Types of funding available to attorneys for startup, cash flow, and growth

Funding Sources for Attorneys – Like any business, attorneys require funding for startup, growth, and operations. Unlike most businesses, plaintiff attorneys can put in years of work, incurring expenses the entire time before they get paid for their work.

Very few businesses have this challenging of a cash flow cycle. Many businesses struggle with cash flow issues waiting only thirty days to receive payment for their services. Lawyers often wait years. This is why attorney funding is an important topic for lawyers who are starting their own practice or law firms looking to continue growth.

Here are three core reasons why law firms seek out funding — each explored with new insights and practical relevance.

1) Expanding Client Reach and Case Portfolio

For attorneys, securing new clients and taking on additional cases often demands significant upfront investments — whether in marketing, research, case development, or engaging expert witnesses.

These expenses are typically incurred well before any payment is received, which can challenge a firm’s finances and make it difficult to pursue worthwhile opportunities.

Flexible funding allows attorneys to say “yes” to promising or complex cases without hesitation.

It also lets firms be more selective and strategic, targeting cases that align with their strategic plan and expertise, even when payouts may be months or years away.

2) Fueling Law Firm Growth and Innovation

Just like successful businesses in other industries, law firms can harness external capital to drive expansion.

Strategic funding enables investments in hiring skilled personnel, adopting new technology, developing more robust marketing, and even entering new legal markets or specialties.

When utilized responsibly, attorney funding does more than cover costs — it gives a firm the leverage to innovate and edge out competitors.

By allocating capital toward practice development and client service initiatives, law firms can increase value for both clients and the business.

3) Keeping Cash Flow Stable and Operations Smooth

The financial backbone of any law firm is steady cash flow — ensuring ongoing expenses such as payroll, rent, insurance, and technology are met.

Legal work often involves long cycles from case initiation to final settlement or verdict, which can leave revenue streams unpredictable.

Attorneys need funding options to bridge this timing gap by providing liquidity when it’s needed most.

Some legal funding providers offer specialized financial products—like case-cost financing and settlement advances — designed to match the rhythms of legal billing and reimbursement.

This helps law firms keep operations running smoothly, avoid interruptions, and confidently meet all financial obligations.

For an in-depth analysis of the cash flow struggles law firms face, read our comprehensive article: Cash Flow 101 for Law Firms

By understanding and strategically leveraging these options, attorneys can set the foundation for enduring growth and stability.

What Makes Legal Funding Companies Unique in The Financial Landscape

Legal funding companies provide specialized financial solutions designed to meet the unique needs of attorneys and law firms.

Unlike traditional banks, these companies understand that legal work— especially litigation cases involving contingency fees —often requires heavy upfront spending with long waits for payment.

Instead of focusing solely on credit scores or personal collateral, they look at your active cases, potential settlements, and accounts receivable when making funding decisions.

Legal funding companies play a vital role in supporting law firms and attorneys by offering financial solutions designed specifically for the legal industry.

Unlike traditional banks or commercial lenders, these companies evaluate a firm’s eligibility based on its active caseload, anticipated settlements, and accounts receivable rather than relying solely on credit scores or personal collateral.

This industry-specific knowledge allows them to better understand the cash flow challenges that litigation and contingency-fee practices face, making funding accessible to firms that might not qualify for conventional financing.

Funding decisions typically consider the projected value and strength of ongoing cases, expected timelines for resolution, and the overall track record of the firm.

Types of Legal Funding Lawyers Should Know About

Pre-settlement Funding

Pre-settlement funding offers attorneys and law firms an advance on the anticipated outcome of pending lawsuits, giving them access to critical working capital before a case concludes. This is especially valuable in litigation and contingency-fee practices, where attorneys often invest substantial resources over months or even years before fees are collected. With pre-settlement funding, law firms can cover pressing litigation expenses—such as expert witness fees, depositions, medical records, court filings, discovery costs, and even operational overhead—without draining their own reserves.

