A Comparison of Funding Sources Available for New Attorneys

Funding for New Attorneys: A Comprehensive Guide to Attorney Financing

Launching a legal career or starting a new law firm is an exciting milestone, but it can create some significant financial challenges. For those looking to start up a new law firm, how to find funding is a popular topic.

That’s why we assembled this simple guide to funding for attorneys. We explore funding options from using credit cards to lawyer loans and more.

Funding Sources for a New Startup Attorney

Launching a law firm or stepping into solo legal practice is an exhilarating leap that blends professional ambition with entrepreneurial spirit.

But with this new beginning comes a fundamental question: How can new attorneys secure the funding needed to turn their vision into a thriving legal practice?

Like any budding business, a law firm requires substantial upfront investment—a reality that often surprises even the most prepared new lawyers.

From renting office space and purchasing legal software to marketing your services and covering payroll, the initial costs can quickly add up. Cash flow challenges are especially pronounced in law, where client payments may lag weeks or even months after work begins, making access to reliable funding not just helpful, but essential for survival and growth.

Securing proper financing isn’t just about meeting today’s bills. It’s about creating the foundation for future success—investing in technology that boosts efficiency, supporting staff who help you deliver quality service, and enabling expansion into new practice areas as your reputation grows.

Smart funding empowers attorneys to focus on what truly matters: serving clients and building a strong, ethical legal practice.

This comprehensive guide examines the diverse funding landscape available to attorneys just starting out. It is designed to demystify attorney financing and help you make confident, informed choices no matter where you are in your journey.

We’ll explore:

Traditional Business Loans: Including SBA-backed loans, bank loans, and online lenders, along with tips for improving your approval odds.

Lines of Credit and Business Credit Cards: Flexible funding for daily expenses and unpredictable cash cycles, including how to use them responsibly to build business credit.

Legal Funding Companies: Specialized funding based on your caseload or receivables instead of just personal credit, offering options such as pre-settlement funding, post-settlement advances, and law firm lines of credit.

Alternative and Creative Solutions: Grants targeting legal aid or technology innovation, crowdfunding platforms for mission-driven firms, as well as the growing role of angel investors, private equity, and legal incubators in a select number of states.

Best Practices: Actionable advice for putting your firm on strong financial footing, from developing a compelling business plan and tracking cash flow to negotiating optimal terms with funders.

Whether you’re financing your practice with personal savings, securing a small business loan, seeking a grant, or partnering with a legal funding provider, understanding your options is the first step toward building a resilient and prosperous law firm.

Every attorney’s situation is unique, and the best funding path blends strategic choice with a clear-eyed view of your practice goals, risk tolerance, and the ever-changing landscape of legal finance.

By mastering the range of funding sources available—along with the nuances of each—you’ll not only set your new practice up for financial strength but also position yourself to deliver outstanding legal counsel from day one. Let’s dive into the essential funding avenues every new attorney should consider, so you can move forward with confidence and clarity.

Why Funding Matters for New Attorneys

Starting a legal practice requires capital. From office space and technology to marketing and payroll, the costs add up quickly.

Many attorneys underestimate the amount of working capital needed to bridge the gap between opening their doors and receiving their first client payments.

Without adequate funding, even the most talented lawyers can struggle to survive the critical early years.

Key reasons new attorneys need funding:

- Covering start-up costs (rent, equipment, insurance, licenses)

- Managing cash flow during slow-paying client cycles

- Investing in marketing and client acquisition

- Hiring support staff or co-counsel

- Upgrading technology and cybersecurity

- Expanding practice areas or locations

Common Funding Options for New Attorneys

SMALL BUSINESS LOANS

Small business loans are a traditional choice for attorneys seeking to finance their new practice. These loans are typically offered by banks, credit unions, or specialized lenders and can be used for a wide range of business expenses.

- SBA Loans: The U.S. Small Business Administration (SBA) backs several loan programs, including the popular SBA 7(a) and 504 loans. SBA loans often feature lower interest rates and longer repayment terms but require extensive paperwork and a solid business plan.

- Bank Loans: Conventional business loans from banks may offer competitive rates, especially if you have a strong credit history and collateral. However, new law firms may face stricter approval criteria due to the perceived risk. Also, banks will not typically consider a lawyer’s case inventory, the real capital that a law firm has, as collateral for a loan. They are often looking for more tangible assets like real estate or equipment.

