Legal Funding – Covering the Ever Rising Costs of Lawsuits For Attorneys

Litigation is expensive, whether it is commercial litigation, intellectual property litigation, or even pro bono work. Litigation of any kind can become unbelievably expensive for law firms that take cases on a contingency fee basis. They must fund massive up-front costs which may continue for months or even years before they recoup any of that money. However, there are ways for law firms to find litigation funding to reduce the financial burden of financing ongoing legal proceedings. This article will explain the high costs associated with litigation, and how law firms utilize litigation funding and legal funding companies to continue operations and win big for their clients.

Litigation is Expensive

Litigation is expensive and becoming more so every day. Below we have compiled a list of court cases we are aware of, the time it took these cases to settle, and just SOME of the costs incurred by the Law Firm.

Class Action Lawsuit over Product Liability – Settlement Value $90M

Costs: $600K in attorney costs which include process-server fees, filing fees, and other court-related expenses, copy costs, expert fees, and consultant fees.

This case dragged on for five years until the final settlement was completed and accepted. The law firm had to lay out $600,000 in cash from their own pocket and sustain these expenses for five years. And these are just the direct costs. Over that same five-year period, the law firm had to pay lawyers, rent, phones, utilities, marketing costs, and costs of taking on other cases as well. This is how legal funding options for litigation financing came about – to help law firms fund these expenses while they wait to get paid until the case settles or concludes.

Personal Injury Case Where the Injured Party is Deceased – Settlement Value $3.5M

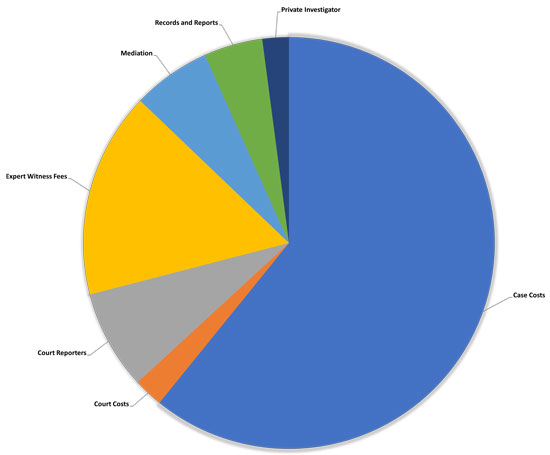

COSTS FOR THIS CASE:

Case Costs……………79,000

Court Costs………..…$3,000

Court Reporters……..…$10,133

Expert Witness Fee…..……$21,000

Mediation………….$8,000

Records and Reports………….$6,000

Private Investigator..………..$2,700

Total Expenses…$129,833

And again, these are just some of the direct costs associated with taking on and winning this case. The law firm still had to operate their law firm until the case concluded and then wait even longer until the defendant paid what they owed.

Now imagine being a smaller law firm and trying to finance a case like this on your credit card or personal savings. What would you do? Chances are you wouldn’t take the case. Or maybe you would take the case and try hard to settle it because you knew how expensive the litigation was going to be. This is just another case of how litigation financing can help lawyers grow and take on cases they might otherwise have to pass on or settle too easily rather than going to court. If the law firm has third party litigation financing behind them, they don’t have to come out of pocket with as much money to take the case, litigate it, and then wait for the defendant to pay.

California Based Class Action Case – Settlement Value $20M

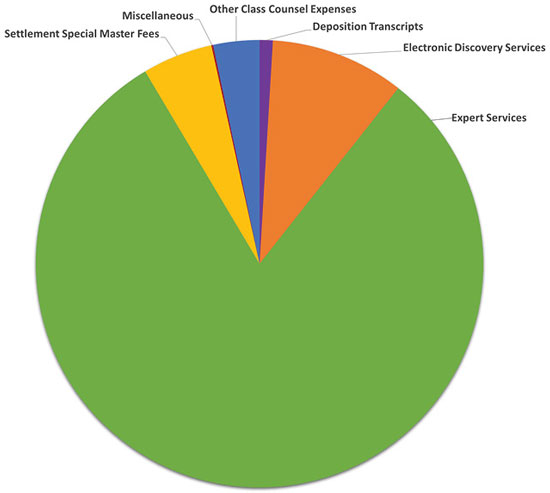

COSTS FOR THIS CASE:

