Settlement Funding – For Law Firms and Plaintiffs

Settlement funding is for law firms of all sizes. Settlement funding helps law firms and attorneys manage cash flow, finance operations, and keep their law firm on a path to growth.

Balanced Bridge Funding specializes in settlement funding for all types of cases. Our approval process is simple, fast, and discreet.

Contact Us Today to Apply.

Why Work with Balanced Bridge Funding?

At Balanced Bridge Funding, we are professional, courteous, fast, and discreet. Our clients like to keep their financing activities private, and we respect their wishes. When you work with us, you work with a group of true professionals with many years of legal funding industry experience.

When you work with Balanced Bridge Funding you are working with a true funding company. We are not a brokerage for someone else’s business. When you work with us, you work with the source, not a “middle man.” Going direct to the funding source can help keep costs down, maintain privacy, and ensure you are working with the people who actually make the decisions about your funding.

What is Settlement Funding?

Settlement funding is a financial vehicle law firms and attorneys can use to receive advances on upcoming contingency fee payments from a settlement award. These funds can be used to finance rapid expansion, growth, take on new clients, and finance operations.

Who is Settlement Funding For?

Law firms of all sizes make use of settlement funding to finance operations, leverage growth, and new clients in a highly competitive industry.

In the infancy of Legal Financing, settlement funding was primarily utilized by small law firms who did not have the cash reserves to endure long waiting periods before they received their contingency fees from a settlement award.

Today, law firms of all sizes make use of settlement funding to leverage growth. Like most big businesses, large law firms are leveraging “other people’s money” to finance their growth and expansion.

Settlement Funding Strategy for Growth

Business owners who think small tend to stay small. Large businesses never hesitate to use “other people’s money” to fund their future growth. They borrow, sell debt, sell shares, and take positions on commodity exchanges to hedge against price fluctuations. They buy new companies just to leverage their assets for the growth of their existing businesses. Law firms should be no different.

Major lawsuits are expensive and can last years or even decades. During that time, the law firm does not receive any capital from the lawsuit. Even after the case is settled, it can take years before the money is actually paid out.

Settlement funding is a great way to leverage the work you’ve already done to fund future growth instead of putting growth on hold while you wait to be paid.

How Does Settlement Funding Work?

Once you (the law firm) have reached a settlement or judgement on behalf of your client, the money you are owed is considered an asset. The money you are owed is property with a knowable value. Because it is an asset, all or part of it can be sold. We (Balanced Bridge Funding) purchase a portion of the amount owed to you (at a discount). You get money now, and we own the asset (a portion of the settlement funds you sold to us). You go on about running your law firm, and we wait for the settlement funds to be paid to us directly by lead counsel, or whomever is designated to distribute the funds on behalf of the settlement.

How Does Balanced Bridge Funding Get Paid?

When the settlement is ready to be paid, Balanced Bridge Funding is repaid what it is owed directly from the case administrator, lead counsel, or from the escrow account. You are paid any remainder owed to you. Remember, we purchased this asset from you. It is ours, and our responsibility, to collect what is owed to us from the settlement or award.

Is Settlement Funding a Loan?

Although settlement funding is often referred to as a loan for lawyers, it is not. We are purchasing an asset from you at a discount rate. The terms might seem semantical, but they matter.

Some states have passed bills just to specify that legal funding does not in any way meet the criteria of a loan and cannot be called a loan.

Example: In 2020, Utah passed HB 312 that specifically states settlement funding does not meet the definition of a loan or credit. (source).

Unlike a loan, settlement funding does not have monthly or interim payments to a lender. When your case finally pays out, the obligor pays Balanced Bridge Funding directly.

What Type of Settlements Does Balanced Bridge Funding Finance?

We fund all types of settlements where there is a delay between time of settlement and actual payment. Here are just a few (not all) types of settlements we will fund:

- Class Actions

- SSDI

- Veterans Disability Claims

- Sexual Assault

- Infant Injuries

- Product Liability

- Personal Injury

- Truck Accidents

- Mass Torts

- Multi-District Litigation

- Employment Discrimination

- Wrongful Death

- Slip & Fall

- Medical Malpractice

- And More!

Chances are, if you are going to receive a settlement or award, you can receive settlement funding from Balanced Bridge Funding.

Is Settlement Funding Regulated?

As of 2022, there is no federal regulation for third party litigation funding. Some states have begun considering regulation, and it is reasonable to expect regulation in the future and for those regulations to differ state to state.

The legal industry is policing themselves (as they tend to do) regarding legal funding. The American Bar Association (in 2020) issued a report of “best practices” for third party litigation funding.

The Legal Funding industry has made a great deal of progress policing itself. There are at least two associations now in the Legal Funding Industry. The Alliance for Responsible Consumer Legal Funding (ARC), and the American Legal Finance Association (ALFA).

Does Balanced Bridge Funding Belong to an Association?

Yes, Balanced Bridge is a member of ARC – The Alliance for Responsible Consumer Legal Funding.

Talk to Us Today About Settlement Funding

Call: 267-457-4540 to speak to one of our legal funding experts.

-OR-

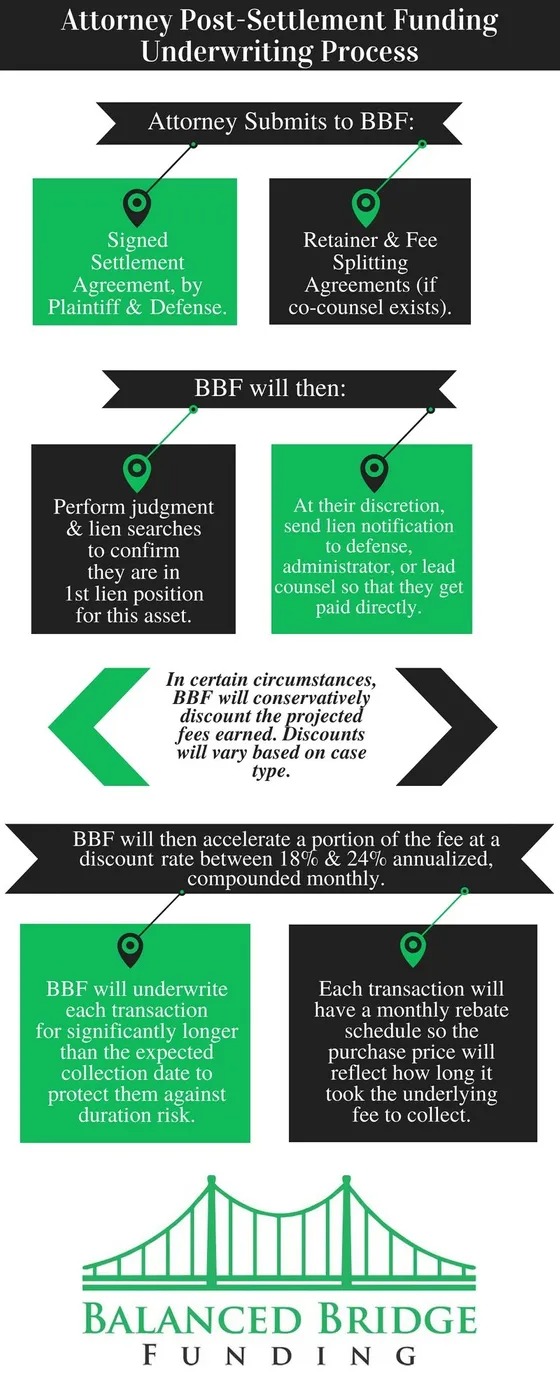

Infographic Explaining the Underwriting Process for Attorney Settlement Advances: