Introduction – Factoring for Law Firms

Factoring for Law Firms can be an invaluable tool for helping attorneys manage cash flow to pay bills, market their law firm, hire new personnel, take on bigger cases, hire the best litigation support staff, and win increased settlements for their clients.

Factoring is a financial arrangement that allows businesses of all kinds to sell their pending invoices (accounts receivable) at a discounted rate to a factoring company in order to receive [partial] immediate payment.

By doing this, businesses like law firms get their money right away instead of waiting for their clients to pay their invoices, which can take thirty, sixty, or even ninety days. This additional capital can then be used to cover operating costs, pay staff, and expand the law firm’s services.

Cash flow problems for businesses are primarily caused by having to pay for materials, contractors, and other expenses upfront, and then having to wait to get paid by clients until “later.” The greater the up-front cost of conducting business (like winning lawsuits) is, and the longer it takes to get paid, the greater the cash flow problem is going to be.

Businesses that do not have access to capital when they need it tend to stay small and muddle along. They can’t “afford” to take on new clients or larger business opportunities because they know they must front a lot of money to get the business in the first place, and it might take a long time to get paid – during which time they could literally run out of money to pay their bills and payroll. Because of this, many businesses have sought out non-traditional methods of securing capital, like factoring.

A Brief History of Factoring

Factoring isn’t new – it is an ancient practice that has been used for centuries to help individuals and businesses secure financing. The origins of factoring began in the Middle Ages when merchants would pay for goods with their own goods or commodities in lieu of cash. They would then use a factor, usually a banker or merchant, to collect payment from the buyer in exchange for a commission. This was the earliest form of factoring, and it allowed merchants to purchase goods without having to spend their own money upfront.

The practice of factoring continued through the industrial revolution and into modern times, where factoring has become an integral part of many businesses’ financial strategies. Factoring is now used by businesses large and small to provide financing for various capital investments. Factoring companies can purchase accounts receivable from businesses, giving them the funds they need to make investments in equipment or other resources necessary to grow their business. Additionally, factoring can also be used by individuals to access short-term financing when needed.

Factoring has become an increasingly popular option for those who need access to capital in order to grow their business. With factoring, businesses can access the funds they need when they need them, without having to go through a lengthy loan process or wait weeks or months for approval. For individuals, factoring can provide quick access to much-needed cash flow, offering an alternative to traditional financing.

Overall, factoring is an essential tool for businesses and individuals alike, providing a source of capital when it’s most needed. As the practice continues to evolve and expand, factoring will remain an important part of the global economy for years to come.

How Many Factoring Companies Are in the United States?

It is impossible to provide a definitive answer to this question since the number of factoring companies in the United States is constantly changing. However, as of 2020, there are estimated to be between 500 and 1,000 factoring companies operating in the United States.

And among those 500-1000 factoring companies, only a handful of them specialize in factoring receivables for law firms. Most of those companies are called Legal Funding Companies, Legal Financing Companies, Post Settlement Funding Companies, Settlement Funding Companies, Etc. But whatever you call them, these companies know about litigation financing, how lawyers are paid, and how to provide them with factoring of their caseload to help them keep operating.

How Many Factoring Companies Specialize in Legal Funding (Factoring for Law Firms)

Accurately calculating the exact number of legal funding companies available in the United States can be a bit of a difficult task. Some research suggests there are approximately fifty legal funding companies that specialize in factoring for law firms. Though relatively low in comparison to other service-based businesses, such companies have become increasingly popular due to their accessible and easily comprehendible processes for helping clients receive the funds they need to continue operating and growing their law firm practices.

What is Factoring?

Factoring is the process of selling receivables at a discount to a factoring company in order to receive immediate payment. The law firm gets “some” of their money right away (usually within 48 hours) and the factoring company collects the full amount of the invoice “later” from the client. This type of financing allows law firms to quickly access working capital in order to cover operating expenses, pay staff, and expand their services without having to wait weeks or even months for client payments. Additionally, factoring can help firms manage their accounts receivable effectively and avoid costly late payment fees from clients.

