Agents

You can get SBA loans for certain real estate transactions. According to the SBA website, an SBA 7 (a) loan can be used for:

- Long and short-term working capital

- Revolving funds based on the value of existing inventory and receivables

- The purchase of equipment, machinery, furniture, fixtures, supplies, or materials

- The purchase of real estate, including land and buildings

- The construction of a new building or renovation of an existing building

- Establishing a new business

- Assisting in the acquisition, operation, or expansion of an existing business

- Refinancing existing business debt, under certain conditions

According to the SBA website, the SBA 7(a) loan may be the best type of SBA financing for independent real estate agents and small to mid-size brokerages. How real estate commission advances work.

However, there are some drawbacks to SBA loans.

First – you still need to have good credit, and significant business history to be accepted for an SBA Loan.

Second and probably more important – the paperwork required for obtaining any type of SBA loan is notoriously daunting. Just filling out the paperwork to apply for an SBA loan is sufficient to keep many small business owners from attempting it. Here are just some of the things you need to pull together to apply for any SBA Loan according to the SBA website:

- Borrower Information Form: Complete SBA Form 1919 and submit it to an SBA-participating lender.

- Background and Financial Statements: Complete both SBA Form 1081 (statement of personal history) and SBA Form 413 (personal financial statement). These help SBA and other stakeholders assess your eligibility.

- Business Financial Statements: Submit the following to help show your ability to repay a loan:

- Profit and Loss Statement – Current within 180 days of your application. Also include supplementary schedules from the last three fiscal years.

- Projected Financial Statements – Include a detailed, one-year projection of income and finances and explain how you expect to achieve this projection.

- Ownership and Affiliations: Provide a list of names and addresses of any subsidiaries and affiliates, including concerns, in which you hold a controlling interest or that are otherwise connected to you.

- Business License or Certificate: Provide a copy of the original business license or certificate of doing business. If your small business is a corporation, stamp your corporate seal on the SBA loan application form.

- Loan Application History: Include records of any loans you may have applied for in the past.

- Income Tax Returns: Include signed personal and business federal income tax returns of your business’s principals for the previous three years.

- Resumes: Include personal resumes for each principal.

- Business Overview and History: Provide a history of the business and its challenges. Include an explanation of why you need the SBA loan and how it will help your business.

- Business Lease: Include a copy of your business lease, or a note from your landlord, with the terms of the proposed lease.

PLUS – If you are buying an existing business, gather the following information:

- Current balance sheet and profit and loss statement

- Federal income tax returns for the previous three years

- Proposed bill of sale including the terms of sale

- Asking price with schedule of inventory, machinery and equipment, and furniture and fixtures

- Franchise, jobber, or licensing agreements

- Proof of equity injection

AND – You may be required to submit more SBA forms based on the specific use of proceeds or fees paid on a loan package or to a broker or agent. How real estate commission advances work.

Source: https://www.sba.gov/funding-programs/loans/7a-loans#section-header-2

Also, when you are considering an SBA loan, you also must consider “speed.” If you are needing a cash injection in your business, or you have a great real estate investment opportunity in front of you, an SBA loan is probably going to be too “slow” for you. Just the reporting requirement would take most people a long time to get together.

What Is the Difference Between a Realtor Commission Advance and a Bank Loan?

A realtor commission advance is not a loan. It is not repaid in installments, your credit is not a primary factor in receiving an advance, and the fee structure is much different. Also, a real estate commission advance does not accrue daily, monthly, and yearly interest like a bank loan. How real estate commission advances work.

Credit Checks Are Not Necessary for Commission Advances

Credit checks are another potential hurdle that real estate agents might face when applying for a bank loan or line of credit. Real Estate Agents who recently started working at a different agency, declared bankruptcy within the past few years, or have a high credit utilization ratio, may not meet bank lending standards because of their credit score.

How real estate commission advances work. For real estate commission advance companies, the credit score is not a major determining factor in their underwriting process. They do check for liens and judgments to make sure they can collect their money at closing, but your credit score is not a major factor in their underwriting.

Having Options is Important for Business Finance

When it comes to business finance, regardless of the business you are in, having only one vehicle to manage cash flow is not optimal. A loan or line of credit might be a great option for one aspect of your business and be terrible for the next. Large businesses make use of credit, private equity, equity, bonds, futures trading, and factoring to finance operations and growth. Very few businesses can run on lines of credit alone.

