Hogan, Thiel, and Gawker Explain Lawsuit Funding Ethics

Lawsuit Funding Ethics As Explained By Hogan Thiel and Gawker. Lawsuit funding doesn’t typically make it into the mainstream news cycle, but when the industry is mentioned along with mega-celebrity Hulk Hogan, entertainment and issues site Gawker, and tech billionaire Peter Thiel , people who have never heard of (and never cared about) legal finance are now questioning whether the practice is ethical, let alone legal.

To answer those concerns, I’ve gone back through five years of my own research, scoured internet archives, re-read peer-reviewed journals, and enjoyed numerous lattes. In the following paragraphs, you’ll find the definitive answers to these industry-defining questions.

Is Legal Funding Actually Legal?

Lawsuit Funding Ethics As Explained By Hogan Thiel and Gawker. In a nutshell, yes: legal funding is in fact legal.

Lawsuit funding companies are no longer bound by the outdated (and by outdated, we mean literally medieval ) legal concepts of champerty and maintenance. Here’s a summary of a recent ruling by a Delaware court that sends champerty and maintenance back to the feudal era, where they belong.

Recent Ruling by Delaware Court

Lawsuit Funding Ethics As Explained By Hogan Thiel and Gawker. For the record: champerty and maintenance were laws to prevent wealthy landholders from rigging any lawsuits filed against them. Proponents of modern day champerty and maintenance laws propose that litigation funders essentially act to protect the interests of the wealthy, but, as you’ll soon see, this assertion is not fully accurate.

Lawsuit funding companies are not subject to the same laws that bind traditional lending institutions, like banks, because they do not operate under the same lending model. Banks and other traditional lenders predominantly offer loans, which are given directly from the lender’s capital reserve and are set to be paid back at a specified interest rate. Litigation funders, however, use a factoring model, which relies on the purchase of a client’s future receivables and is thus somewhat riskier than a traditional loan.

Factoring and Legal Funding

Lawsuit Funding Ethics As Explained By Hogan Thiel and Gawker. It’s a bit tricky to fit a proper explanation of factoring into a single paragraph, so I went ahead and wrote a post about factoring and legal funding instead. Give it a read if you’re curious about how factoring works and why it sets legal funding apart from other financial solutions.

Factoring, just like lending, is fully legal. A recent New York Supreme Court case affirmed that purchasing future receivables involves a certain amount of risk, so factoring companies are exempt from usury caps and should not be governed under the same laws as traditional lenders.

Lawsuit Funding Ethics: So It’s Legal. But Is Legal Funding Ethical?

Lawsuit Funding Ethics As Explained By Hogan Thiel and Gawker. Now for the much trickier question regarding lawsuit funding ethics: Is legal funding, as a whole, ethical?

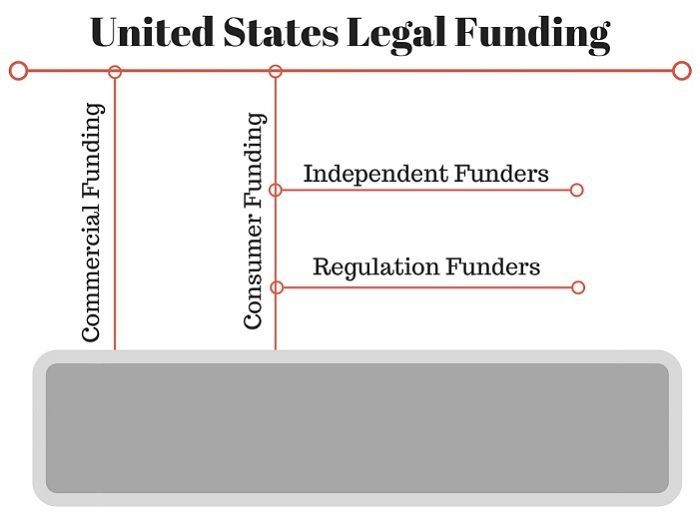

As I said, this question is a lot harder to answer, so I’m going to have to dive deep into the history of the legal finance industry. I’ve quickly drawn up a simple legal funding chart to illustrate the evolution of American-style legal funding, which I’ll explain in this section.