Deposition Transcripts………………$6,000

Electronic Discovery Services…………….$61,000

Expert Services…………$509,000

Settlement Special Master Fees…………….$32,000

Miscellaneous…………………$770

Other Class Counsel Expenses……………$21,000

Total Expenses…$629,770

This case was another instance where the law firm paid over $600,000 and the case lasted for four years. Four years is a lot of time to be over half a million dollars out of pocket and then wait for the defendant to pay once the case concludes.

Common Expenses Associated with Litigation for the Law Firm

Generally speaking, litigation costs typically include court filing fees, and any discovery-related costs such as depositions, expert witness testimony, subpoena services, and more.

Court costs vary depending on court jurisdiction and can often be substantial due to transcriptions and other related expenses incurred during litigation proceedings.

Filing expenses are also associated with litigation. These include filing fees, costs for service of process, copying costs, postage, and other miscellaneous expenses associated with preparing documents for litigation.

How Much Do Expert Witnesses Charge Law Firms?

Law firms typically pay expert witnesses an hourly rate to testify or provide consultation. Depending on their specialty and experience, the cost can vary greatly. On average, law firms may need to pay between $150 and $500 per hour for expert witness testimony from a medical doctor, engineer, or other professional. If you look at some of our examples from earlier in this blog post, one expert witness fee was $21,000, and they can be much higher depending on the expert witness, how busy they are, or how sought after.

The Cost and Importance of Courtroom Graphics

When a case goes to trial, most lawyers are going to make use of litigation support services like courtroom graphics professionals, and audio-visual technicians to help them create a digital display of their case. The cost of courtroom graphics and expert displays can vary greatly depending on the complexity.

For example, a simple audio-visual presentation may only run a few hundred dollars for setup and equipment rental, whereas more complex courtroom visual displays with video recording capabilities could easily exceed $10,000 or more. It all depends on what type of visuals are needed and the extent of work required. Factors such as travel costs, specialized personnel, data acquisition, and engineering services can also play a role in determining the total cost.

In addition to the cost of producing courtroom graphics, the cost of hiring an expert to create and manage courtroom visual displays can also be expensive. This is the person who comes to court and keeps the visual graphics displaying as the lawyer asks questions and conducts their case.

All these things take a lot of time and cost a lot of money but are commonplace in the courtroom today. Lawyers who work on a contingency fee basis don’t get paid unless they win their case, so they invest a lot of money to win them, and it is almost always a substantial up-front cost to do it.

This takes a lot of money out of the law firm’s bank account, which is why savvy lawyers are taking advantage of legal funding options to help finance their cases and manage their cash flow.

The Cost of Jury Consultants

Plaintiff attorneys often hire legal consultants who provide mock juries for lawyers to practice preparing their questions and test them to see how juries will respond depending on how the lawyer asks the question or what words they use.

According to the website USLegal.com, jury consultants charge around $250 per hour, and costs can range anywhere from $10,000 to $250,000 depending on the firm, and the complexity of the case.

Source: https://courts.uslegal.com/jury-system/selection-process-at-the-courthouse/use-of-jury-consultants/#:~:text=In%20either%20instance%2C%20to%20use,anywhere%20from%20%2410%2C000%20to%20%24250%2C000

Other Costs Associated with Lawsuits

Expert witnesses and courtroom graphics are just a few of the larger expenses that are common to lawsuits. But there are other substantial costs as well. There are investigators who are sometimes utilized. Process Services are often required. Travel and Hotel expenses are typical for many lawyers (especially those handling cases in the Federal Court System).