A key feature of most pre-settlement funding is that it’s typically structured as non-recourse financing, meaning repayment is only required if the case is won or successfully settled. This significantly reduces financial risk for the firm, as the funding company takes on the case outcome risk. Decisions are often based on the strength, value, and expected timeline of the case rather than the attorney’s personal credit score or collateral.

However, a drawback that results from this is that pre-settlement funding can often be very expensive, and funders that provide this can be very selective in the cases they will work with.

For plaintiff-focused practices, particularly in areas like personal injury, mass tort, or class action, pre-settlement funding enables firms to handle more complex cases, compete with deep-pocketed defense teams, and withstand the long delays that are common in legal proceedings. Strategic use of this funding can help attorneys avoid the pressure to settle early for less favorable amounts simply due to cash constraints. Instead, it offers the financial breathing room to negotiate from a position of strength, invest in thorough case preparation, and seek optimal results for clients while maintaining the stability of the practice.

Often structured as “non-recourse” arrangements, repayment is only required if the case is won, which reduces risk for the attorney.

Post-settlement Funding

Post-settlement funding provides law firms with immediate access to capital after a case has been successfully resolved but before the settlement funds are actually received. This addresses a common and frustrating cash flow challenge: even after a judgment or settlement, it can take weeks—or even months—for payment to arrive. Delays often occur due to slow insurance company processing, bureaucratic approval procedures, lien resolution requirements, or large institutional defendants dragging out payment.

With post-settlement funding, attorneys can receive a substantial portion of their anticipated fees almost immediately. This allows them to pay their own operational expenses, meet payroll, invest in marketing, cover case costs from other active matters, or simply reduce debt while waiting for the funds to arrive. For firms that handle high-value or high-volume settlements, this can be a critical advantage in maintaining financial stability and keeping business momentum going.

Qualification for post-settlement funding is usually easier than other forms, since the case has already been successfully concluded and the settlement amount is fixed. Funding companies primarily verify documentation of the settlement agreement and the expected disbursement date.

Like pre-settlement funding, repayment is generally tied directly to the settlement payout, aligning repayment with the timing of actual cash inflows. While the fees and rates can be higher than those of traditional loans, the speed and ease of access often outweigh the cost, particularly for firms needing quick liquidity. In many cases, post-settlement funding functions as both a bridge and a growth tool, enabling attorneys to reinvest confidently in their practices without being held hostage by payment delays outside their control.

Balanced Bridge provides post-settlement funding for attorneys. Learn more here.

Lawyers Loans and Lawyer Lines of Credit

Lawyer loans and lines of credit are financing solutions specifically tailored to the business cycles of law firms. Unlike generic small business loans, these funding products are designed to account for the irregular revenue patterns, long case timelines, and unique risks of the legal profession. Funding amounts are often determined by case inventory, projected fee income from ongoing matters, or accounts receivable, giving law firms greater borrowing capacity than they might receive from a traditional lender focused solely on credit scores and hard assets.

A lawyer loan typically provides a lump-sum infusion of capital that can be used for virtually any firm expense—operational overhead, staff salaries, marketing campaigns, technology upgrades, or case-related costs. By contrast, a lawyer line of credit functions much like a credit card but with far greater borrowing capacity and more favorable repayment terms. Attorneys can draw funds as needed, only paying interest on the amount used, which makes lines of credit especially useful for managing unpredictable cash flow.

These financing tools offer flexibility: they can be a safeguard against slow-paying clients, a way to confidently expand operations, or a source of contingent funding for high-cost litigation matters. While they generally require more documentation than pre- or post-settlement funding, approval is often easier through specialty legal lenders than through large banks unfamiliar with law firm economics.

Responsible use of loans and lines of credit can give a firm consistent financial strength, enable strategic investments, and ensure the stability necessary to deliver uncompromising service to clients—without the risk of operational slowdowns due to temporary revenue gaps.

Factoring

Factoring accounts receivable is a legal funding option that allows law firms to convert outstanding client invoices into immediate working capital. In this arrangement, a firm sells its unpaid receivables to a funding company at a discount, receiving a cash advance for the bulk of the invoice’s value right away. The funding company then assumes responsibility for collecting payment from the client when it becomes due.