Legal Funding Industry Created About 30 Years Ago

Lawsuit Funding Ethics As Explained By Hogan Thiel and Gawker. At the top of the chart, we’ve got “United States Legal Funding”. Believe it or not, litigation funding as an industry was created only about thirty years ago. It started in the EU, gained some headway in Australia, and finally made its way to the United States as a hybrid of the European and Australian versions.

The European versions of lawsuit funding operate somewhat differently than our current American version does. For one, contingency fee attorney practices are rare in most of Europe; also, in many European countries, legal funding exists as LEI, or “ legal expenses insurance”, which is essentially insurance to pay for potential legal action. The practice that we recognize as legal, or lawsuit funding didn’t actually exist until the late 1990s—meaning the graduating class of 2016 is older than the US legal funding system.

Commercial and Consumer Legal Funding

Lawsuit Funding Ethics As Explained By Hogan Thiel and Gawker. Once legal funding (commonly referred to in the UK as litigation funding and third-party funding), reached the United States, it fractured into two main camps: commercial and consumer legal funding.

Both commercial and consumer legal funding companies work with plaintiffs and plaintiffs’ attorneys. Commercial litigation funders stick to commercial litigation: the plaintiffs they work with are often business entities involved in litigation against other business entities. Contrastingly, consumer lawsuit funding companies work with individuals or classes of individuals, many of whom are engaged in torts. Occasionally, consumer legal finance companies will also take on antitrust issues, where business entities act as consumers.

Balanced Bridge Funding Specializes in Torts

Lawsuit Funding Ethics As Explained By Hogan Thiel and Gawker. Lawsuit funding companies claim that they balance out the scales of justice by enabling plaintiffs to hold their own against wealthy defendants. In many cases, this is true. Many consumer legal funders, Balanced Bridge Funding included, specialize in torts and only assist attorneys who take cases on a contingency fee basis, as well as their clientele. The plaintiffs that these attorneys represent have often suffered injury or discrimination and are short on funds due to lost wages, high medical bills, or other unfortunate life circumstances.

The attorneys are often from small or medium sized law firms and experience cash flow issues because they are stuck waiting for fees on cases that have been delayed. Admittedly, these legal funding companies do charge higher rates than other lenders, like banks, but most of the people who apply for legal funding don’t have the necessary collateral for bank loans and have been fully briefed on the inner-workings of the factoring arrangement, so they are prepared for repayment.

Courts Comment Favorably on Regulation Funders

Lawsuit Funding Ethics As Explained By Hogan Thiel and Gawker. Numerous courts have commented favorably on the practices of these types of lawsuit funding firms, which would fall into the category of Regulation Funders. These groups tend to self-regulate, join groups such as the American Legal Finance Association or the Alliance for Responsible Consumer Legal Funding, and comply with local and state ordinances. As these companies continue to improve their practices to benefit consumers, more states approve consumer legal funding. By the end of 2015, at least 21 states had passed laws regulating the nascent industry.

But none of this answers our original question: is legal funding ethical?

Before I can answer that, we still have to talk about two more things: Independent Funders and the big, gray box.

Peter Thiel And The Big, Gray Box

Lawsuit Funding Ethics As Explained By Hogan Thiel and Gawker. An industry so new, yet so niche, is sure to have some murky areas, and legal funding has quite a few.

At the lightest side of the gray box you have the legal funding firms that work with fixed-rate attorneys and the plaintiffs they represent. These companies generally operate within the scope of state and industry regulations, but because they have a slightly different client base, they are still figuring out their own framework. They aren’t unethical, per se, but that’s partially because the ethical codes for non-contingency consumer litigation haven’t been well-defined.