Even copying can become a major expense if a case drags on. When lawsuits drag on for a long time, the case files get huge. Imagine warehouses full of documents, because often this is what a long running case file looks like. And any time there is something added to the file, it must go in that massive stack of paper. And then, every time someone needs a copy of the case file for some reason, copy companies must copy that entire warehouse of paper and ship it to the new recipient.

In today’s digital landscape, the file is usually scanned into a PDF document, but in its initial form, it is often still paper, and someone has to handle all of that paper, manage it, maintain it, bates number it, and reproduce it often over the course of years.

Using Legal Funding to Finance the Ever Rising Cost of Lawsuits

As you’ve probably gathered so far from this article, it is expensive to litigate a case. What you might not know is that most of the time, lawyers must front the money for all these expenses. The lawyer, not the client, is usually paying for everything up front, and then they get their money once a case settles or concludes (if they win).

So, imagine trying to grow your law firm from being small to being a major player in a market, or law firm practice area. If you want to take on big cases, you might need hundreds of thousands (or millions) of dollars to pay for all the expenses just to take on a case in the first place. So how would you do that as a law firm owner?

Did you know that most small business owners try to finance their growth using their own savings, personal credit cards, and taking out a second mortgage on their homes? It’s true, and this is the same for law firm owners who are just starting out. They literally put everything at risk to try and grow.

The problem is, cases can drag on for months and sometimes for years, during which time the law firm doesn’t receive any money but is constantly paying out of pocket to finance their case load and trying to win. But even that doesn’t tell the whole story.

When a lawyer wins a case for their client, there isn’t someone waiting outside the courtroom with a check for their lawyer fees. It can take months or even years before a defendant finally pays the money they owe, which means the law firm has paid out tens or hundreds of thousands of dollars, perhaps over years, and has to wait even longer to recoup their money.

The Rise of the Legal Funding Industry

This struggle with long-term cash outlay and delays in getting paid eventually gave rise to the Legal Funding Industry. Legal funding, sometimes called litigation finance, third party litigation funding, pre-settlement funding, post-settlement funding, loans for lawyers, etc., are companies who help law firms finance these long term cash outlays and delays in getting paid for their work.

Law Firms use Legal Funding to get money to finance taking on cases, cover their ongoing operational expenses while they grow their law firms, and take out advances on the money they are owed from cases they have won.

Types of Legal Funding

Pre-Settlement Funding

Pre-Settlement Funding for Plaintiff Attorneys – Pre-settlement funding for plaintiff attorneys is used by attorneys to help take on big cases and to make sure they win. Pre-settlement funding companies are basically “investing” in lawsuits that are just starting or are ongoing, and then if the attorney wins the case, the pre settlement funding company takes a percentage of the overall settlement for “fronting” the up-front cost of the case.

Not all legal funding companies offer or specialize in pre-settlement funding. Pre-settlement funding is risky. If the attorney does not win the case, or the plaintiff is not awarded as much money as their attorney thought they might win, then the legal funding company can lose all of their money, or not get the return they expected.

Risk and reward are what drive the cost of investments. The riskier the investment, the more money the investor expects to receive back in the investment goes their way. Pre-settlement funding is the same – the riskier the case is perceived to be, or the longer it takes to play out, the more money the legal finance company is going to expect to receive when the case concludes.

Why Law Firms Use Pre-Settlement Funding

As we demonstrated earlier in this article, major cases can cost hundreds of thousands of dollars just to litigate, and then, even when the case settles, it can still take months or years before the defendant pays what they owe. And that is just ONE CASE. Imagine if a law firm has dozens of cases like that. Whose money are they going to use to front all of that cash to win the case in the first place? Without legal funding, most smaller law firms wouldn’t be able to take on bigger cases, which would leave all litigation to only the largest law firms, and even they can struggle under the weight of having hundreds of ongoing cases eating up their savings.

