Post Settlement Funding – A Great Source of Capital for New Law Firms

Post Settlement Funding for Attorneys – a great source of capital for new attorneys – Post settlement funding for attorneys is a funding source that many younger attorneys are not aware of, that is one of the easiest sources of capital to qualify for.

Because post-settlement funding companies do not typically need to see your credit score or financial history, post settlement funding is easy to apply for and receive funds quickly.

Law firms, like any business, are often looking for capital when they are starting out. This is especially true for Plaintiff Attorneys who work on a contingency fee basis.

The gap between resolving a case and receiving settlement funds can stretch for months, sometimes even years, putting immense pressure on your ability to pay staff, cover overhead, and continue taking on new clients and cases.

If you are an attorney looking for an easy source of capital, you should know about post settlement funding.

Understanding Post Settlement Funding for Attorneys

Post settlement funding is easy to qualify for. Once you have won an award for a client, or reached a settlement agreement, you simply apply for post settlement funding, agree to the amount, fill out some paperwork, and you can have some of your money in a matter of days.

Post settlement funding for attorneys is not a loan. Post settlement funding is a financial service that allows attorneys and law firms to sell a portion of their anticipated legal fees or settlement awards after a case has been resolved but before the funds are actually paid out.

Unlike pre-settlement funding, which is available while a case is still pending, post settlement funding is only offered once a settlement agreement has been reached and the payout is simply delayed due to administrative, procedural, or other reasons.

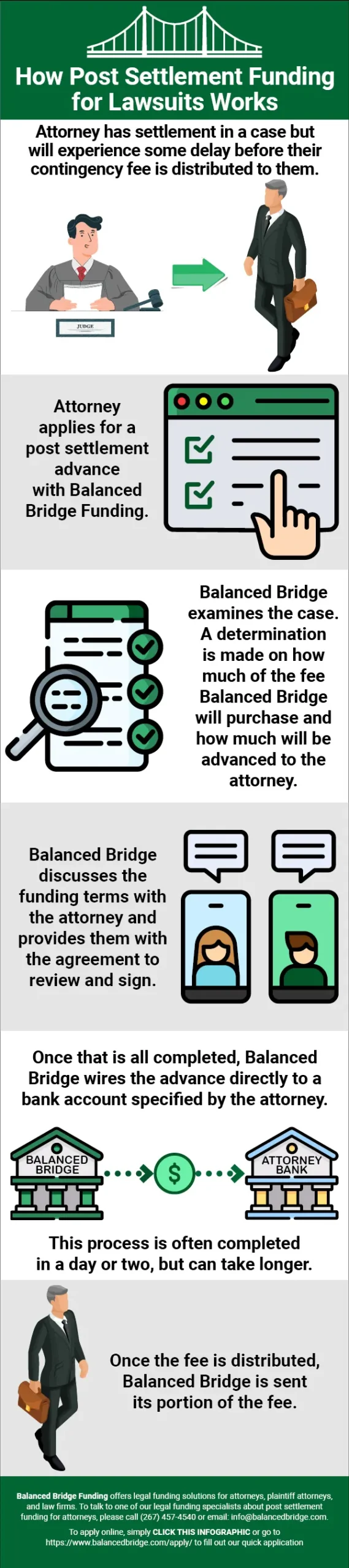

How Post Settlement Funding for Attorneys Works

- There is a settlement in a case, but there will be some delay before the awards and contingency fees for the attorneys are distributed.

- Attorney applies for a settlement advance with Balanced Bridge Funding, against their fees.

- Balanced Bridge examines the case. A determination is made on how much of the fee or award Balanced Bridge will purchase and how much will be advanced to the attorney.

- Balanced Bridge discusses the funding terms with the attorney and provides them with the agreement to review and sign.

- Once that is completed, Balanced Bridge wires the advance directly to a bank account specified by the attorney.

This process is often completed in a day or two but can take longer.

Once the fee or award is distributed, Balanced Bridge is sent its portion to satisfy collection on the advance.