Predatory Lenders Keep Individuals in Constant Loop of Debt

Lawsuit Funding Ethics As Explained By Hogan Thiel and Gawker. At the darker end of the spectrum, you have the companies that operate strictly outside of tasteful ethical boundaries. Some have been called predatory lenders and, much like the payday loan companies that keep disenfranchised individuals in a constant loop of debt, these companies charge exorbitant rates that are way outside of the appropriate scope of risk.

Peter Thiel and Independent Funders fall somewhere in the middle of this gray area. Peter Thiel, co-founder of PayPal and Palantir, is the tech mogul–turned–legal financier that you’ve been seeing all over the news these days. He’s what I’d call an Independent Funder because he chose to fund a consumer litigation case for his own profit with his own funds.

Hulk Hogan Needs Help of Litigation Financing

Lawsuit Funding Ethics As Explained By Hogan Thiel and Gawker. To provide a bit of background on the case, Hulk Hogan (given name Terry Bollea) filed a lawsuit against the media company Gawker, which released a sex tape featuring Hogan and the wife of the creatively-named DJ, Bubba the Love Sponge. Hogan sued Gawker, alleging that he was unaware of the tape’s being filmed, that his privacy was at stake, and that his personal reputation as Terry Bollea was tarnished as a result of the leak. However, as a result of his 2007 divorce, Hogan’s finances were not quite what they were (though apparently, he still has a net worth of $25 million), and he needed the help of litigation financing to take on the media giant.

Though Hogan isn’t the picture of the ideal legal funding client, his case against invasion of privacy was worthy. Peter Thiel decided to take up the cause. Soon, journalists began to speculate whether Thiel was funding the case to help out his buddy Hulk, or to get revenge on the media outlet for allegedly outing him to the public in 2007. Most of the speculation of the case (that I’ve read, anyway) focuses less on Hogan’s privacy rights and more on whether Thiel is acting ethically in his involvement of the case—especially now that Gawker has declared bankruptcy, possibly as an aftermath of the $140 million verdict against the company.

Outdated Laws of Champerty and Maintenance

Lawsuit Funding Ethics As Explained By Hogan Thiel and Gawker. All of this brings us back to the medieval, outdated laws of champerty and maintenance. As stated before, these laws were created to prevent wealthy landowners from rigging lawsuits waged against them. But as time went on, these laws were interpreted to mean that legal funders shouldn’t take an actual interest in the outcome of a case.

In our profit-driven society, this concept doesn’t work, as legal funding partially exists so that funding companies can make a profit—after all, if they were unable to make a profit, the underwriters, marketers, and other staff would no longer be gainfully employed, thus destroying the industry altogether.

Legal Funding Companies Include Clause in Contractts to Reassure Clients

Lawsuit Funding Ethics As Explained By Hogan Thiel and Gawker. However, legal funding companies who stick to regulations typically include a clause in their contracts assuring the client that the legal funding company will not, in any way, seek to influence the outcome of the lawsuit. Legal funding companies should only be involved in litigation insofar as finance is concerned; otherwise, the outcome of the suit is completely left to the justice system.

In the case of Bollea v. Gawker, many speculate that Thiel, the litigation financier, did not take any interest in the financial outcome of the lawsuit, but instead took an interest in the legal outcome of the case. Thiel is under no obligation to disclose the direct level of his involvement in the lawsuit, but if he did indeed get involved with the case to influence its outcome beyond financially enabling the plaintiff to stand trial, that would be considered unethical according to the mainstream standards of the legal funding industry.

And The Final Answer Is…

Lawsuit Funding Ethics As Explained By Hogan Thiel and Gawker. After looking at the history of the industry, legal funding is generally an ethical practice. But when financiers operate outside of the agreed-upon industry standards and state regulations and aim to exploit a lawsuit to meet personal ends, legal funding moves into an ethical gray area. Even if a cause seems just, tampering with the legal system can yield questionable results.

Written by Shayna Keyles. You can follow her on Twitter at @shaynakeyles .