Speed and Flexibility

How real estate commission advances work. Another thing to consider when you are thinking about your business finance options is speed, agility, and flexibility. When you need a large amount of cash by tomorrow afternoon to get in on a real estate deal you just found out about, a loan or line of credit in most cases is going to be nearly impossible to secure in time.

Although banks hold a great deal of the world’s financial power, FAST is not a word most people would associate with the banking industry. Speed, agility, and creativity are not part of their business model. They are careful. They have lending standards that are precise and specific. They have processes they use to help ensure they don’t make “bad loans.” All this checking and double-checking takes time.

But with a real estate commission advance, you can often secure capital the next day. Real estate commission advance companies have different lending standards than the banking industry. This makes our industry incredibly agile.

Plus, using a real estate commission advance is very flexible. You can take out a real estate commission advance when you need it and use other financing vehicles when you don’t. How real estate commission advances work.

Real Estate Commission Advances Do Not Require Additional Collateral

Another great thing about a real estate commission advance is that you don’t need to tie up collateral outside of the commission itself. You are securing the transaction with your future commissions, not your liquid assets, which frees those assets up to be used as collateral for longer-term financing projects.

How real estate commission advances work. It’s not easy to keep coming up with collateral. Once you pledge an asset against a loan, a Lien is filed against it, notifying the whole world that in the event of default, someone else has first rights to the asset. Because of this, you can’t always use one piece of collateral for two separate loans – meaning, to continue taking out financing that requires collateral, you have to keep coming up with new collateral. But with a real estate commission advance, the commission you are owed is the collateral, so no additional collateral is required (in most cases).

Debt to Equity

Another challenge with traditional lending institutions is that the more money you borrow, the less the banks are willing to loan you in the future. If a bank looks at your outstanding debts and sees you already have a lot of loans taken out, they will be less likely to loan you more money. They know the more debt you have, the harder it is to keep up with your payments. And until you get some of your debt paid down, they may refuse to loan you more money, even if you are asking for the money because your company is growing. How real estate commission advances work.

But when you take out a Realtor Commission Advance, it does not show up on your credit report, which helps you maintain a healthy debt to equity ratio.

When Realtors Should Use a Real Estate Commission Advance

How real estate commission advances work. Realtors could start taking advantage of real estate commission advances right away to finance expansion, hire new talent, increase their marketing budget, and more. Big businesses never hesitate to finance their growth using third-party finance companies. Why should small businesses be any different?

How to Finance Your Real Estate Business

If you perform an internet search for “how to finance your real estate business,” most of the results you find suggest you use your own savings, your own personal credit cards, take out a double mortgage, borrow money from your friends or parents, or sell your valuable personal items. These are the standard answers given to the real estate industry about how to finance your growth and operations.

We have a better suggestion than selling your possessions or draining your parents’ bank account – start making use of commission advances for realtors to help manage your cash flow. Get started right away so you get in the practice of financing operations with third-party funding companies instead of your own personal assets. How real estate commission advances work.

Marketing For Real Estate Agents – Leveraging Third Party Financing

How much should realtors spend on marketing? A common number thrown out if you search the internet for “How much should realtors spend on marketing” is 8% to 10% of total sales.

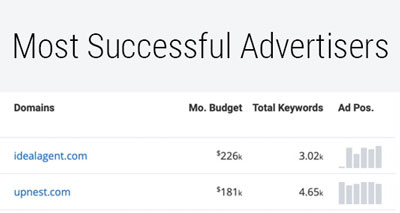

But this doesn’t make much sense. According to research we conducted on SpyFu – there are real estate companies out there spending over $200,000 PER MONTH on pay-per-click ads alone. You shouldn’t be limiting your marketing spend based on a percentage of sales. How real estate commission advances work.

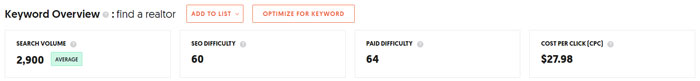

Research we compiled from Ubersuggest indicates that for some keywords such as “find a realtor” companies are paying up to $27.98 PER CLICK for those keywords in their area.