To talk to one of our legal funding specialists about getting help managing your law firm cash flow, please call (267) 457-4540 or email info@balancedbridge.com

Why Do Settlement Payments Get Delayed?

Even after a case is resolved, the path to payout is rarely straightforward. Delays can occur for a variety of reasons:

- Administrative delays like lien resolutions

- Waiting on final approval from a judge, government entity, or committee

- Defendants taking some time after settlement to distribute settlement checks

- Structured payment arrangements or installment schedules

During this waiting period, law firms still need to meet payroll, cover rent, pay case costs, and keep the practice running smoothly. And sometimes, they just want to get access to capital because they have worked hard for a long time and want their just rewards.

Why Attorneys Use Post Settlement Funding

Attorneys and law firms of all sizes and specialties turn to post settlement funding for strategic reasons:

- Smoothing Cash Flow

Contingency fee practices face irregular income streams. Post settlement funding bridges the gap between case resolution and payment, ensuring the firm can cover ongoing expenses like payroll, rent, and case costs without disruption.

- Paying Down Debt and Meeting Obligations

After years of work on a major case, attorneys may need to pay down lines of credit, distribute bonuses, or simply pay themselves and their staff. Post settlement funding provides the flexibility to access capital without waiting for the defendant or insurer to pay.

- Investing in Growth

Growth requires capital. Law firms use post settlement funding to invest in marketing, technology, hiring, and expansion into new practice areas or geographic markets. Leveraging this funding allows firms to seize opportunities and stay competitive, rather than being held back by cash flow constraints.

- Avoiding Traditional Debt

Post settlement funding is not a loan. It does not require monthly payments and is against something that banks typically don’t consider an asset – settlement fees. The advance is repaid only from the settlement proceeds, and if, for any reason, the settlement is not paid, the attorney owes nothing.

Sometimes lawyers use post settlement funding for non-strategic reasons. They have worked hard for a long time to win or settle a case, and they want some funds right away. Who doesn’t want to be paid as soon as possible for their work?

Post Settlement Funding vs. Traditional Loans

A key distinction is that post settlement funding is not a loan. Instead, it is the sale of a portion of a pending asset (the contingency fee or settlement award) to a third party for immediate cash.

The funding provider assumes the risk—if the settlement is not paid, the attorney is not personally liable to repay the advance.

Difference Between Post Settlement Funding for Attorneys and Traditional Loans

| Post Settlement Funding | Traditional Loan | |

| Personal Guarantee | Not required | Usually required |

| Credit Impact | None | May affect credit score |

| Risk | Non-recourse | Recourse |

| Approval Speed | 24–48 hours | Days to weeks |

How Post Settlement Funding Benefits Young Attorneys and New Law Firms

For young attorneys and those launching new practices, post settlement funding can be transformative. It is much easier to qualify for than a traditional loan, and you receive your money much faster.

- Overcoming Cash Flow Challenges

New firms often face irregular income and significant startup costs. Post settlement funding provides immediate capital for delayed, settled fees, helping young attorneys cover operating expenses, invest in marketing, and build a financial cushion.

- Seizing Growth Opportunities

Opportunities—such as hiring talent, expanding into new practice areas, or investing in technology—often require capital. With post settlement funding, young attorneys can act quickly, rather than missing out due to cash constraints.

- Avoiding Personal Debt

Traditional loans can be risky for new attorneys, often requiring personal guarantees and monthly payments. Post settlement funding is non-recourse and does not impact personal credit, making it a safer option for financing growth.

- Building a Sustainable Practice

By smoothing out cash flow and providing access to capital, post settlement funding allows young attorneys to focus on building their practice, serving clients, and planning for long-term success.

How to Fund a New Law Practice Using Post Settlement Funding

Launching a new law practice is an exciting but financially demanding endeavor. Here’s how post settlement funding can help:

Step 1: Secure Your First Cases

Start by taking on cases that have a high likelihood of settlement. Once you’ve secured a settlement, you can use post settlement funding to access capital immediately, rather than waiting for the payout.

Step 2: Apply for Post Settlement Funding

Contact a reputable post settlement funding provider like Balanced Bridge Funding and provide documentation of your settlement agreement and expected fee. The provider will evaluate your case and determine the advance amount, typically a percentage of your anticipated fee.

