Data Breach Insurance Lawsuits Are Increasing in Lockstep With the Skyrocketing Number of Data Breaches in the United States

Data Breach Insurance Lawsuits – With the proliferation of digital data, data breaches have become an increasingly important issue. Companies face significant losses due to lost or stolen proprietary information and lawsuits that invariably follow a significant data breach.

Google Data Breach Lawsuit – As an example, early in 2024, Google settled for $350 million over a data breach involving their Google+ platform. It is reported that insiders knew about the potential for data breach, but continued to tell the public that they were publicly talking about their commitment to security. Google+ is no longer around, but the lapse in security cost Google far more than anyone could have imagined.

TicketMaster Data Breach Lawsuit – In June 2024, a class action lawsuit has been filed against TicketMaster and Live Nation for a data breach that was caused by a hacker. The lawsuit alleges that Ticketmaster and its parent company Live Nation failed to protect PII (Personally Identifiable Information) of up to 560 million of their customers. The data breach may have included names, addresses, emails, phone numbers and credit card information. ShinyHunters, the group claiming responsibility, says the stolen data includes names, addresses, phone numbers and partial credit card details from Ticketmaster users worldwide.The hacking group is reportedly demanding a $500,000 ransom payment to prevent the data from being sold to other parties.

Christie’s Data Breach Lawsuit – In Jun 2024, Luxury Auction House Christie’s has been sued in New York Federal Court for a data breach. The lawsuit alleges Christie’s did not do enough to protect customers from a loss of protected personal data and did not do enough to aid customers after the breach occurred.

If you read sufficient headlines, in 2024 it seems that no company is immune from data breaches. Nearly every major company you have ever heard seems to have fallen victim at one time or another. The major difference is that lawyers are helping their clients push back when businesses are found to be negligent in properly protecting their customers data.

To protect their businesses from these risks, many companies are turning to data breach insurance. In the event of a data breach, companies can file a claim with their insurer to recoup some or all their losses.

Data breach lawsuits are becoming more commonplace as well. Companies that have suffered from a data breach may bring legal action against the parties responsible for the loss or misuse of their information. This includes filing claims against thieves who stole the information, as well as claims against companies whose negligence may have caused or contributed to the breach – and lawsuits against the insurance companies who sell data breach insurance policies.

Data breach lawsuits are proving to be an excellent source of revenue for law firms that specialize in suing or defending insurance companies. Law firms who engage in insurance plaintiff work can use their expertise and experience to ensure that data breach victims receive full compensation for their losses. Law firms who defend insurance companies can increase their billable hours for the firm by adding data breach insurance defense as a practice area.

Data breach lawsuits have also become an important tool in promoting data security. By filing lawsuits against negligent companies, law firms are helping to hold them accountable and ensure they take all necessary steps to protect their customers’ information.

As data breaches continue to be a major problem for businesses, the demand for legal services related to data breach insurance and lawsuits will only increase. For law firms that are well-versed in insurance law, data breach lawsuits represent an opportunity to expand their practice and generate more revenue.

Data security is becoming increasingly important for businesses of all sizes, making data breach insurance and lawsuits a key part of any comprehensive risk management strategy. By understanding the legal risks associated with data breaches, law firms can help their clients protect themselves and get the justice they deserve.

Whether it’s protecting clients from financial losses due to data breaches or holding negligent companies accountable, or defending insurance companies against baseless claims, law firms that specialize in data breach insurance and lawsuits can be invaluable partners in the fight against cybercrime, recovering damages for clients, and protecting insurance companies from excessive financial losses.

About Data Breach Insurance

Data breach insurance is a type of insurance coverage that helps protect businesses from financial losses and liabilities resulting from a data breach or cyberattack. It is designed to assist companies in managing the costs associated with a data breach incident, including legal expenses, notification and credit monitoring services for affected individuals, public relations efforts, and potential regulatory fines.