It’s going to be difficult to successfully compete with other companies for those keywords trying to contain your marketing budget to just 10% of your sales – especially if you are an up-and-coming real estate agent. How real estate commission advances work.

How much you spend on marketing as a realtor shouldn’t be determined by a percentage of any number. You need to spend as much money on marketing as you possibly can until you reach your growth goals.

Lost Time is Lost Money

To be successful, it is important to keep your money “flipping.” Sitting around waiting for your money is just lost time you can’t get back. That “lost time” just gets “added” at the end of the time it takes you to become successful. If your marketing is effective, you are better off taking out a real estate commission advance, getting that cash in your bank now, and spending it on marketing to keep the new projects and customers coming in.

In an interview, Gary Vee (Vaynerchuk) said something like this: “Every month I saw the bill come in from Google and it was like, eighty thousand dollars per month. And I thought to myself I should try to keep that expense down. I was wrong. So wrong. I should have been figuring out how to get that number up to three million dollars per month. And If I had done that, my company could have been where it is now, three years ago. But I only looked at the expense, not the goal of my marketing.”

So, as you are thinking about spending money on your marketing, and trying to finance as much as you can to do it, if your marketing has a great return on ad spend, what difference does it make if a real estate commission advance costs you 10% if your return on marketing is 20% or 30%? If your marketing works, you shouldn’t be trying to reduce marketing costs, you should be figuring out how you can borrow as much money as you can to do more marketing. How real estate commission advances work.

You can’t do that by sitting around for sixty or ninety days waiting to get paid on your last deal. You need to get access to that capital right away to “leverage” your marketing. Otherwise, you are simply going to delay your long-term success.

Myths About Using Real Estate Commission Advances

A common myth about using real estate commission advances is that only realtors who lack cash flow discipline would take advantage of a real estate commission advance. This idea is based upon the reasoning that “if you were successful” you could use your own money to finance your continued growth. But the truth is, no “real” business does things this way. How real estate commission advances work.

Big businesses never hesitate to use “other people’s money” to finance their growth while keeping their own money in their checking accounts. Why should you be any different?

The truth is, being debt free, or financing your own growth with your own cash reserves should NEVER be a goal of a business owner. Anyone with even a cursory understanding of business finance knows that if you find a business that has no debt, and only uses cash to finance growth and operations – that business is “asleep at the wheel” and is missing huge opportunities.

How real estate commission advances work. How do you know this? Because if a company is hiring top talent, making use of the best technology, marketing heavily, and constantly finding new deals to pursue, they wouldn’t be able to finance all of it on their own cash. Their cash flows wouldn’t allow it. So, if you spot a business that is debt free, you can know with certainty that they are losing ground to someone else who is financing their growth with “other people’s money” which means their balance sheet will show debt.

When you try to rely on your own resources to finance your growth, you are by design, limiting your growth and slowing it down. Not only that, but you are also setting yourself up to have market share taken away by other real estate agents who DO understand business finance. They will go out, borrow, find private equity, factor their commissions, and raise capital to grow. And if they do, you are going to fall behind while you try to finance your growth yourself.

How real estate commission advances work. Business owners who think small – tend to stay small. And if staying small is your goal, then maybe this article isn’t for you. But if your goal is to grow, take market share, and really succeed in your career, then you should not aspire to finance the growth of your real estate business with your own limited cash reserves. Big business would NEVER do this, and neither should you.

So be careful listening to “the experts” in your industry. Although they might be well intended, their ideas might very well limit your growth and slow you down. It isn’t a shameful thing to borrow money to finance your growth. Big business always uses third-party funding to finance their continued growth because they know they’ll get left in the dust by their competitors if they don’t.

Summary

Real Estate Agents will tend to have cash flow problems because they have bills that must be paid regularly, but they get paid at irregular intervals. Having money going out faster than it comes in and at irregular intervals causes cash flow problems. How real estate commission advances work.

The solution to cash flow problems for realtors is to “finance the gap” between signing a deal and getting paid at closing. You can do this with business lines of credit, bank loans, SBA-backed bank loans, credit cards, and using real estate commission advances.

How real estate commission advances work. Of these options, a real estate commission advance is the easiest to qualify for, does not require good credit, does not impact your credit rating, and allows you to get cash in your bank account quickly.