How Factoring for Law Firms Works

Factoring is a relatively easy process for law firms. First, they need to compile all of their current open invoices and send them to a factoring company. The factoring company will review the invoices and calculate a discount rate based on their risk assessment of the debtors.

Once the law firm agrees to the discounted rate, they can receive payment from the factoring company immediately – usually within 48 hours of submitting their invoices. The remaining balance of the invoice will then be paid after the debtors pay their invoices.

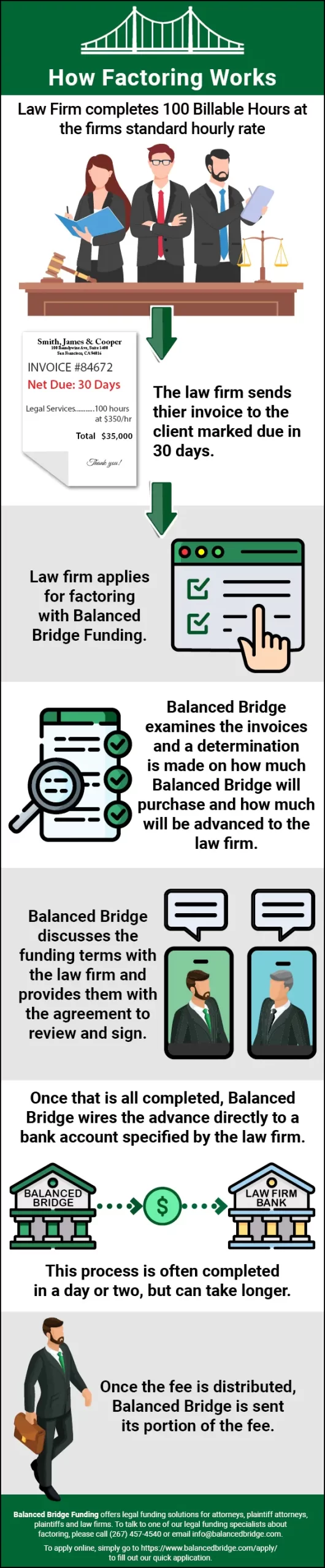

Infographic: How Factoring Works

- A law firm has settlement in a case but will experience some delay before its contingency fee is distributed to them.

- The law firm applies for a post-settlement advance with Balanced Bridge Funding.

- Balanced Bridge examines the case. A determination is made on how much of the fee Balanced Bridge will purchase and how much will be advanced to the firm.

- Balanced Bridge discusses the funding terms with the law firm and provides them with the agreement to review and sign.

- Once that is all completed, Balanced Bridge wires the advance directly to a bank account specified by the firm.

This process is often completed in a day or two but can take longer.

Once the fee is distributed, Balanced Bridge is sent its portion of the fee.

Factoring for Law Firms Improves Cash Flow

By taking advantage of factoring, law firms can benefit from improved cash flow and increased working capital. This lets them expand their services and grow their practice without having to front considerable amounts of money for operating expenses.

Cash Flow Problems

Cash flow problems can arise for many reasons, including low sales volume, high expenses, and slow customer payments. Cash flow problems are often the result of inadequate cash management processes.

Slow Paying Clients’ Impact on Cash Flow for Attorneys

If customers take too long to pay their invoices, a business may have difficulty covering its immediate operating expenses and other obligations. But more than that, with a great deal of available capital “tied up” in variable costs (like Cost of Goods Sold), it makes it difficult for the business to continue taking on new clients because they can’t afford the cost of goods sold expense the new business will create. This is the main cash flow problem that factoring for law firms solves – you can get some of your money right away by selling your invoices to a law firm finance company like Balanced Bridge Funding.

This doesn’t just apply to plaintiff work either. Large law firms who work on billable hours may have millions of dollars in outstanding accounts receivables. This is money their clients owe them, but for whatever reason are not paying. Meanwhile, the law firm is paying for office space, rent, utilities, and expenses related to cases, and is billing their clients, but not getting paid. If this goes on for too long, cash flow gets tight. Law firms need to keep tight control on their accounts receivable balance and make sure they are collecting their invoices quickly before they age and clients become reluctant to pay. By selling these invoices to a legal factoring company, the factoring company handles the collection of the invoices, and the law firm keeps its cash in the bank.

