When attorneys or law firms seek post-settlement funding from third-party providers like Balanced Bridge Funding, one of the first questions is: what paperwork needs to be submitted? Because Balanced Bridge focuses exclusively on post-settlement (not pre-settlement) advances and works directly with attorneys or firms, the documentation is tailored to verifying the settled case, the attorney’s entitlement to fees, and ensuring clear paths for repayment.

Below is a breakdown of the typical documents and supporting materials you might be asked to provide during the application process Each request is different, and the required documents will be tailored to each specific transaction.

Core Documents to Verify the Settlement

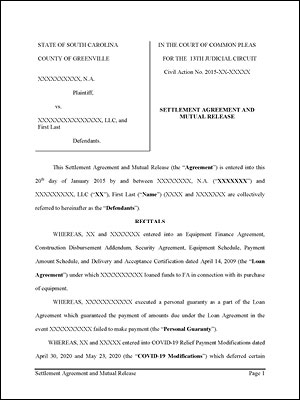

1. Executed Settlement Agreement/Release

You’ll need to provide the settlement agreement and/or fully signed release ). This shows that the dispute has been resolved and establishes the amounts to be paid.

2. Settlement Order / Disbursement Authorization

A fully signed settlement order or disbursement order is often required. This establishes the authority to distribute funds and confirms that the parties have relinquished rights to further dispute the settlement amount.

3. Attorney Fee Agreement / Contingency Agreement / Fee-Split Agreement

You’ll need to show how your attorney’s fee is determined — typically via your retainer or contingency agreement with the client. If there are multiple attorneys involved in a case, you will also need to show what your portion of the fee is. This demonstrates your entitlement to a portion of the settlement proceeds.

Supporting Documents Related to Liens, Obligations, and Encumbrances

4. Lien and Subrogation Statements

If there are medical liens, government liens (e.g., Medicare), or other subrogation interests, you’ll generally need documentation showing their amounts, status, and whether they’ve been negotiated or settled. This is important because liens often impact net settlement proceeds available to attorneys.

5. Proof of Existing Obligations or Offsets

If part of the settlement is earmarked for tax withholding, child support, creditor judgments, outstanding costs, or other obligations, the funder may require documentation that identifies them. This avoids surprise deductions that could undermine the advance.

Case and Procedural Detail to Support Underwriting

6. Case Summary and File History

A concise narrative or case summary—identifying parties, court and case number, relevant claims, procedural posture, and risk factors—helps the funder assess the viability and timing of disbursement.

7. Court Orders or Approvals (if available)

In some scenarios (e.g. class actions, minors, structured settlements), court approval or preliminary/final orders must be provided. Funders will want to see evidence that all necessary judicial steps have been (or will be) complied with. Balanced Bridge can provide funding before court approval has been granted.

8. Proof of Identity, Firm Documentation, and Bank Account Info

Because the advance will flow to your law firm or attorney account, the funder will require verification of firm identity (e.g. business registration, EIN, bar registration, driver’s license) and banking details for wire transfers.

Timeline and Processing Expectations

Once you submit the required documents, Balanced Bridge (and similar providers) generally aim to turn around approvals swiftly—typically within a few days of receiving a complete and clean package.

Because Balanced Bridge works exclusively in post-settlement funding, their documentation and underwriting processes are optimized for settled cases, making the qualification and funding pipeline leaner than in pre-settlement funding scenarios.

Reach Out to an Experienced Team at Balanced Bridge Funding

If you’re an attorney or firm with a case that has settled but isn’t yet disbursing, understanding the required documentation is critical to a smooth funding process. Submitting the executed settlement agreement, release documents, evidence of fees, liens, and firm identity will help accelerate underwriting and get you access to capital sooner.

At Balanced Bridge Funding, we tailor the documentation requirements to each deal—always working with you to structure clear, fair, non-recourse advances. Ready to explore funding for a settled case? Reach out today and our legal funding team will guide you through the application steps, review your documentation, and help you secure an advance that supports your cash flow needs.

For more information about Balanced Bridge Funding’s post settlement funding for attorneys and law firms, please call 267-457-4540 or email info@balancedbridge.com or click to fill out our simple and fast application.