Data breach insurance is an important consideration for businesses in today’s digital landscape. Here are some key points to know about this type of insurance:

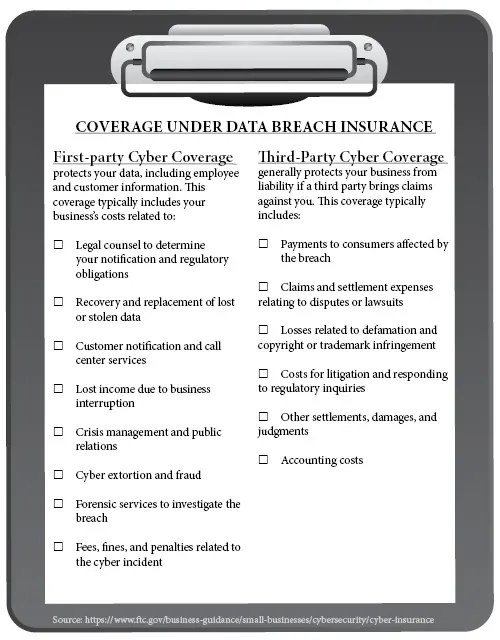

Coverage under data breach insurance policies typically extends to both first-party and third-party expenses. First-party coverage addresses costs incurred directly by the insured business, such as forensic investigations, notification expenses, credit monitoring services, and public relations efforts. On the other hand, third-party coverage deals with claims and lawsuits brought by affected individuals or other entities, including legal defense costs and settlements.

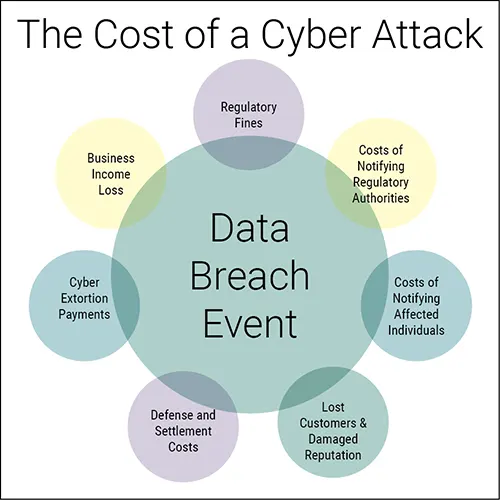

One of the primary benefits of data breach insurance is its ability to provide financial protection. Data breaches can result in significant financial losses for businesses due to expenses like legal fees, reputational damage, customer notification, and potential regulatory penalties. By offering coverage for various costs associated with responding to a breach, data breach insurance helps mitigate these financial risks.

Another advantage of data breach insurance is its customization options. Policies can be tailored to meet the specific needs of a business, considering factors such as risk profile, industry, and size. This flexibility allows organizations to adjust coverage limits, deductibles, and provisions according to their unique circumstances.

It’s worth noting that while “cyber liability insurance” and “data breach insurance” are sometimes used interchangeably, there can be subtle differences between the two. Cyber liability insurance typically offers broader coverage for cyber-related risks, encompassing not only data breaches but also network security incidents and privacy violations. Data breach insurance, on the other hand, specifically focuses on data breach incidents and their aftermath.

For businesses, data breach insurance holds great importance. Data breaches can have severe consequences, ranging from financial losses and reputational damage to legal liabilities. Having data breach insurance enables businesses to recover more quickly and efficiently after an incident by providing financial support and access to resources for a comprehensive response.

It’s essential for businesses to recognize that the specifics of data breach insurance policies can vary among insurance providers and jurisdictions. You can read more about data breach insurance here and at the FTC Website here.

Insurer Role in Data Breach Lawsuits

Data breach lawsuits can be a major financial burden for companies or organizations involved, especially if they are found to have been negligent or reckless. In these cases, an insurer can play an important role by providing coverage for legal costs and damages awarded to plaintiffs.

Insurance policies designed to cover data breach litigation typically include provisions for legal fees, investigation expenses, settlement costs, and punitive damages. However, they may also impose certain limitations on coverage or require organizations to meet certain security requirements to be eligible for protection.

Given the increasingly high cost of data breach lawsuits, it is essential for businesses and other organizations to purchase insurance that provides sufficient coverage for their specific needs. Doing so can help ensure that they are properly prepared in the event of a data breach and avoid the financial burden associated with litigation.

Why is Data Breach Insurance Important?

Data breaches are on the rise, as are the costs associated with damages and the litigation that often ensues as the result of a data breach. In 2023, a total of 1393 data breaches have been reported in the U.S. Those numbers have gone up every year from 2005 until 2020 with the only exception being 2017. Because of this continued rise in data breaches, insurance companies began offering data breach insurance to help protect businesses from financial disaster should a data breach occur.