Court Cases Dragging on for a Long Time Impact Cash Flow for Law Firms

Lawyers, unlike a lot of professions, must wait a really long time to get paid for their work. And while they are waiting to get paid, they often have extremely high expenses. It can take years for a client to settle or for a case to work its way through the court system. And even once a case concludes, it can take even longer before a defendant pays. Meanwhile, law firms have to keep fronting the costs to take on new cases, salaries, court costs, and costs to hire expert witnesses – all of which cost a lot of money.

Imagine having to pay hundreds of thousands of dollars out of your own pocket right away in hopes (lawyers work on contingency mostly) that you will eventually win a case that might take a year or even five or ten years to conclude. And during that time, you still had to pay rent, salaries, court costs, travel costs, litigation support services, and make a living yourself. Because that is exactly what plaintiff attorneys do, and must continue doing if they want to grow their law firm.

This is why law firms began using legal funding options – because they simply couldn’t afford to take on certain types of cases and wait years to get paid for their work. Legal funding has helped level the playing field.

Low Sales Volume (Caseload) Hurts Cash Flow

Low sales volume (caseload) is a common cause of cash flow problems. Even though taking on large cases, or a ton of cases that drag on cause cash flow problems of their own, those are variable costs. Meaning, you only have expenses associated with lawsuits when you have lawsuits.

But your overhead is a fixed cost, meaning you have to pay your rent and pay salaries no matter how low or high your sales volume is. You can manage your variable costs with financing options like factoring, lines of credit, or equity investment – but you need a steady sales volume coming in to make sure your fixed costs are covered month to month.

Excessive Expenses

It is expensive to run a law firm. Salaries, rent, expert witnesses, travel, and court costs, are all expensive and can make it hard to finance operations for law firm managers. Law firm partners and managers should monitor expenses to ensure they are operating as lean as possible without sacrificing the quality of service and outcomes (winning lawsuits for their clients).

This is why having solid, reliable, and accurate financial statements are important. If you don’t have financial statements prepared properly (accurately) each month, it is impossible to see expenses creeping up and eroding your profitability. If your law firm does not have monthly financial statements prepared, you have no visibility into expenses, and excess is inevitable.

Lawsuits are Expensive – How Much Do Lawsuits Cost the Law Firm?

This is a question that many law firms must consider when assessing the cost of litigation for their clients. The answer to this question can vary based on the size and complexity of a case as well as various other factors.

Generally speaking, litigation costs typically include court filing fees, and any discovery-related costs such as depositions, expert witness testimony, subpoena services, and more.

Court costs vary depending on court jurisdiction and can often be substantial due to transcriptions and other related expenses incurred during litigation proceedings.

Filing expenses are also associated with litigation. These include filing fees, costs for service of process, copying costs, postage, and other miscellaneous expenses associated with preparing documents for litigation.

How Much Do Expert Witnesses Charge Law Firms?

Law firms typically pay expert witnesses an hourly rate to testify or provide consultation. Depending on their specialty and experience, the cost can vary greatly. On average, law firms may need to pay between $150 and $500 per hour for expert witness testimony from a medical doctor, engineer, or other professional.

The Cost and Importance of Courtroom Graphics

Because courtroom visuals can be an important part of any trial, it’s important for attorneys to weigh the cost versus the potential benefit when making decisions about courtroom graphics.

The cost of courtroom graphics and expert displays can vary greatly depending on the complexity.

For example, a simple audio-visual presentation may only run a few hundred dollars for setup and equipment rental, whereas more complex courtroom visual displays with video recording capabilities could easily exceed $10,000 or more. It all depends on what type of visuals are needed and the extent of work required. Factors such as travel costs, specialized personnel, data acquisition, and engineering services can also play a role in determining the total cost. It is important to note that courtroom graphics are typically considered an investment in courtroom proceedings and therefore must be carefully budgeted for when preparing a legal case.

Courtroom graphics are an important part of any trial or legal proceeding. By incorporating visuals into the presentation of evidence and legal concepts, jurors and judges can more quickly comprehend what they are presented with. In certain cases, courtroom graphics may even be utilized as the primary means to convey information to a jury or court.

