Cash Flow 101 for Real Estate Agents – How to Manage Cash Flow for Realtors

What is Cash Flow for Real Estate Agents

Cash Flow 101 for Real Estate Agents– Real Estate Commission Advances: Before we start talking about managing cash flow for Real Estate Agents, let’s first talk about what cash flow is and why it matters. Cash flow is a word that is thrown around a lot in the business world, but in truth, very few people truly understand it.What is Cash Flow?

Cash flow is the term used to describe the flow of cash coming into your business bank account and cash flowing out of your account. That is what cash flow is – the flow of money in and out of your business. Accountants utilize the Statement of Cash Flows to document how cash comes into and leaves a business. Unfortunately, unless you are an accountant, this financial statement is hard to understand so most people, even senior executives in major companies, do not try to read it.What is Cash Flow Management?

Cash flow management is any activity a person engages in to regulate the amount of cash flowing into the business bank account and the amount of cash flowing out of it. In fact, people would probably understand cash flow management better if they named it “cash flow regulation.” Cash Flow 101 for Real Estate Agents– Real Estate Commission Advances. In a perfect cash flow scenario, you would always have cash flowing in faster than it leaves, but in business, especially businesses like real estate, this is rarely the case. This is why it is so difficult to stay in the real estate agent business – because cash often “flows out” much faster than it “flows in.”Why Cash Flow for Real Estate Agents Matters

Conversely, as long as you have cash to pay your bills, employees, and vendors – you stay in the game. There is nothing more to it than that. The game of business continues or ends based entirely on your ability to produce cash either by sales, taking out loans, or selling equity. Cash Flow 101 for Real Estate Agents– Real Estate Commission Advances. But what about profit? Isn’t profit important too? Businesses do not close because of profit, or lack of profit. Businesses close because they can no longer pay their bills or pay payroll. As long as there is sufficient cash in your account to pay your people and your vendors, you get to stay in business. If you think this isn’t true, just think about Uber or Amazon.com. Amazon didn’t post a profit for almost twenty years and not only stayed in business, but became one of the largest companies in the world. Uber hasn’t turned a profit yet. And who knows if they ever will. And the truth is, they don’t need to. Why? Because they have cash pouring into their bank account every minute of every day from around the world. They will never run out of cash, so they will never go out of business. Cash Flow 101 for Real Estate Agents– Real Estate Commission Advances. How do these companies who never turn a profit thrive – because they have MASSIVE amounts of cash coming into their bank account every second of every day. Their cash account will never be empty. Their expenses might go up or down, but they will always have cash in their business to pay bills. So remember the only thing that matters is getting cash into your bank account and trying to keep it in there as long as you can.Why do Real Estate Agents Struggle with Cash Flow?

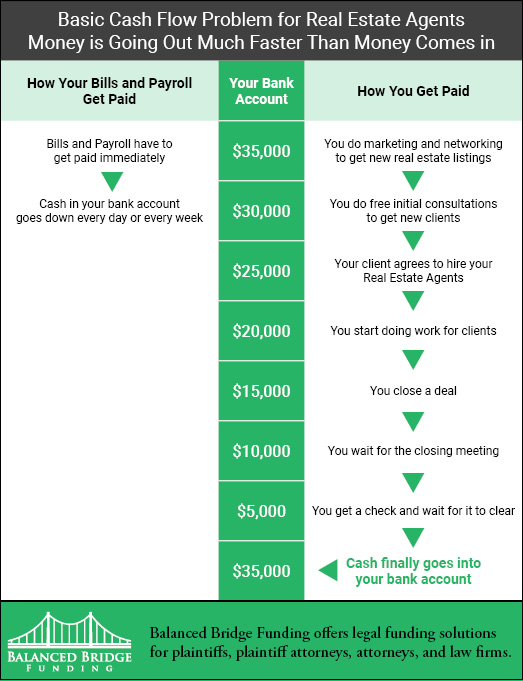

To understand why Real Estate Agents struggle with cash flow, you need to understand how cash comes into your Real Estate Business, and how it goes out. The main problem Real Estate Agents have with cash flows is caused by the “timing” of cash coming in versus cash flowing out. (Which is true for lots of different companies).Here is an Example of What We Mean by Timing of Cash Flows:

When do you have to pay your employees? Probably every week or every other week, right? So every week or every other week, cash flows out of your bank account to pay employees. They want their money now, and you have to pay them immediately. Cash Flow 101 for Real Estate Agents– Real Estate Commission Advances. But does cash flow INTO your bank account every day, every week or every other week as a Real Estate Agent? For most Real Estate Agents, the answer is no, it doesn’t.In fact, how long does it take for you to get paid for your services? Real Estate Agents specializing in large estates might wait months for closing, and during that time, while you are waiting, you still have to pay your bills, rent, employees, advertising, licensing, etc. Cash is constantly flowing out, but it might only flow in a few times per year.