Businesses that are debt free are “asleep at the wheel.” If they were investing in new talent, investing in the latest technology, marketing heavily, and constantly finding new deals to close, they wouldn’t be debt free. Big businesses ALWAYS finance operations with “other people’s money.” Why should small businesses operate differently? How real estate commission advances work.

If your competitor uses debt, equity, lines of credit, and real estate commission advances and you don’t, you are going to lose ground constantly to your competitor and they are going to secure market share and leave you behind as they accelerate.

Real Estate Commission Advances are fast, flexible, easy to get, and can help you solve your cash flow struggles and help keep you “in the game.” How real estate commission advances work.

What Does a Real Estate Commission Advance Application Look Like?

The application takes about 10 minutes to complete and can be filled out online. It asks for the amount of advance you are looking for, information related to the property on which you are requesting an advance, and the approximate closing date. Information related to the lender and lending officer is also usually requested. How real estate commission advances work.

In the application, you will be asked to provide:

- Proper identification, such as your driver’s license

- MLS listing of the property showing the status as “under contract”, “pending”, or “sold”

- Wire instructions (where to send your advance)

- Closing date

- Whether you are representing the buyer or seller.

- Evidence that contingencies have been satisfied.

- Commission sharing agreement or documentation showing net fees owed to you.

Applying with Accel Commission Advance

Once Accel receives your application, their proprietary cloud-based processing system allows them to advance your commission quickly and efficiently, in as little as 24 hours. How real estate commission advances work.

What Do the Underwriters Look For in an Application?

To confirm that the agent or broker requesting the advance is actively representing buyers or sellers in real estate transactions, underwriters look at data related to the number of transactions that the agent or broker has completed in the last six months and how many active and pending listings they currently have.

How real estate commission advances work. Accel Commission Advance requires that an agent or broker has at least one other listing or active deal in the process of closing. The deal must also be scheduled to will close within 45 days. Your credit score is not considered in their underwriting process.

How Are the Fees Determined?

Fees are set based on numerous factors, and each case is assessed individually. Accel offers reduced fees as an agent or broker completes more advances with them and establishes a consistent track record. Accel offers competitive fees as low as 8 percent. How real estate commission advances work.

How Do I Get My Money from a Real Estate Commission Advance?

Advances will be delivered to your bank account via a wire transfer. Accel gets you paid fast. Overnight funding for Realtors is possible, especially for agents and brokers that have already done business with Accel.

How Do I Pay Back a Real Estate Commission Advance?

Repayment of the advance happens automatically when your sale closes. The settlement company will receive a commission disbursement authorization signed by your broker instructing them to send a portion of your commission directly to Accel on your closing date. So there is nothing for you to do. We collect our money directly at closing. How real estate commission advances work.

About Accel Real Estate Commission Advance:

We are a direct funder, not a broker like most real estate commission advance companies. Because there’s no middleman involved, our fees are among the lowest in the industry, as we pass our savings on to you. How real estate commission advances work.

We factor numerous asset classes, helping attorneys, professional athletes, business owners, and of course real estate agents and brokers. Let Accel finance your next Real Estate Commission Advance.

Frequently Asked Questions about Real Estate Commission Advance

Question: Is there a minimum size commission that you advance Real Estate Agents?

Answer: There is no minimum size commission, but the minimum fee is $250.

Question: Is there a maximum size commission that you advance?

Answer: Yes. The maximum amount is $30,000.

Question: Are there any reserve holdbacks?

Answer: Yes, there is a 10% reserve holdback on every advance.

Question: Are there any administration fees?

Answer: There is a $30 wire fee for any outgoing wires. Agents can opt to receive funds via eCheck for no charge.

Question: Are there any application fees?

Answer: No

Question: Do you advance brokers of record?

Answer: Yes, on a case-by-case basis.

Question: Can I advance more than one deal at a time?

Answer: Yes

Question: How much of my commission can I advance?

Answer: Up to 80% of net commission due to agent.

Question: How quickly can I get my advance processed?

Answer: Advances are processed in 48 hours or less – the majority of advances fund the same day.

Question: Are your advances restricted to a closing within 90 days?

Answer: Within 120 days.

Question: Do you require a minimum size deposit?

Answer: No