Step 3: Use the Funds to Build Your Practice

With immediate access to capital, you can:

- Pay office rent and overhead

- Hire staff (paralegals, associates, administrative help)

- Invest in marketing and client acquisition

- Upgrade technology and office equipment

- Attend professional development events

Step 4: Repay When the Settlement Arrives

When the settlement funds are finally paid, the funding provider receives payment to satisfy the advance.

The Strategic Benefits of Post-Settlement Funding

- Improved Cash Flow

The period between case resolution and settlement payment can be lengthy, tying up significant financial resources. Post-settlement funding bridges this gap, providing the liquidity needed to cover operational expenses, pay staff, and manage overhead costs. This steady cash flow allows firms to maintain stability and focus on client service, even during periods of delayed payments. - Increased Case Capacity

A shortage of funds often limits a firm’s ability to take on new cases, especially those requiring substantial upfront investment. With post-settlement funding, firms can reinvest in their practice, covering costs like expert witnesses, discovery, and trial preparation for new matters, thereby expanding their portfolio and increasing revenue potential. - Strategic Marketing and Growth Investment

Growth requires visibility and resources. Post-settlement funding can be used to boost marketing efforts, such as digital advertising, SEO optimization, and client outreach campaigns. These investments help attract more clients and cases, further expanding the firm’s reach and market share. - Operational Stability

Unforeseen delays in settlement disbursements can strain a law firm’s financial stability. Post-settlement funding offers an alternative source of capital to meet ongoing obligations, minimizing the impact of case delays and ensuring uninterrupted client service. This safeguard enhances the firm’s credibility and reputation in the market. - Flexibility Without Traditional Debt

Unlike bank loans or lines of credit, post-settlement funding does not require monthly payments, personal guarantees, or impact the attorney’s credit. The advance is typically repaid once the settlement distributes. This flexibility allows law firms to pursue growth opportunities without the risks associated with traditional debt.

Addressing Common Myths and Misconceptions About Post Settlement Funding

MYTH: Only Struggling Firms Use Post Settlement Funding

REALITY: Today, firms of all sizes use post settlement funding as a strategic financial tool. It is not a sign of weakness, but of smart cash flow management and business acumen.

MYTH: It’s Too Expensive

REALITY: While there is a cost to post settlement funding, it is often outweighed by the benefits of immediate access to capital, the ability to seize opportunities, and the avoidance of traditional debt.

MYTH: It’s Complicated

REALITY: The application and approval process is typically fast and straightforward, with funds available in days—not weeks or months. Post settlement funding is much faster and easier than applying for a traditional loan (generally).

Choosing the Right Post Settlement Funding Provider

When selecting a post settlement funding provider, attorneys should consider:

- Reputation and Experience: Look for companies with a strong track record and positive client feedback.

- Transparency: Ensure the provider is clear about rates, fees, and terms.

- Speed of Funding: Choose a provider that can deliver funds quickly—typically within a matter of days.

- Non-Recourse Terms: Confirm that repayment is only required if the settlement is paid.

A trustworthy funding partner should act as an ally, not just a lender, helping you navigate the process with clarity and professionalism.

Maximizing the Strategic Value of Post Settlement Funding

To get the most from post settlement funding, attorneys should approach it as a strategic business tool, not a last resort. Here are some best practices:

- Plan Ahead: Anticipate cash flow needs and explore funding options before a crunch arises.

- Communicate Clearly: Work with your funding provider to ensure all parties understand the terms and repayment process.

- Invest Wisely: Use advances to strengthen your practice—whether through hiring, technology, marketing, or professional development.

- Monitor Results: Track how funding impacts your firm’s growth, profitability, and ability to serve clients.

Key Questions Attorneys Ask About Qualifying for Post-Settlement Funding

Attorneys considering post-settlement funding often have specific questions about eligibility and the application process. Below are the most common questions, along with concise answers.

1. What Are the Basic Eligibility Requirements?

Is my case eligible for post-settlement funding?