The Timing of Cash Flows Problem for Real Estate Agents

Download The Timing of Cash Flows Problem Infographic by Balanced Bridge Funding

This creates a real problem for lots of companies, but Real Estate Agents are particularly susceptible to cash flow problems because they are so expensive to operate, and it often takes a long time to actually receive your money for your work. Your money is simply flowing out at more regular intervals than it comes in which leaves the Real Estate Agents struggling to “finance the wait.”Problems Lack of Cash Flow Creates in Real Estate Agents

- Paying Your Bills and Employees – This is the most obvious problem unbalanced cash flow creates for Real Estate Agents. If you can’t make payroll, you are in trouble. If you can’t pay your bills, your vendors discontinue services, which limits your ability to operate (and damages your company’s credit).

- Growth – The less obvious problem lack of cash flow creates is that it forever limits your growth.

- Doing it All Yourself – In the short term, if you can’t pay your employees, they will leave, which means whatever they were doing, you now have to do it yourself. And while you are doing that, you are not networking, marketing, doing work you can bill for, or seeking new opportunities for growth. And although this is uncomfortable, lots of small Real Estate Agents stay stuck in this forever. They always struggle with cash flows and they never grow. Cash Flow 101 for Real Estate Agents– Real Estate Commission Advances.

- Long Term Risk – In the long term, if your cash account is short, how much risk are you going to take on new opportunities? How many large opportunities will you miss out on because you simply can’t get involved in them because you know you don’t have enough money to sustain yourself while you wait for a big deal to close? Or if you do take on a big listing, you know you won’t be able to give it proper attention because you are busy chasing smaller deals so you can get money in the bank.

- Marketing – How much marketing are you going to do when you are struggling to make payroll? Probably not much. Marketing is risky – a lot of marketing doesn’t pay off immediately and sometimes doesn’t pay off at all. Real Estate Agents who struggle with cash flow don’t do much marketing. They can’t afford to take the risk. Plus, most marketing companies expect you to pay them in advance, which takes cash out of the cash account and can increase cash flow struggles.

- Fix and Flip – A company struggling with cash flow imbalance isn’t going to invest in fix and flip type investments. Those types of deals really eat up cash in a hurry. Contractors want their money up front. Material suppliers want their money up front. Permits must be filed up front. And who knows when you will get paid from a fix and flip deal? Real estate agents who struggle with cash flow don’t invest in fix and flip deals, they are too busy chasing the money every day to ever make long term investments. Cash Flow 101 for Real Estate Agents– Real Estate Commission Advances.

How Real Estate Agents Finance Operations (Cash Flow)

Cash Flow 101 for Real Estate Agents– Real Estate Commission Advances. Real Estate Agents finance operations much the same way that any small business does; they use personal savings, 401k’s, personal credit cards, small business loans, loans from family and friends, lines of credit (if they are very lucky), and Real Estate Agents funding options from Real Estate Agents financing companies like Balanced Bridge Funding for real estate commission advances.Becoming Debt Free is Not a Good Business Goal

Show me a business that is debt free and I will show you a company that is asleep at the wheel. Financiers all know this is true. Although being debt free on a personal level may be a worthy goal, it is not good to be debt free as a business. Why? Because to be debt free as a company almost always means that you are not:- Investing in Growth

- Investing in New Technology

- Investing in New Talent

- Investing in New Markets

- Taking Long Term Risk

- Trying to Stay Ahead of The Pack

Controlling Fixed Costs (Expenses)

A big part of managing cash flow for realtors begins with controlling your fixed costs.What Are Fixed Costs for Real Estate Agents?

To begin understanding fixed costs you must first understand that costs (as far as accounting goes) are divided up into two categories: Fixed Costs and Variable Costs. Cash Flow 101 for Real Estate Agents– Real Estate Commission Advances. Fixed costs are fixed; these are bills you have to pay regardless of whether you make any money or not. You still have to pay them every single month on a specified day. Fixed costs include office rent, utilities, internet connection, business car payment, monthly memberships, and for most businesses, payroll*. *Note About Payroll: As far as accounting goes, on your income statement, you will always see payroll listed as a variable cost, just because “that’s the way accounting does it.” But the fact is, payroll is rarely variable. If you have employees you have to keep paying them whether you are doing well or not.What are Variable Costs?

Variable costs are so named because they vary, meaning they are not a monthly bill you have to pay. Generally, variable costs are incurred as the result of actually closing a sale. If you don’t sell anything, you don’t normally incur any variable costs. As an example – if you were in the sign printing business. If someone orders some real estate signs, before you can make them, you have to buy materials. The cost of those materials is considered a variable cost because you only incur this cost when you make a sale. Variable costs for real estate agents might include staging a home, or paying for a repair out of pocket, or buying a sign or advertisement just for that one property. Cash Flow 101 for Real Estate Agents– Real Estate Commission Advances.Controlling Variable Costs

It is important to pay attention to variable costs also because these costs do impact your bottom line, and keeping costs down is always a good idea.Why are Fixed Costs Important with Regard to Cash Flow?