According to the Identify Theft Resource Center, in the first half of 2023, U.S. data breaches affected over 156 million individuals, marking a significant surge of more than 150% compared to the reported number of victims in the same period of 2022, as per the Identify Theft Resource Center’s findings.

ForgeRock, a global digital identity company, just released a report that shows the United States as the most expensive country in the world to recover from a data breach. They estimate that the average cost of recovery is a whopping $9.5 million.

Because of this trend, we can expect to see a nearly continuous rise in data breaches and the insurance claims (and lawsuits) that go with them. We can also expect to see more law firms specializing in suing and defending insurance companies who offer data breach insurance.

Data Breach Insurance Lawsuits – a Growing Opportunity for Lawyers

Law firms who already specialize in litigating insurance cases either for plaintiffs or defending insurance companies, may find an excellent source of new revenue by adding data breach insurance law as a practice area.

One thing appears certain, the instances of data breaches will continue to rise. Businesses will be looking to protect themselves by purchasing data breach insurance. This will present opportunities for insurance lawyers who specialize in lawsuits against insurance companies as well as for those law firms who specialize in defending insurance companies.

Reasons Lawyers May Consider Data Breach Insurance Cases

High-Profile Nature: Data breaches often involve large corporations and organizations that have significant resources (and even more significant insurance policies). These high-profile cases can generate media attention and public interest, which can be advantageous for lawyers seeking exposure for their firm. Also, because of their high profile nature, people may seek to take advantage of these companies and the insurance companies who insure them, providing an excellent opportunity for lawyers who specialize in defending insurance companies.

Potential for Significant Damages: Data breaches can result in substantial financial losses for individuals and businesses. Along with significant damages come significant contingency fees plaintiff attorneys will receive when they win data breach lawsuits for their clients. And, for law firms who specialize in defending insurance companies, they can expect a significant increase in the number of billable hours they can charge their insurance clients.

Increased Understanding of Data Protection Laws: As more countries and regions pass comprehensive data protection laws, there is an increased understanding of the legal implications of a data breach. Lawyers are better equipped to identify and argue violations under these new regulations, which can further their success in pursuing damages in court. This will make it easier to win insurance cases for plaintiff attorneys and increase the demand for defense attorneys who know how to successfully defend data breach insurance cases or who are adept at reaching reasonable settlement agreements for their insurance clients.

Data Breach Class Action Opportunities: Data breaches often affect many individuals simultaneously, making them well-suited for class action lawsuits. Lawyers can represent a group of affected individuals, pooling their resources and increasing the chances of a successful outcome. Defense attorneys can expect to accrue significant billable hours working on defense and/or reaching settlement agreements in class action lawsuits that arise involving their insurance clients.

Evolving Landscape: The field of data breaches is continually evolving, with new breaches and security vulnerabilities emerging regularly. This constant stream of cases ensures a steady flow of potential clients seeking legal representation to recoup damages and insurance companies who need help reaching favorable settlement agreements.

Lawyers must stay up to date on the latest developments to effectively represent their clients. This requires an understanding of the current laws and regulations, as well as emerging trends and best practices related to data security. Additionally, staying informed about technological advances and cybersecurity measures is essential for any lawyer looking to specialize in data breach cases.

The ever-changing landscape of data breaches requires lawyers to stay informed about the latest developments. By doing so, they can ensure that their clients receive proper legal representation and achieve a successful outcome.

Data breach lawsuits offer several benefits for lawyers, including increased exposure and potential financial gain. However, they also provide an important service for individual clients as well as the insurance companies defense attorneys represent. By taking on data breach insurance cases, lawyers can help secure damages for their clients or protect insurance companies from losses.

Data Breach Insurance Lawsuits for Defense Attorneys

Lawyers who defend data breach insurance companies will need to be well versed in the particulars of the insurance policies their clients sell as well as the evolving precedents set by cases that have already been litigated. Here are some key areas they may consider:

- Understanding Cyber Insurance Policies: Lawyers should thoroughly review the cyber insurance policies held by their clients. This includes analyzing the coverage limits, exclusions, and conditions outlined in the policies. By understanding the specific terms of insurance coverage, lawyers can effectively defend their client’s interests when facing data breach claims.