Legal funding has helped level the playing field for smaller firms. But it has also helped attorneys “wait out” all of the stall tactics the opposing counsel might use to try and force a client into a premature settlement. Sometimes the wait to get paid is simply too painful for some people or businesses. But with legal funding behind them, lawyers are winning bigger payouts for their clients, because they can “afford to wait” so to speak.

What is Post Settlement Funding?

Post settlement funding can be split into two categories: Post Settlement Funding for Attorneys and Post Settlement Funding for Plaintiffs.

Post Settlement Funding for Plaintiff Attorneys

Post settlement funding for plaintiff attorneys is used by attorneys to help get some of their money in the bank once a case concludes. Lawsuits advance slowly through the court system and can take years to settle; and once the case concludes it can still take months or YEARS to get paid.

Lawyers who work on contingency fees have had to finance their entire court case – laying out cash the entire time to pay for everything from copying costs to expert witnesses. And then, there can still be a long waiting period to get their money. Post Settlement Funding for Plaintiff Attorneys allows lawyers to take out an advance against the money they are owed to pay bills, continue operations, and fund future cases to keep the law firm growing.

How Does Legal Funding for Attorneys Work?

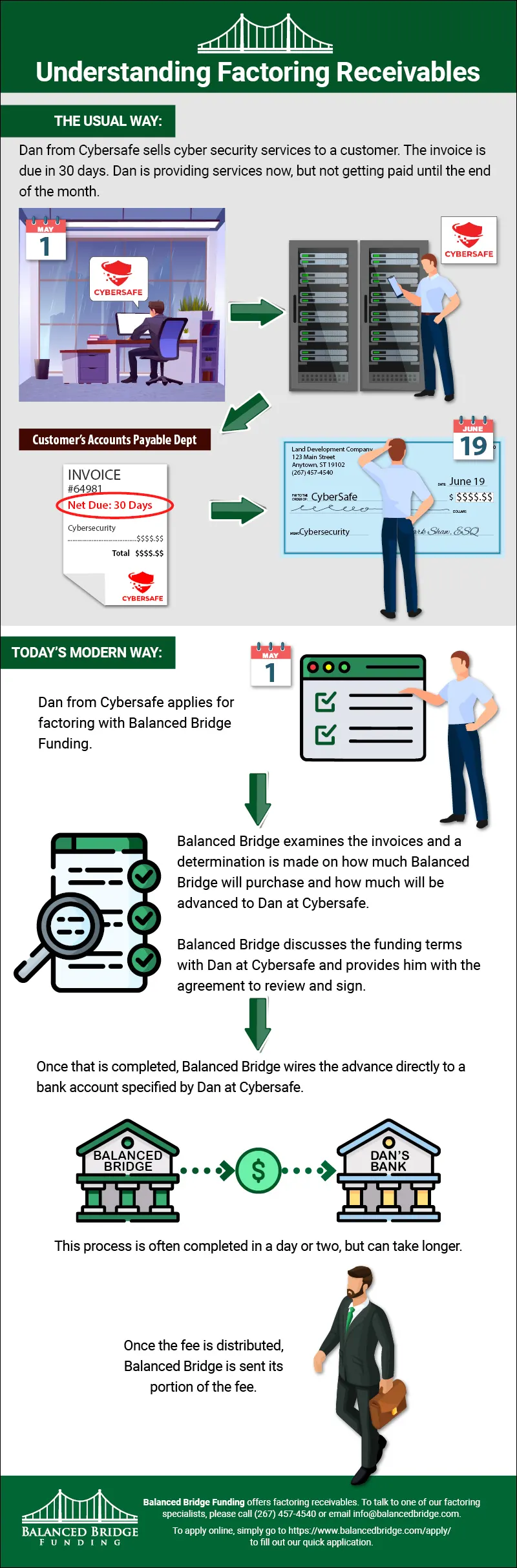

Legal funding works a lot like factoring receivables, only for lawyers. When you factor your accounts receivable, you sell them to a third-party financier at a discounted rate, and they collect the full amount in the future.