Attorneys must have a resolved case where a settlement has been reached but is waiting disbursement. Only plaintiff attorneys —not defendants—can qualify for this type of funding.

What types of cases qualify?

Most civil cases with a confirmed settlement are eligible, including personal injury, medical malpractice, employment disputes, product liability, and class actions.

2. What Documentation Is Required?

What documents do I need to provide?

Attorneys typically need to submit the settlement agreement, documentation of their fees, a release form, and documentation of any liens or obligations tied to the settlement.

3. How Much Funding Can I Receive?

What percentage of my settlement can I access?

Funding companies usually advance a percentage of the net settlement, depending on the case size, type, and any outstanding liens or fees.

Are there minimum or maximum funding amounts?

Some providers have minimum settlement thresholds (e.g., $10,000 or more), and the maximum advance may be capped at a certain percentage of the net settlement.

4. How Is My Application Evaluated?

What factors affect my eligibility?

Key factors include the size of the settlement, the net amount after fees and liens, the expected payout timeline, and the risk of appeals or disputes.

Does my credit score matter?

No, post-settlement funding is non-recourse and does not require a credit check.

5. What Could Disqualify My Application?

What are common reasons for denial?

Applications may be denied if the settlement is not finalized, documentation is incomplete, the net settlement value is too low, or there are unresolved liens that would consume most of the proceeds.

Are structured settlements eligible?

Structured settlements may have additional restrictions or require specialized funding arrangements.

6. How Fast Is the Process?

How quickly can I receive funds?

Most funding companies can approve and disburse funds within 24 to 48 hours after receiving all required documentation.

Attorney Questions on Qualification

Question: Is my case eligible?

Typical Answer: Must have a finalized settlement; only attorneys qualify

Question: What documents are needed?

Typical Answer: Settlement agreement, fee documentation, release form, lien info

Question: How much can I get?

Typical Answer: Amount varies by case

Question: Does credit matter?

Typical Answer: No credit check or collateral generally required

Question: What could disqualify me?

Typical Answer: Unresolved cases, incomplete docs, low net value, excessive liens

Question: How fast is funding?

Typical Answer: 24–48 hours after approval

Summary – Post Settlement Funding for Attorneys – Funding for New Attorneys

Post settlement funding is a powerful, flexible financial solution for attorneys and law firms—especially for young attorneys looking to build and grow their practices.

By providing immediate access to earned fees, it helps manage cash flow, pay expenses, and invest in future growth, all without the risks and burdens of traditional debt.

As the legal industry continues to evolve, attorneys who leverage post settlement funding are better positioned to remain agile, competitive, and successful.

If you’re interested in learning more about how post settlement funding can benefit your practice, reach out to a trusted provider and discover how you can unlock the value of your pending settlements—today.

About a Post Settlement Advance with Balanced Bridge Funding

Is Post Settlement Funding a Loan?

A settlement advance for class action lawsuits is not a traditional loan. Rather than lending you money, a legal funding company considers the money you are owed from a class action lawsuit as an asset, akin to stocks or bonds.

Like any other asset you possess, such as a car or house, you have the option to sell it to someone else.

How Much of My Settlement Fees Can I Sell to Receive an Advance?

The answer is – it depends. In most cases, you will be able to sell a large portion of your lawsuit settlement fees. But you will not normally be able to sell 100% of it.

Why Are Payments Delayed in Lawsuits?

Even after settlements are reached in cases, various delays can hold up distribution of contingency fees for plaintiff attorneys.

Delays can include a wait for final approval from a judge or waiting for the defendant to distribute settlement checks.

In those situations, Balanced Bridge provides advances to attorneys on the pending fees.

About the Authors

Balanced Bridge Funding offers legal funding solutions for attorneys and law firms. We provide post-settlement advances and can help in situations where an agreement has been reached but there will be some delay until distribution of the contingency fee for attorneys.

To talk to one of our legal funding specialists about getting help managing your law firm cash flow, please call (267) 457-4540 or email info@balancedbridge.com or to apply online, simply CLICK HERE to fill out our inquiry form.