When it comes to courtroom graphics, the cost can be a factor. The cost of having graphics created for a trial can vary based on the size and complexity of the project. Existing PowerPoint slides, display boards, and photographs often require additional work before they can be used in the courtroom. This can include enhanced image quality, animation, or interactive features. Other courtroom visual displays may require more specialized software and hardware—like touchscreens or high-definition flat-screen monitors. Such equipment can be expensive to rent or purchase for a single trial, but necessary for creating an effective presentation.

In addition to the cost of producing courtroom graphics, the cost of hiring an expert to create and manage courtroom visual displays can also be expensive. While some experts may offer lower rates, the most qualified courtroom audio-visual professionals often charge more due to their expertise in using specialized software and equipment.

Other Costs Associated with Lawsuits

Expert witnesses and courtroom graphics are just a few of the larger expenses that are common to lawsuits. But there are other substantial costs as well. There are investigators who are sometimes utilized. Process Services are often required.

Plaintiff attorneys often hire legal consultants who provide mock juries for lawyers to practice preparing their questions and delivering their cases to see how juries will respond to presenting information one way versus another.

Another thing people never consider is the cost of copying. When lawsuits drag on for a long time, the case files get huge. Imagine warehouses full of documents, because often this is what a long-running case file looks like. And any time there is something added to the file, it has to go in that massive stack of paper. And then, every time someone needs a copy of the case file for some reason, copy companies have to copy that entire warehouse of paper and ship it to the new recipient.

In today’s digital landscape the file is usually scanned into a PDF document, but its initial form, it is often still paper, and someone has to handle all of that paper, manage it, maintain it, bates number it, and reproduce it often over the course of years.

Money Going Out Constantly and No Money Coming in

Now that you’ve been exposed to some of the massive costs that go into litigating a case, who would you imagine pays for all of these upfront expenses? Plaintiff attorneys work on a contingency fee basis, meaning they don’t get paid until they win their case. So who is paying for all of these expenses up front? Who is fronting the money?

The answer is – the law firm.

And this is one of the reasons law firms use legal funding solutions like factoring for law firms – because by the time they win the case, they’ve been shelling out money for a long time and had zero money coming in. By the time the case finally concludes, they need to get their money back in the bank as soon as they can to cover marketing, taking on new cases, paying salaries, and paying for overhead. The trouble is, even when a case is over, it can take months or even years for a defendant to pay the money they owe from a lawsuit, making the wait for the money even longer.

Because of this, law firms use factoring – they sell some of their pending contingency fees from cases they’ve won for their clients at a discount to a legal factoring company so they can get access to some of their money right away (often within 48 hours).

Control Over Law Firm Financing

Utilizing factoring helps law firms gain control over their financing and cash flows. When attorneys use factoring – they can choose to use it periodically or on an as-needed basis.

Some clients pay their bills quickly, others might take thirty, sixty, or even ninety days to pay. With factoring for attorneys, the firm can decide which invoices they want to factor and which invoices they know will be paid in a timely manner. Because of the flexibility of factoring and factoring companies, law firms can use factoring when they want to, and not at all when they don’t feel they need the additional cash influx.

Easy to Apply and Get Approved for Law Firm Factoring

It is relatively easy to apply and get approved for law firm factoring. Factoring is a non-traditional form of financing and doesn’t require the completion of lengthy loan applications. Plus, factoring companies don’t care as much as banks about credit scores (although they will check credit for things like judgments and bank liens). This makes it an ideal choice for law firms looking to quickly access capital without the hassle of more traditional forms of financing like loans or lines of credit.

Factoring for Small Law Firms

Small law firms can particularly benefit from factoring. By taking advantage of this type of financing, small firms can free up working capital that would otherwise be tied up in pending client payments, or in receiving contingency fees from cases they have won and used to cover operating costs and expand their services.

Additionally, with improved cash flow, smaller firms are able to compete against larger firms that may have historically had stronger financial backing. Small businesses that lack access to capital from third parties tend to stay small forever. They know they don’t have enough cash to take on larger clients because the initial upfront expenses simply overwhelm their personal resources. If you are going to grow your business, you are going to need access to capital, and preferably, access to capital when you need it most. This is where non-traditional funding options like factoring receivables come into play.