Infographic Understanding Factoring Receivables

- A business sends its invoice to a client marked due in 30 days.

- The business applies for factoring with Balanced Bridge Funding.

- Balanced Bridge examines the invoices. A determination is made on how much of the invoices Balanced Bridge will purchase and how much will be advanced to the business.

- Balanced Bridge discusses the funding terms with the business and provides them with the agreement to review and sign.

- Once that is completed, Balanced Bridge wires the advance directly to a bank account specified by the business.

This process is often completed in a day or two but can take longer.

Once the fee is distributed, Balanced Bridge is sent its portion of the fee.

This is how factoring receivables works. You get part of your money now by selling rights to the money you are owed in the future at a discounted rate. This is how legal funding works as well. Your settlement award or judgment from a lawsuit is considered an asset, just like a stock or bond is considered an asset. And just like a stock or bond (or accounts receivables), you can sell the rights to your settlement award or judgment at a discount.

Let’s imagine you are a plaintiff attorney, and you win a class action lawsuit for your client, but it is going to take six months before the defendant pays what they owe. But as the attorney, you’ve already waited a long time and have a lot of cash “out there,” and want some of that money now. So sell part of your pending attorney fees to a legal funding company (like Balanced Bridge Funding) at a discount.

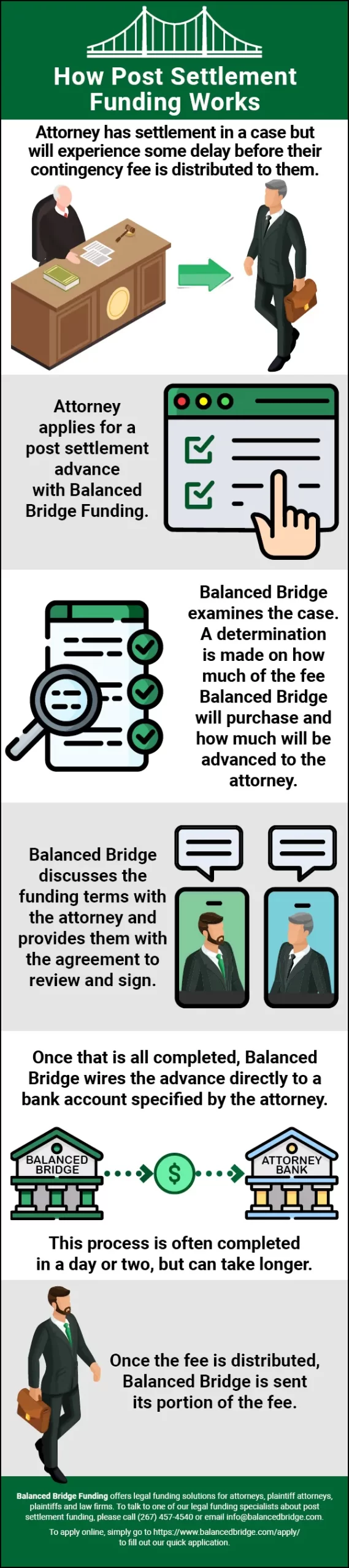

Here is an Example of How Legal Funding for an Attorney Operates

- Attorney has settlement in a case but will experience some delay before their contingency fee is distributed to them.

- Attorney applies for a post-settlement advance with Balanced Bridge Funding.

- Balanced Bridge examines the case. A determination is made on how much of the fee Balanced Bridge will purchase and how much will be advanced to the attorney.

- Balanced Bridge discusses the funding terms with the attorney and provides them with the agreement to review and sign.

- Once that is all completed, Balanced Bridge wires the advance directly to a bank account specified by the attorney.