- Online Lenders: Fintech companies and online lenders provide faster approval processes and may be more flexible for new attorneys, but their rates can be higher.

Pro Tip: Shop around for the best terms and be prepared to provide a detailed business plan, cash flow projections, and personal financial statements.

LINES OF CREDIT

A business line of credit gives attorneys access to a revolving pool of funds that can be drawn upon as needed. This is especially useful for managing unpredictable cash flow or covering short-term expenses.

- Working Capital Lines: Ideal for covering payroll, rent, or unexpected costs.

- Secured vs. Unsecured: Secured lines require collateral, while unsecured lines are based on creditworthiness and may have higher interest rates.

BUSINESS CREDIT CARDS

Business credit cards are a convenient way to finance day-to-day expenses and build business credit. Many cards offer rewards, cash back, and introductory APR periods.

- Pros: Easy approval, flexibility, rewards programs.

- Cons: High interest rates if balances are not paid in full; risk of accumulating debt.

Best for: Small purchases, emergencies, and establishing a credit profile for your law firm.

For more About Pros and Cons of Using Personal Credit Cards Please Read Our Full Article

LEGAL FUNDING COMPANIES

Legal funding companies specialize in providing capital to attorneys and law firms. Unlike traditional lenders, these companies understand the unique cash flow cycles of legal practices and often base funding decisions on your caseload or expected settlements rather than just credit scores.

Types of Legal Funding

- Pre-Settlement Funding: Advances against potential case settlements, allowing attorneys to cover litigation costs before a case concludes.

- Post-Settlement Funding: Advances on settlements or judgments already awarded but not yet paid out.

- Lawyer Loans & Lines of Credit: Loans or revolving credit lines tailored for law firms, often secured by case inventory or receivables.

- Factoring Accounts Receivable: Selling unpaid client invoices to a funding company at a discount for immediate cash flow.

Advantages:

- No personal credit checks for some products

- Funding based on case value or receivables

- Flexible repayment structures

Disadvantages:

- Higher costs than traditional loans

- Not all cases or firms qualify

Understanding Post Settlement Funding for Attorneys

Balanced Bridge provides post settlement funding for attorneys, offering advances on fees in settled cases experiencing distribution delays. Lien resolutions, waiting for final approval, slow-paying defendants, and other factors can leave plaintiff attorneys waiting months for their contingency fees, even after a settlement is reached. Balanced Bridge can help bridge that gap, providing capital for law firms to utilize now.

Post settlement funding is easy to qualify for. Once you have won an award for a client, or reached a settlement agreement, you simply apply for post settlement funding, agree to the amount, fill out some paperwork, and you can have some of your money in a matter of days.

Post settlement funding for attorneys is not a loan. Post settlement funding is a financial service that allows attorneys and law firms to sell a portion of their anticipated legal fees or settlement awards after a case has been resolved but before the funds are actually paid out.

Unlike pre-settlement funding, which is available while a case is still pending, post settlement funding is only offered once a settlement agreement has been reached and the payout is simply delayed due to administrative, procedural, or other reasons.

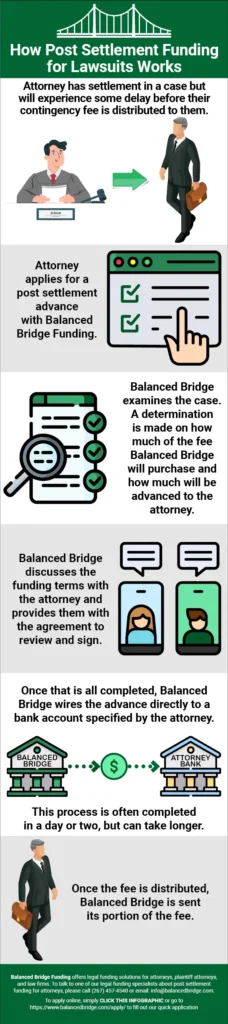

How Post Settlement Funding for Attorneys Works

- There is a settlement in a case, but there will be some delay before the awards and contingency fees for the attorneys are distributed.