Fixed costs include everything you have a monthly bill for. These are things that cause cash to “flow” out of your checking account. Plus, they are fixed. They will perpetually drain money and never contribute to bringing in more money. That is the nature of fixed costs. Because fixed costs eat up cash every single month, regardless of whether you have any sales or not. Remember the basic cash flow problem – money going out at regularly scheduled intervals and sales happening at non-frequent intervals. Cash Flow 101 for Real Estate Agents– Real Estate Commission Advances. Fixed costs are those costs that directly contribute to cash flow struggles because there is no way to stop paying them if your sales slow down. If there is a recession, too bad, you still have to pay your office rent. If you take a few weeks off for vacation and that causes a two week delay later in sales, too bad, the monthly expenses still have to be paid.Controlling Fixed Costs

The two primary fixed costs you need to control are rent and payroll. Cash Flow 101 for Real Estate Agents– Real Estate Commission Advances. In most businesses, payroll and rent will take up to 50% of every dollar you make (or more). Therefore, you need to pay close attention to them, especially when you are just starting out in business. Too many times new business owners have taken on a huge space they think will “impress” clients. Instead, what it does is drain your cash account every month for five years (most business leases are five to ten years) until you can correct your mistake. Plus – if you are a new real estate agent, why take on rent at all? There are lots of good shared working spaces and answering services you can use to your advantage. Remember – the less money you have to put out every month, the easier it is to stay afloat during lean times. Payroll – you need to control payroll. Especially when you are just starting out. You can make good use of outsourced services of all kinds now. Personal assistants, virtual personal assistants, part-time help, etc. You can find an outsourced service for just about everything now. Take advantage of them. Payroll often accounts for 25% to 35% of every dollar you make. Keep your payroll under a watchful eye. It can creep up quickly.Never Take On a Fixed Cost You Can Avoid

Cash Flow 101 for Real Estate Agents– Real Estate Commission Advances. In general, when you are thinking about fixed costs, a good way to think about it is to never incur a fixed cost you could have avoided. And if you must incur a fixed cost, keep it as low as you possibly can. Remember, it doesn’t matter if there is a recession, you still have to pay the office rent.How Real Estate Commission Advances Help with Cash Flow

Remember the basic Real Estate Agent cash flow problem? Money goes out fast and comes in slow? One of the ways Real Estate Agents can manage their cash flow is by using a real estate commission advance company (like Balanced Bridge Funding) to get their money right away instead of always waiting until closing is complete. Cash Flow 101 for Real Estate Agents– Real Estate Commission Advances. When you sell a home, you are owed your commission. That commission is considered an asset, like a stock or a bond. Because of this, you can “sell” all or a portion of the money that is owed to you to a real estate commission advance company and get your money now, instead of waiting for closing which can be months away. The short version of the way this works is: You sell us the commission you are owed for an agreed upon price, and then we own it, and we wait to get paid at closing instead of you. It is as simple as that. You get your money now, and we get paid to do the waiting for you. This way, you are getting cash flowing into your cash account faster, which helps regulate cash flow. Remember, the longer you wait for your money, the more opportunities you will miss. To learn more about how this works, visit our sister company, Accel Real Estate Commission Advance.Factoring Receivables vs. Real Estate Commission Advance

Cash Flow 101 for Real Estate Agents– Real Estate Commission Advances. A real estate commission advance is a form of factoring, and factoring receivables is what this type of transaction has historically been called. Most industries use factoring companies to help solve their cash flow challenges. Large companies use factoring to manage cash flow and ensure long-term growth. Smaller companies and start up real estate agents use factoring to stay in business and help manage cash flow. Getting your cash fast matters, as we’ve already described above.Why Real Estate Commission Advance Instead of a Traditional Line of Credit

We get this question a lot, and there are lots of good reasons to use Real Estate Agent Commission advances instead of a traditional line of credit.- Do You Qualify: You first have to assume you can get a line of credit.

- Inflexibility: A line of credit is fixed, meaning if you have a bunch of new listings come in, you cannot easily just bump up your line of credit to accommodate new business. It is fixed.

- Credit Score: a real estate commission advance is not a loan, so it is not based on your credit, nor does it impact your credit score because you are not applying for, or taking out a loan.

- Debt-to-Equity Ratio: The more you borrow, the less you are able to borrow. This is called your debt-to-equity ratio. The more you borrow, the less the bank will loan you in the future.

- Variable Cost: Unlike a loan that has to be paid back every month (which reduces cash in the bank), you don’t pay us back for your real estate commission advance. We get paid at closing. And, it is truly variable cost because you are only using your real estate commission advance when you have deals closing. If things slow down, you factor less, and there is less expense. Cash Flow 101 for Real Estate Agents– Real Estate Commission Advances.