This process is often completed in a day or two but can take longer.

Once the fee is distributed, Balanced Bridge is sent its portion of the fee.

Are There Other Types of Litigation Financing?

There are types of litigation financing (legal funding) outside of just pre-settlement funding and post settlement funding (although these are probably the most common types of legal funding).

Some legal funding companies specialize in loans for lawyers. These are loans against a law firm’s book of cases they are working on. Companies who specialize in loans for lawyers are financiers who understand how law firms are paid and see law firm caseloads as being good collateral to make loans against.

Other legal funding companies specialize in factoring invoices for law firms. Lots of businesses take advantage of factoring. Read our article here about factoring for law firms to learn more about how factoring for law firms works. Law firm factoring companies are often utilized by law firms who do a lot of their work by “billable hours” rather than contingency fee work. Lawyers at a firm in a specific practice area like business law can rack up a lot of billable hours every month working for their clients. Then at the end of the month, they invoice their client for the work they completed. But sometimes the client doesn’t pay that invoice for thirty, sixty, or ninety days. Again, that is a long time to wait for your money, so law firms sell those invoices to third party finance companies who specialize in factoring law firm invoices at a discount so they can get most of their money right away.

Some legal funding companies offer lines of credit for lawyers. Banks may not be willing to extend a business line of credit to newer law firms that may not have established credit as a business yet. But legal funding companies who offer lawyer lines of credit understand the legal billing process and offer a rolling line of credit to qualified attorneys (though they are usually secured with some type of collateral).

And you can bet there will be more legal funding financial vehicles that emerge over the coming years.

Summary – Legal Funding – Covering the Ever Rising Costs of Lawsuits

Litigation is expensive, and prior to the Legal Funding Industry, was simply too costly for smaller firms to take on bigger cases. But with legal funding, law firms of all sizes are not able to compete for cases, win big for their clients, and manage their long-term cash flow.

The costs of lawsuits continue to rise. Litigation services, consultants, and expert witnesses alone can drive the out-of-pocket cost of lawsuits into the hundreds of thousands, and even millions, of dollars. And all these expenses must be paid upfront, whether the lawyer wins their case or not.

Litigation finance companies are a great way to help secure the financing law firms need to take on these bigger cases and cover the massive up-front cost.

Once a case settles or a judgment is rendered, there isn’t someone waiting outside the courthouse with a check. It can take months or even years for attorneys to get paid for the cases they’ve won for their clients. Legal funding helps here by offering a way to take out an advance on pending payments from settled (or won) caseloads.

Legal Funding companies all have their specialty finance areas. Some specialize in pre-settlement funding and others in post settlement funding. Some focus on factoring invoices for law firms, and others on loaning money against caseloads. It is important to find a reputable legal finance company and know what they specialize in prior to engaging with them for financing. This way you can ensure the best possible outcome for yourself, and for your clients.

About Legal Funding with Balanced Bridge Funding

A Post Settlement Advance is a Non-Recourse Transaction: We Accept All the Risk

Post Settlement funding is a non-recourse transaction. This means you don’t need to worry about what might happen if the defendant suddenly can’t pay your settlement award — we accept all risk of non-payment, meaning that you will still get to keep the money from your settlement advance if the defendant goes bankrupt or is unable to pay for whatever reason.

Fast, Hassle-Free Application

In most cases, we can get your money in your hands in one week or less. Our application is simple, straightforward, and easy to complete. Remember, this isn’t a loan, so there isn’t as much paperwork to go through. In most cases, we can approve your application and have your money deposited into your checking account in a matter of days.

About The Authors

Balanced Bridge Funding offers legal funding solutions for plaintiffs, plaintiff attorneys, attorneys, and law firms. To talk to one of our legal funding specialists about getting help managing your law firm cash flow, please call (267) 457-4540 or email: info@balancedbridge.com.

Or to apply online, simply CLICK HERE and fill out our quick form application.