- Attorney applies for a settlement advance with Balanced Bridge Funding, against their fees.

- Balanced Bridge examines the case. A determination is made on how much of the fee or award Balanced Bridge will purchase and how much will be advanced to the attorney.

- Balanced Bridge discusses the funding terms with the attorney and provides them with the agreement to review and sign.

Once that is completed, Balanced Bridge wires the advance directly to a bank account specified by the attorney.

This process is often completed in a day or two but can take longer.

Once the fee or award is distributed, Balanced Bridge is sent its portion to satisfy collection on the advance.

To talk to one of our legal funding specialists about getting help managing your law firm cash flow, please call (267) 457-4540 or email info@balancedbridge.com.

Attorneys can also find more information about Balanced Bridge post-settlement advances here.

Alternative and Creative Funding Strategies

Grants for Attorneys and Law Firms

Some organizations, especially those supporting public interest law, offer grants to attorneys and law firms:

- Legal Services Corporation (LSC): Offers forgivable loans and grants for attorneys working with legal aid organizations.

- Pro Bono Innovation Fund: Supports projects that expand access to justice.

- Technology Initiative Grants: Funds innovative uses of technology in legal service delivery.

Pro Tip: Check local bar associations and government programs for regional grant opportunities.

Crowdfunding

Crowdfunding platforms like Kickstarter or Indiegogo can be used to raise funds for a new law firm, especially if you have a compelling mission or serve underserved communities. This approach works best for niche practices or firms with a strong community focus.

Angel Investors and Private Equity

Law firms do face some unique challenges because, depending on the state, you may or may not be able to take advantage of investors who are not part of the firm. Most states do not allow outside investors. But there are exceptions. If you are in one of those states, you may be able to take advantage of investment capital.

- Angel Investors: Individuals or groups who invest in early-stage law firms in exchange for equity or a share of profits. This is rare in legal practice but possible for firms with innovative business models or technology-driven approaches.

- Private Equity: Never overlook private equity investment. There are many types of investors, and it is becoming more common for heavy hitting investment firms to look for smaller companies. If you have a few cases with promising caseloads, you may find someone interested in investing to help you win those cases and grow your firm.

How to Choose the Right Funding Option

Key considerations:

- Interest Rates and Fees: Compare the true cost of funds, including origination fees, interest, and any hidden charges.

- Repayment Terms: Understand the repayment schedule and whether payments are fixed, variable, or tied to future case outcomes.

- Collateral Requirements: Know what assets (if any) you must pledge.

- Speed and Flexibility: Some funding sources (like legal funding companies) offer faster approval than banks.

- Impact on Ownership: Equity investors may require a stake in your firm.

- Reputation and Transparency: Work with reputable funders and read reviews from other attorneys.

Best Practices for Securing Attorney Funding

- Build a Solid Business Plan: Demonstrate your market, revenue projections, and growth strategy.

- Maintain Good Credit: Both personal and business credit scores matter, especially for traditional loans.

- Diversify Funding Sources: Don’t rely solely on one funding type; mix credit lines, loans, and legal funding as needed.

- Monitor Cash Flow: Use accounting software to track receivables and expenses.

- Negotiate Terms: Don’t accept the first offer—shop around and negotiate for better rates or more favorable terms.

- Consult Experts: Work with accountants and legal finance specialists to make informed decisions.

More About Funding Sources for New Attorneys

Can new law firms get business loans?

Yes, new law firms can apply for business loans through banks, credit unions, SBA programs, and online lenders. Approval depends on creditworthiness, collateral, and a solid business plan.

Are there grants available for new attorneys?

Yes, especially for attorneys working in public interest or legal aid. The Legal Services Corporation and other organizations offer grants and forgivable loans.

What is legal funding and how does it work?

Legal funding provides advances based on expected settlements, judgments, or receivables. It helps attorneys cover expenses while waiting for case outcomes. Repayment is often contingent on case success, and personal credit checks are not always required.

Summary: Funding Sources for New Startup Attorney

Securing the right funding is one of the most important steps a new attorney can take. With a wide array of options—from traditional loans and lines of credit to specialized legal funding companies and grants—today’s attorneys have more tools than ever to build thriving practices.

By understanding the landscape, comparing providers, and making strategic choices, new attorneys can overcome financial barriers and focus on delivering outstanding legal services.