- Assessing Liability and Coverage Issues: Lawyers need to evaluate the liability and coverage issues surrounding the data breach incident. This involves determining whether the breach falls within the scope of the insurance policy, identifying any exclusions or limitations that may apply, and assessing the potential liability of the insured party. By conducting a comprehensive analysis, lawyers can formulate a strong defense strategy.

- Investigating the Data Breach: Lawyers should conduct a thorough investigation into the data breach incident. This may involve working with forensic experts, IT specialists, and other professionals to gather evidence, determine the cause and extent of the breach, and assess any negligence or misconduct on the part of the insured party. A comprehensive investigation helps lawyers build a solid defense case.

- Developing Legal Arguments: Based on the findings of the investigation, lawyers need to develop legal arguments to defend their clients. This may include challenging claims made by affected parties, asserting the applicability of insurance coverage, and presenting evidence that demonstrates compliance with industry standards and reasonable security practices. Effective legal arguments can help protect the interests of the insurance company in data breach cases.

- Managing Regulatory Compliance: Lawyers should also assist their clients in navigating regulatory obligations and compliance requirements. Data breaches often trigger legal obligations for reporting and notification, as well as potential investigations by regulatory authorities. Lawyers need to ensure that their clients understand and fulfill these obligations, minimizing any legal risks associated with non-compliance.

By focusing on these areas, lawyers defending data breach insurance companies can prepare a strong defense strategy and mitigate potential legal liabilities.

Cost of Cyber Attack Infographic

The Future of Data Breach Insurance Lawsuits

Data breaches continue to rise across every industry in the United States. It would be hard to find any company of significant size that has not experienced one (or multiple) data breaches. Victims of data breaches include businesses, hospitals, non-profits, municipalities, and governments.

And with each data breach, individuals can face losses and hardships and seek damages as a result. This provides an excellent opportunity for plaintiff lawyers to help these clients and/or to defend the insurance companies being sued.

Data breach insurance is now available for purchase and is becoming popular among businesses. Plaintiff firms who specialize in insurance work may wish to become familiar with data breach insurance policies to effectively litigate cases for plaintiffs or to defend insurance companies when (not if) these cases arise for their clients.

As more legal precedents are set from cases that have already been litigated, we can expect to see more law firms seeking out data breach insurance lawsuits as a source of dependable revenue for their law firm – and you can also expect to see the attorneys who defend insurance companies expanding their practice areas to increase their billable hours.

Law firms who are looking to break into new practice areas may find a lucrative revenue stream in defending clients who are victims of data breaches, defending companies who are being sued for data breaches, and the insurance companies who insure them.

Data breach insurance lawsuits are a growing opportunity for increased revenue for lawyers, and we can expect to see this trend continue indefinitely along with the ever-rising number of data breaches that occur every day.

About The Authors – Balanced Bridge Funding

Balanced Bridge Funding offers legal funding solutions for plaintiffs, plaintiff attorneys, attorneys, and law firms. To talk to one of our legal funding specialists about getting help managing your law firm cash flow, please call (267) 457-4540 or email info@balancedbridge.com, to apply online, simply CLICK HERE and fill out our short, quick application.

About Legal Funding with Balanced Bridge Funding

Does Balanced Bridge Funding Offer Pre-Settlement Lawsuit Funding?

Balanced Bridge Funding does not offer pre-settlement funding currently. We do offer post-settlement funding options for attorneys as well as plaintiffs whose potential settlements qualify (which many do).

A Post Settlement Advance is a Non-Recourse Transaction: We Accept All the Risk

Post Settlement funding is a non-recourse transaction. This means you don’t need to worry about what might happen if the defendant suddenly can’t pay your settlement award — we accept all risk of non-payment, meaning that you will still get to keep the money from your settlement advance if the defendant goes bankrupt or is unable to pay for whatever reason.

Fast, Hassle-Free Application

In most cases, we can get your money in your hands in one week or less. Our application is simple, straightforward, and easy to complete. Remember, this isn’t a loan, so there isn’t as much paperwork to go through. In most cases, we can approve your application and have your money deposited into your checking account in a matter of days.

To talk to one of our legal funding specialists about post settlement funding, please call (267) 457-4540 or email info@balancedbridge.com, or to apply online, simply CLICK HERE and fill out our short, quick application.