This solution is particularly effective for firms struggling with slow-paying clients or institutions that routinely take 60, 90, or even 120 days to pay invoices. Instead of waiting for payments and risking operational slowdowns, attorneys gain instant liquidity to cover salaries, rent, marketing expenses, or investments in active cases. Factoring is not a loan, so it doesn’t create debt on the firm’s balance sheet; instead, it’s a sale of an asset (the receivable), which can be advantageous for cash flow management.

Legal factoring companies understand professional services receivables and often customize terms to fit the billing cycles of law firms. For firms that bill hourly or handle large corporate matters on retainer, factoring can smooth income fluctuations and reduce the strain caused by unpredictable payment timelines.

While factoring does come at a cost—the discount rate—it can relieve significant financial pressure, especially in times of rapid growth or during heavy litigation periods when expenses spike. Used strategically, factoring preserves the firm’s ability to operate at full capacity, take on more work, and remain financially agile, even when clients delay payment.

Summary – Funding Sources for Attorneys

The advantages of working with legal funding companies are significant. Many products do not require personal credit checks or guarantees, protecting an attorney’s personal assets.

Newly established firms without an extensive credit history can still qualify by leveraging the value of their cases.

Repayment schedules are often tied to settlement timelines, which ensures that outgoing payments align with incoming revenue.

Because funding companies assess law firms using legal-specific benchmarks rather than standard lending models, they can provide solutions that are far more flexible than those available in the traditional banking sector.

For any attorney or law firm considering these options, due diligence is critical. It’s important to thoroughly vet potential funding companies, reviewing their reputation, transparency, and contract terms—especially the fee structures, interest rates, and repayment mechanisms.

When used strategically, legal funding can provide a financial lifeline that empowers attorneys to take on stronger cases, invest in practice growth, and maintain smooth operations even when revenue is delayed.

More About Post Settlement Funding for Lawyers

Balanced Bridge provides post settlement funding for attorneys, offering advances on fees in settled cases experiencing distribution delays.

Lien resolutions, waiting for final approval, slow-paying defendants, and other factors can leave plaintiff attorneys waiting months for their contingency fees, even after a settlement is reached.

Balanced Bridge can help bridge that gap, providing capital for law firms to utilize now.

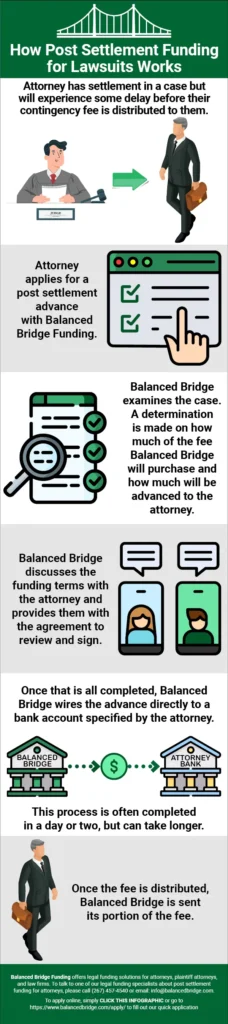

How Post Settlement Funding for Attorneys Works

- There is a settlement in a case, but there will be some delay before the awards and contingency fees for the attorneys are distributed.

- Attorney applies for a settlement advance with Balanced Bridge Funding, against their fees.

- Balanced Bridge examines the case. A determination is made on how much of the fee Balanced Bridge will purchase and how much will be advanced to the attorney.

- Balanced Bridge discusses the funding terms with the attorney and provides them with the agreement to review and sign.

Once that is completed, Balanced Bridge wires the advance directly to a bank account specified by the attorney.

This process is often completed in a day or two but can take longer.

Once the fee or award is distributed, Balanced Bridge is sent its portion to satisfy collection on the advance.

To talk to one of our legal funding specialists about getting help managing your law firm cash flow, please call (267) 457-4540 or email info@balancedbridge.com or apply online here.