Remember: The best funding solution is one that aligns with your practice goals, risk tolerance, and long-term vision. Take the time to research, plan, and consult with experts before committing to any financial product.

PERSONAL SAVINGS AND BOOTSTRAPPING

- Personal savings: Many attorneys start by investing their own funds to cover initial expenses such as licensing, office setup, and marketing.

- Friends and family: Consider seeking small investments or loans from people you trust who believe in your vision.

GRANTS AND NON-DILUTIVE FUNDING

- Legal Services Corporation (LSC) Grants: Programs like the Basic Field Grant, Pro Bono Innovation Fund, and Technology Initiative Grant support law firms, especially those serving low-income clients or innovating with technology.

- Private and Nonprofit Grants: Organizations such as the Freed Fellowship and IFundWomen offer grants to small businesses and startups, including law firms.

- Local and state government grants: Check with your local bar association or economic development office for region-specific opportunities.

LOANS AND LINES OF CREDIT

- Small Business Administration (SBA) Loans: SBA-backed loans often have favorable terms for new businesses but require thorough documentation and a strong business plan.

- Traditional bank loans: Suitable if you have good credit and collateral. Keep in mind, banks often will not consider case inventory as collateral for traditional loans.

- Business lines of credit: Provide flexible access to funds as needed, which can help with cash flow during the startup phase.

LEGAL FUNDING COMPANIES

- Specialized legal lenders: Some companies focus on financing law firms, offering products like lawyer loans, lines of credit, and receivables factoring. These lenders may evaluate your caseload and business model rather than just credit score.

CROWDFUNDING AND ALTERNATIVE FINANCING

- Crowdfunding platforms: Sites like Kickstarter or Indiegogo allow you to raise funds by pitching your law firm’s mission to the public.

- Equity crowdfunding: Platforms such as AngelList and Republic let you raise capital in exchange for equity, though this is less common for traditional law firms due to ethical and regulatory considerations.

ANGEL INVESTORS AND VENTURE CAPITAL*

- Angel investors: Individuals or groups willing to invest in early-stage businesses in exchange for equity. This is more common for legal tech startups than for traditional law practices.

- Venture capital: Typically reserved for high-growth legal tech ventures or firms with scalable business models.

*If your state allows outside investment.

INCUBATORS AND ACCELERATORS

- Legal and business incubators: These programs offer funding, mentoring, and office space in exchange for equity or participation. They can be valuable for networking and business development.

Practical Steps to Take

- Develop a solid business plan: Clearly outline your niche, target market, and financial projections to improve your chances with lenders and investors.

- Network locally: Engage with your bar association, attend legal networking events, and connect with local entrepreneurs.

- Research and apply for grants: Focus on those tailored to legal services or small businesses in your region.

- Explore SBA and bank loan options: Prepare necessary documentation and consider meeting with a small business advisor.

- Consider alternative and creative funding: Legal funding companies, crowdfunding, and incubators can provide additional support.

- Seek mentorship: Experienced attorneys and business advisors can help you navigate funding and growth challenges.

Summary Table: Funding Options for Startup Attorneys

| Funding Source | Key Features | Considerations |

| Personal Savings/Family | Fast, no interest/equity loss | Risk to personal finances |

| Grants | No repayment, non-dilutive | Highly competitive, eligibility varies |

| SBA/Bank Loans | Larger amounts, structured repayment | Requires good credit, paperwork |

| Legal Funding Companies | Tailored to law firms, flexible terms | May have higher fees |

| Crowdfunding | Public support, marketing exposure | Time-consuming, not guaranteed |

| Angel Investors/Venture Cap. | Large capital, strategic support | Equity loss, more common in legal tech |

| Incubators/Accelerators | Funding, mentorship, resources | May require equity or participation |

About the Authors

Balanced Bridge Funding offers legal funding solutions for attorneys and law firms. We provide post-settlement advances and can help in situations where an agreement has been reached but there will be some delay until distribution of the contingency fee for attorneys.

To talk to one of our legal funding specialists about getting help managing your law firm cash flow, please call (267) 457-4540 or email info@balancedbridge.com or to apply online, simply CLICK HERE to fill out our inquiry form.