Factoring for Law Firms is Also Known as Post Settlement Funding

Factoring for law firms is also called Post settlement funding or settlement funding. Legal funding companies who offer post settlement funding provide financial support to attorneys in exchange for a portion of the proceeds of their lawsuit settlements. This type of funding allows attorneys to receive immediate financial compensation while still servicing their clients and continuing with their cases.

Post settlement funding is advantageous for many attorneys because it enables them to receive immediate financial compensation without having to wait for a defendant to pay the money they owe from a judgment or settlement award. Knowing they have access to their contingency fees when they need it helps attorneys stay focused on their cases and keep their business running until a resolution is reached.

Overall, Post Settlement Funding allows attorneys to receive immediate funds from their lawsuits without compromising the outcome of their cases. By utilizing the services of a legal funding company, attorneys can make sure that they can continue operating financially while still providing exceptional service to their clients. Post settlement factoring enables law firms to remain competitive in an ever-changing legal landscape, allowing them to serve greater numbers of individuals who may not have otherwise been able to afford quality representation or seek justice for their grievances.

How Post Settlement Funding for Attorneys Works

Post settlement funding, also known as factoring for law firms, provides a reliable source of cash flow to attorneys and legal practices. Simply put, when lawyers win cases or settle out of court on behalf of their clients, they can receive a portion of the proceeds in advance. This advance provides them the money needed to cover costs associated with their practice while waiting for the remainder of the payment from the defendants or claims administrators, which typically takes several weeks or months to process.

Additionally, it gives attorneys peace of mind knowing that their practice is financially secure until their clients receive full payment from defendants or claims administrators. Post settlement funding is an invaluable resource for any attorney, giving them the resources they need to succeed while waiting on payments from cases won or settled out of court. By working with Legal Funding Companies.

This type of factoring is not only efficient and cost-effective, but can also help protect attorneys from the risk associated with nonpayment of services rendered. By factoring their accounts receivables, law firms can receive a lump sum payment for their invoices in as little as 48 hours, allowing them to pay expenses and grow their businesses without having to wait on slow-paying clients.

Furthermore, factoring for law firms is a safe and secure form of payment processing as the factoring company assumes all the risk associated with any late or nonpayment of invoices. This type of factoring is ideal for law firms that need quick access to working capital without worrying about their client’s ability to pay.

Summary

Overall, factoring can be an extremely beneficial tool for law firms looking to manage cash flow and expand their practice. If managed correctly, this type of financing can enable firms to increase their services and compete with larger competitors on equal footing – all while avoiding costly late payment fees from clients.

With the right planning and strategy, any size law firm can take advantage of the many benefits of factoring. By taking the time to become familiar with this type of financing, law firms can achieve their goals and grow their practice without having to worry about cash flow issues. Factoring is a simple and efficient way for law firms to access capital quickly and improve their bottom line. With the right approach, any firm can make great use of it!

About Factoring for Law Firms with Balanced Bridge Funding

A Post Settlement Advance is a Non-Recourse Transaction: We Accept All the Risk

Post Settlement funding is a non-recourse transaction. This means you don’t need to worry about what might happen if the defendant suddenly can’t pay your settlement award — we accept all risk of non-payment, meaning that you will still get to keep the money from your settlement advance if the defendant goes bankrupt or is unable to pay for whatever reason.

Fast, Hassle-Free Application

In most cases, we can get your money in your hands in one week or less. Our application is simple, straightforward, and easy to complete. Remember, this isn’t a loan, so there isn’t as much paperwork to go through. In most cases, we can approve your application and have your money deposited into your checking account in a matter of days.

About Balanced Bridge Funding

Balanced Bridge Funding offers legal funding solutions for plaintiffs, plaintiff attorneys, attorneys, and law firms. To talk to one of our legal funding specialists about getting help managing your law firm cash flow, please call (267) 457-4540 or email info@balancedbridge.com.

Or to apply online, simply CLICK HERE and fill out our quick form application.